Recent figures from credit rating firm Moody’s revealed that housing affordability in Australia worsened recently, but Heath Bedford associate director at Performance Property Advisory, believes any affordability issues are the result of planning and supply issues.

“The problem has more to do with our continued strong population growth, a chronic shortage of appropriate housing, all time low interest rates and an undue focus on developing our capital cities,” Bedford said.

“Restrictive planning policies have locked up a lot of our inner to middle ring suburbs from appropriate medium density development, skewing our construction pipeline to high-rise development in our CBDs, inner city fringe and house and land packages on the urban fringe,” he said.

Bedford said this is particularly a problem in Sydney and Melbourne as there is still a demand for detached houses on quarter-acre blocks in those cities and policy makers aren’t doing enough to make regional areas more attractive.

“Slow land release in regional areas is a significant impediment to the supply of land for new housing and coupled with the mismatch between buyer demand and the type of land released, this has been especially problematic,” he said.

“Governments need to focus on developing our key regional areas which could be greater hubs for employment and education, dispersing demand more evenly.”

While he acknowledges that house prices have risen in numerous areas across Australia recently, Bedford also argues that there are still affordable options outside Sydney and Melbourne.

“While apparently boom-like conditions, the market is in fact making up for lost time. This has been compounded by a chronic undersupply of housing supply over this period, strong population growth and falling interest rate environment.”

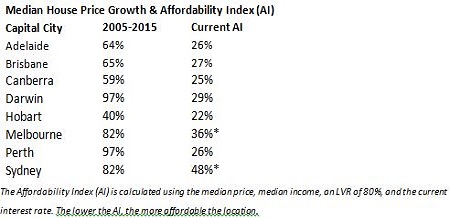

“Melbourne and Sydney are unaffordable at present but the other capital cities are still very affordable based on their long term affordability index measure. In fact, they are the most affordable they have been since the very early 2000s. In some cities we are likely to see affordability improve: Perth for example is experiencing and will continue to see prices decline after a strong 10-year growth period.”

Source: Performance Property Advisory