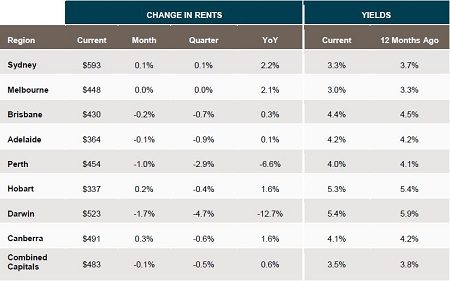

The latest CoreLogic RP Data Rent Review report reveals the combined capital cities annual rate of rental growth was just 0.6%, a slight improvement from the 0.5% recorded in September.

The increase in the annual rate of growth came despite the fact that four out of the eight capital city markets saw their rents go backwards during October.

Darwin, Perth, Brisbane and Adelaide all saw rental decreases during the month, with Darwin leading the way with a decline of 1.7%.

Rents rose over the month in Canberra, Sydney and Hobart, with Canberra leading the way with a increase of 0.3%.

Rents in Melbourne were unchanged over October.

Over the 12 months to the end of October rents improved in all capital cities except Darwin and Perth, where significant falls of 12.7% and 6.6% have been recorded.

Sydney and Melbourne recorded the biggest increases over the year, with rents rising 2.2% and 2.1% respectively.

Source: CoreLogic RP Data

While October saw the annual rate of rental growth improve slightly, there is little sign that trend will continue.

“The data points to an ongoing softening of rental growth, particularly throughout this year,” CoreLogic RP Data research analyst Cameron Kusher said.

“With just two months remaining to year’s end, it seems that rental growth will be very soft over 2015,” Kusher said.

Kusher said the recent construction boom combined with slowing rates of population growth are among the main reasons for the subdued rate of rental growth.

Rich Harvey, managing director of Propertbuyer, said the modest rise over October was no surprise and agreed it would likely be a while before rental growth accelerates.

"It's going to take a while for rents to catch up, the thing that's going to cause that would be a rise in interest rates," Harvey said.

"They do have a lot of catching up to do, but that's to be expected when you have a period of strong capital growth like we have recently. A place like Sydney especially, which has had great growth and is still growing in the blue-chip areas is not going to see rents grow for a while," he said.

The slow pace of rental growth has also meant that yields have suffered, with no yields now lower in every capital city compared to this time last year, with the combined capital city yield sitting at just 3.5%

Despite its large fall in asking rents over the last 12 months, Darwin is still recording the best overall yield at 5.4%, followed by Hobart at 5.3%.

Melbourne is currently home to the worst yield, at just 3%, with Sydney’s 3.3% the next lowest.

In separating houses and units, the highest yields for houses are found in Hobart at 5.3% and Darwin at 5.2%, while the best yields for units are in Darwin at 6.1% and Hobart and Brisbane at 5.3%.

For those who may be put off by the fall in yields, Harvey said there are some ways around that.

"The first thing is to make sure you buy the right type of poperty that allows you to add value and then increase the return from that. That could be adding a bedroom, building a granny flat or another sort of extension.

"The other thing is to look at properties that have multiple income streams. Things like duplexes or a building that has a shop below with a flat above it."