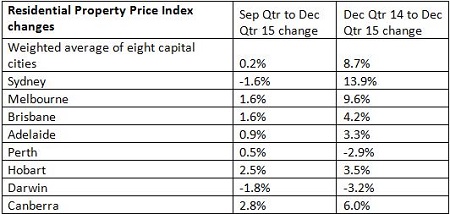

Released yesterday, the Australian Bureau of Statistics’ (ABS) latest Residential Property Price Index has revealed the average rate of capital growth across Australia’s capital cities was just 0.2% during the December quarter.

The index shows average rate of capital growth across the capital markets in the 12 months to December was 8.7%.

Glen Byres, the Property Council of Australia’s chief of policy of housing said the slow rate of growth in the December quarter illustrated the effects of increased supply and a forced slowdown in lending to investors has had on the market.

“House price growth continues to pull back – suggesting the delivery of new stock in the market and caps on investor lending are working,” Byres said.

“Nationwide growth is moderating. It has now fallen from 4.7% in the June 2015 quarter to just 0.2% in the December quarter,” he said.

Byres said market conditions in Sydney over the quarter, which saw experienced a price drop of 1.6% - its first in three years, are the main indicator of the effect supply has on the market.

“We are seeing benefits of policies that have increased housing supply across Australia. Our concern is that the changes proposed to negative gearing will risk the progress we have made – and this will flow through to investment, jobs and rents,” he said.

“Sydney – as the market with both our biggest affordability challenge, and the strongest surge in supply – has recorded negative growth for the first time in three years as the index fell 1.6% in the December 2015 quarter.”

According to the Housing Industry Association (HIA) work commenced on a record 220,000 new homes in Australia during 2015, which has eased affordability constraints.

“From an affordability perspective, the slowdown in dwelling price growth to a more sustainable pace is a welcome development. The final quarter of 2015 also saw a narrowing of the gap between the capital cities in terms of price growth. In previous quarters, the divergence in the pace of price growth from city to city was very large,” HIA senior economist Shane Garrett said.

“During 2015, a record 220,000 new dwellings commenced construction across Australia. The additional supply is playing an important role in containing the severe price pressures in markets like Sydney and Melbourne. Ensuring an adequate supply of new housing in the future requires root-and-branch reform in areas like planning, land supply and the taxation burden on residential building,” Garrett said.

Over the quarter, Darwin was the only other city to see capital growth in negative territory, prices falling 1.8%.

Canberra was the best performer in the quarter, with prices rising 2.8%, followed by Hobart at 2.5%.

In the year to December 2015 there was little surprise, with Sydney and Melbourne easily returning the highest rates of annual growth at 13.9% and 9.6% respectively.

The worst performers over the year were Darwin and Perth, where prices fell at an annual rate of 3.2% and 2.9% respectively.

Source: ABS/PCA