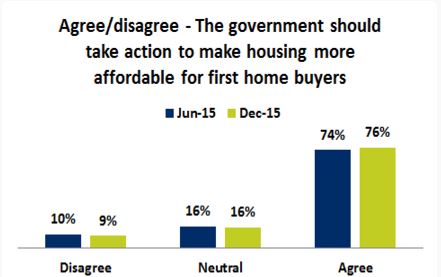

According to the results of survey conducted by non-major lender ME Bank in December 2015, 76% of Australian households are in favour of the government intervention around affordability; while 9% disagreed action should be taken while 16% were neutral to the idea.

Compared to the previous edition of the survey carried out in June 2015, support for government action increased 3%, while those disagreeing decreased by 1%.

Source: ME Bank

Support for government action on the issue of affordability was widespread among buyer types, with 81% of respondents to the December survey who are looking to buy property in the next 12 months supporting the idea, while 70% of investors were also in favour.

When it comes to what actions should be taken, 76% agreed (9% disagreed; 15% neutral) the federal government should do more to encourage the development of lower priced housing, up 2% from June 2015.

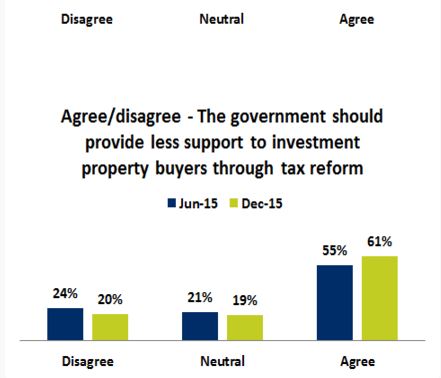

Sixty-one percent of respondents agreed (20% disagreed; 19% neutral) the federal government should reform the tax system to provide less support to investment property buyers, with 42% of investors believing the tax mix should be addressed.

Source: ME Bank

ME Bank chief executive officer Jamie McPhee said the survey’s results show housing affordability is a pressing issue for many Australians, particularly younger generations.

“We see the impact a lack of access is having on younger generations’ sense of financial wellbeing, which is falling behind the financial wellbeing of older Australians,” McPhee said.

“Property is an important wealth generator and the inequities in accessing housing should be tackled,” he said.

While property taxes may be a contentious issue at the moment, McPhee said the fact that a significant portion of investors believe the tax mix should be addressed is an important statistic.

“Australia’s current tax arrangements are contributing to the problem by advantaging investors over first home buyers and they should be addressed within a broader review of our taxation system.”

"That 70% of property investors agree something should to be done and 42% agree tax concessions for property investors should be changed, shows reforms would receive wide support.