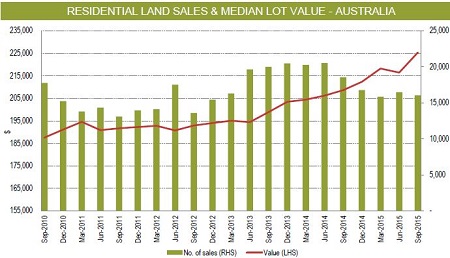

Released yesterday, the report shows that the number of residential lot sales fell by 2.7% across Australia during the September 2015 quarter, which coincided with a 4.2% increase in the median price of a residential lot to $225,450.

Movements were even more pronounced in capital city markets, with sales of residential lots decreasing by 4.5%, while median prices increased by 5.4% $262,069.

In the year to September 2015, the median capital city residential lot price increased 10.7%.

HIA senior economist Shane Garrett said the report highlights the seriousness of supply issues currently facing Australia

“At about 12:50am [Tuesday] morning, Australia’s population broke the 24 million barrier for the first time. [This] report provides a sobering indictment of how land supply policy is not keeping pace with the housing needs of our growing population,” Garrett said

“The combination of strong land price growth yet declining transaction volumes are hallmarks of a market constrained by supply bottlenecks,” he said.

Source: HIA/CoreLogic RP Data

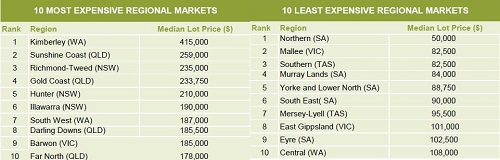

Residential lot prices are at their highest in Sydney, where the median price rose 22.8% in the year to September and 9.1% over the quarter to $392,500.

Perth’s residential lots are the second most expensive in the nation, up by 5.3% annually and 2.5% over the September quarter to $266,500, followed by Melbourne where the median price increased 6.9% over the quarter to $232,000.

The median residential lot price in Brisbane sits at $231,250, with Adelaide’s at $200,000, while Hobart has the cheapest lots in the nation at $143,500.

According to Garrett, the current supply constraints will result in more than just increased property prices if they are not addressed.

“Ineffective land supply policy will limit Australia’s long term growth potential and erode competitiveness by forcing costs up,” he said.

“The key supply side issues like planning delays, efficient infrastructure provision and the mammoth taxation burden on new housing need urgent attention. Otherwise, living standards for Australia’s 24 million residents will never reach their full potential.”

Source: HIA/CoreLogic RP Data

CoreLogic RP Data research head Tim Lawless said buyer demand for residential lots remains elevated, despite falling lower after a peak in mid-2014, and it is likely that lot sizes will have to be reduced.

“Buyer demand across the vacant land market has remained strong, which is why prices are rising on lower sales, however, as land prices rise it is likely block sizes will have to reduce in order to maintain an affordable price point for buyers,” Lawless said.

“Median lot prices have risen across every capital city over the past twelve months except for Adelaide (-1.0%). The tight supply of land across Sydney has seen median land prices rise by the most of any capital city over the past year, up 22.8% compared with a weighted average across the capitals of 10.7% growth,” he said.

“Despite having the most expensive housing and vacant land, Sydney is currently showing the second largest median lot size amongst the capital cities at 537 square metres. Somewhat counterintuitively, the median land area has historically been the smallest in Adelaide, with the September quarter data showing a median lot size of just 375 square metres.”