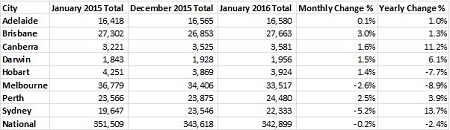

While listings increased in all but two capital cities over the month, solid decreases in Sydney and Melbourne were responsible for bringing the total number of listings down to 342,899 according to figures from SQM research.

Sydney had the largest monthly fall in listings, with a monthly fall of 5.2%, while listings fell 2.6% in Melbourne.

The largest monthly increase was recorded in Brisbane where listings rose 3%, while Perth saw a 2% increase.

Canberra, Darwin and Hobart all saw monthly increases of between 1.4% and 1.6%, while Adelaide recorded the smallest monthly rise at 0.1%.

Looking at year-on-year figures, listings are higher now than they were 12 months ago in all markets except Melbourne and Hobart.

Melbourne has recorded the largest yearly fall at 8.9%, while listings are down 7.7% in Hobart.

Sydney and Canberra have easily seen the largest yearly increases, with listings up in the two cities by 13.7% and 11.2% respectively.

Darwin has experienced a year-on-year increase of 6.1%, while listings are up 3.9% in Perth over the year.

Brisbane (1.3%) and Adelaide (1%) saw slight year-on-year increases.

Source: SQM Research

Louis Christopher, head of SQM Research, said the figures show mixed market conditions will continue across Australia in 2016, with Melbourne showing more signs of being the nation’s best performer.

“As we enter into the new property season it’s clear that our latest indicators are suggesting a continued mixed market across the nation. On the one hand there is an overhang of stock on the market in Sydney, which is a symptom of the slowdown in the market there that started the second half of last year,” Christopher said.

“While on the other hand Melbourne does not appear to have any overhang, and so will be entering the new season less stock on the market than what has been the average for the past five years. Our forecast released back in October 2015, that Melbourne would outperform Sydney this year, seems to be very likely now,” he said.