The analysis of settled sales data over the 2014-15 financial from CoreLogic RP Data has revealed that vacant land selling prices increased by 6% across the combined capital cities over the year.

In comparison, vacant land prices across regional markets have fallen by 3.4% over the same period.

As of June, the median vacant land price across the capital cities sat at $258,543, while regional vacant lots carry a median price of $156,500.

Those figures show that the price of vacant land in regional centres now sits 39% lower than the price of vacant land in capital cities, which is the widest differential since August 1990.

While the price of vacant lots in the nation’s capital cities is on the rise, the research shows the size of lots isn’t.

“The median lot size for capital city vacant land has seemingly hit a trough having been relatively stable over the past two years. Meanwhile lot sizes have trended higher over the past year in regional areas,” CoreLogic RP Data research analyst Cameron Kusher said.

“In regional markets, it has actually risen by 8.3% over the past year,” Kusher said.

At the end of June 2015 the rate per square metre was recorded at $557 across the combined capital cities and $170/sqm across the combined regional markets.

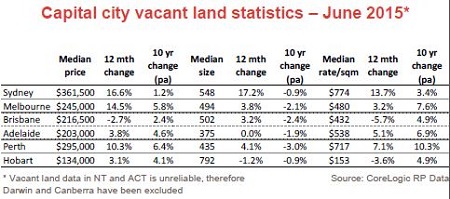

On a price/sqm basis, two capital cities are head and shoulders above the rest.

“On a rate per square metre basis, vacant land in Sydney and Perth is much more expensive than all other capital cities. The rate per square metre has generally risen over the past year,” Kusher said

“When looking at individual capital cities, vacant land prices are much higher than all other capital cities in Sydney. The cost of vacant land has risen sharply over the past year in Sydney, Melbourne and Perth.”

“As we continue to see the costs of capital city land continue to rise, the rebound caused by this effect is that ultimately the cost of new housing will also rise.”