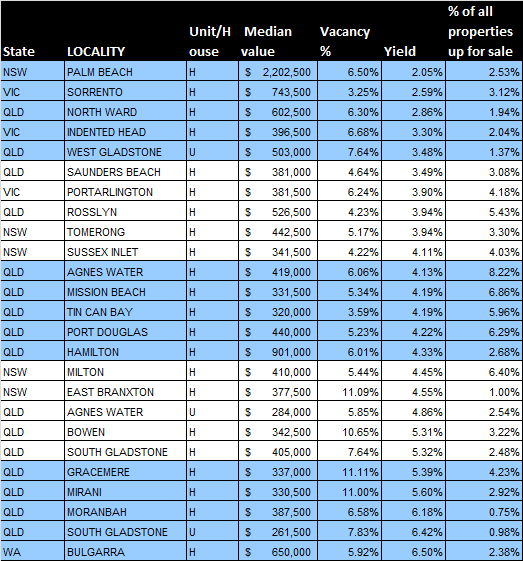

With this in mind, DSRScore.com.au figures reveal the markets across Australia that are currently facing the steepest impediments to capital growth. These include slow sales turnover times, too many properties on the market and too much competition among landlords for tenants.

The full list of suburbs is available below. Markets that deserve a special mention include:

PALM BEACH, NSW

Let’s face it. With a $2.2 million median house price, you probably weren’t going to buy a rental property in Palm Beach anyway, but the market is currently in dire straits.

They may shoot Home and Away in this suburb, but believe it or not, 27% of the residents are renters and you have to spare a thought for their landlords who have to suffer through a measly 2% average rental yield.

A ridiculously high 6% of rental properties are also vacant, almost unheard of in Sydney.

SOUTH GLADSTONE, QLD

But what about all that gas activity, right?

Investors may, or may not, have heard about Gladstone’s burgeoning economy, but the property market has gone soft in recent times – largely as a result of building activity overshooting demand.

This is clear from South Gladstone’s vacancy rate which, at 7.8%, is among Australia’s highest.

Property prices have also tanked in recent times and RP Data figures show that unit values dropped 11% over 2013.

Perhaps the biggest sign of the market’s change of fortune is that demand is waning. The average unit is sitting on the market for seven and a half months, according to DSRScore.com.au. This wouldn’t be happening if buyers were rallying to the suburb.

GRACEMERE, QLD

This dormitory town surrounding Rockhampton has seen a massive spike in properties coming onto the market. The proportion of all properties in the area that are up for sale is currently sitting at just over 4% - hardly ideal conditions for house price growth.

The current vacancy rate for rental properties is also a hard to believe 11.1%.

In this kind of environment, landlords with lower quality properties will suffer and many will be forced to drop their rents or face having an investment property without a tenant.

PORT DOUGLAS, QLD

Pretty Port Douglas may be, but one glaring statistic sums up the housing market. Just over 6% of all detached houses are up for sale.

By contrast, the average Australian suburb has less than 1.5% of its properties on the market, and in capital cities that number tends to dip below 1%.

If Port Douglas is to see any capital growth in the future the oversupply of stock coming onto the market will need to be absorbed. Put simply: prices won’t increase when buyers have a wealth of other options and face almost no competition from other buyers for a property.

How close is the market to seeing this excess absorbed? Pretty far. The average property is spending just over a year on the market before getting a buyer. Buyers aren’t rushing to Port Douglas to buy and the oversupply of houses could be staying for a long time.

Source: DSRScore.com.au