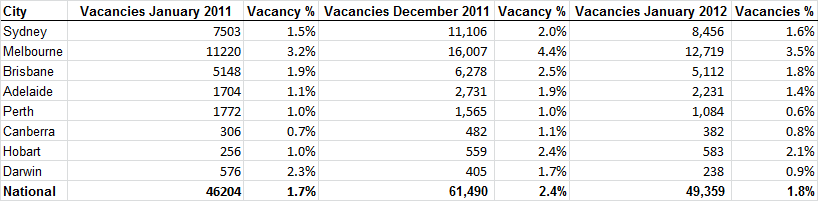

The residential vacancy rate dropped in all of Australia’s capitals during January, meaning landlords still have the upper hand across most of the country.

These are the thoughts of SQM Research managing director Louis Christopher, following the company’s publication of January’s vacancy rates.

The one notable exception, he says, is Melbourne – whose vacancy rate remains high at 3.5%, despite a significant drop from last month’s figure of 4.4%.

“Overall it is still a landlord's market for most parts of the country, with the exception of Melbourne,” said Christopher.

Perth remains the capital city with the tightest rental market, according to SQM Research figures, with its vacancy rate dropping from 1% to 0.6% during January.

“Perth vacancies appear to be quickly disappearing,” said Christopher, adding that if vacancy rates continue to sit at below the 1% mark then the city will experience “accelerated rent hikes” this year.

The next lowest vacancy rates were found in Canberra (0.8%), Darwin (0.9%) and Adelaide (1.4%), with the national figure dropping from 2.4% to 1.8%.

But before investors get too ahead of themselves, Christopher warns landlords to remember that January’s big vacancy rate drops come off the back of December’s seasonal increases.

Noting that the January’s total number of vacancies (49,359) remains higher than it was before the seasonal spike in November (48,244), as well as being higher than it was this time last year (46,204), SQM Research believes that the figures may in fact point to a slightly looser rental market.

“There has certainly been a large seasonal effect on the December results. Vacancies have now come back to the pre-Christmas numbers, albeit at a slightly higher level,” said Christopher. “We note too that vacancies are also slightly higher than this time last year.”

The results:

Source: SQM Research

What's your take on rental market conditions? Have your say in our property investment forum.

More stories: