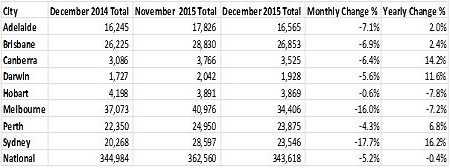

Recent figures from SQM Research show that total residential listings in Melbourne decreased by 7.2% over 2015.

Over the year, the Victorian capital and Hobart, which recorded a 7.8% decline, were the only two capital cities to see yearly decreases.

On the other hand, cities such as Sydney (16.2%) Canberra (14.2%) and Darwin (11.6%) all saw significant rises in listings over 2015.

Source: SQM Research

According to Louis Christopher, head of research at SQM Research, the difference in listings performance in Sydney and Melbourne over 2015 show the different direction the two markets, which have been considered by many in recent years to be the country’s premium locations, are taking.

“The yearly result is a better indicator of the market. And on that front we are recording large rises in Sydney while Melbourne listings are noticeably down,” Christopher said.

“To me this is yet another indicator of the slow market that Sydney is now experiencing and the contrasting Melbourne market, which this information suggests, is firming,” he said.

The idea of a firming Melbourne market is one that is supported by Amy Mylius, a buyers’ advocate with Melbourne based Cate Bakos Property, though some sectors of the market will likely perform better than others.

“That [a decrease in listings] was something we definitely felt last year and talking to agents there was just a feeling that with the strong capital growth that was being experienced people weren’t willing to sell,” Mylius said.

“I think people will want to keep capitalising on that this year and we don’t think there’s going to be a decline anytime soon, especially in the performance of the premium investor stock, the kind of properties that would be attractive to owner occupiers,” she said.

Mylius said that might not be a circumstance repeated across the entire Melbourne market, especially in the off the plan and high rise sectors.

“I think there will be a bit of divergence in the market though, the off the plan and high rise stock will probably peter off a bit. The APRA changes mean investors need a 20% deposit for those now and that’s having an effect.

“The thing is while some of those new off the plan and high density properties might be available and their prices might fall away a bit, they’re not always the most attractive in terms of where people want to live.”