“The poor performers are probably yet to see significant growth during this cycle and may offer investors very good growth prospects and for home buyer’s an opportunity to purchase well from despondent vendors,” said Residex founder John Edwards.

Edwards said that knowing where a suburb is in its growth cycle was key to identifying the opportunity within that area.

“If you combine the knowledge about a suburb’s growth cycle along with research data, suburb information and if you find out what the public considers the best streets are, then good buying decisions should result,” Edwards said.

He added that recent activity bodes well for some of Sydney’s poorer performing areas over 2013.

“Recent auction activity and the numbers point to a market where the upper end is beginning to slow and the lower cost areas are currently the most sought after...

"Based on the data, it would appear that lower cost suburbs will see the strongest growth in the next 12 months.”

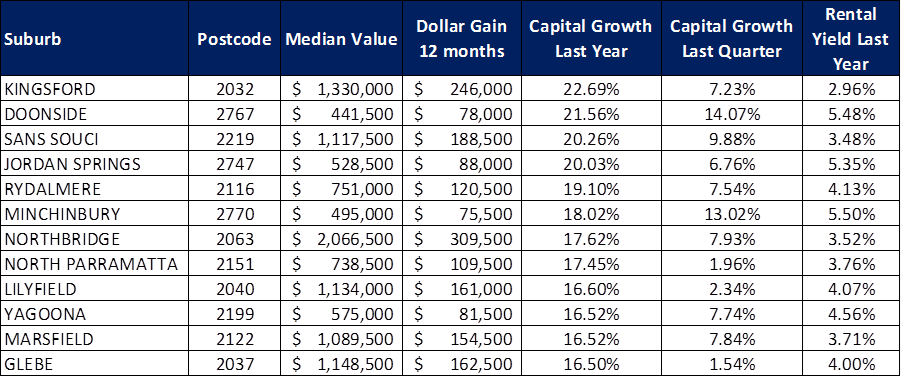

Capital Growth Best Performers - Houses

Source: Onthehouse.com.au / Residex

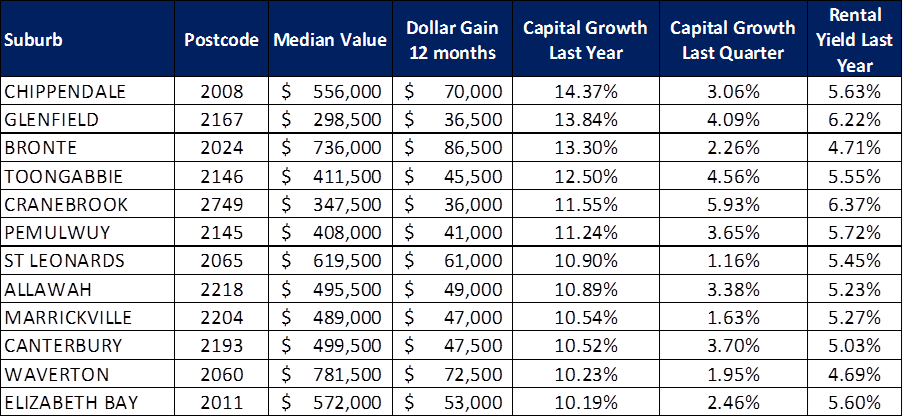

Capital Growth Best Performers – Units

Source: Onthehouse.com.au / Residex

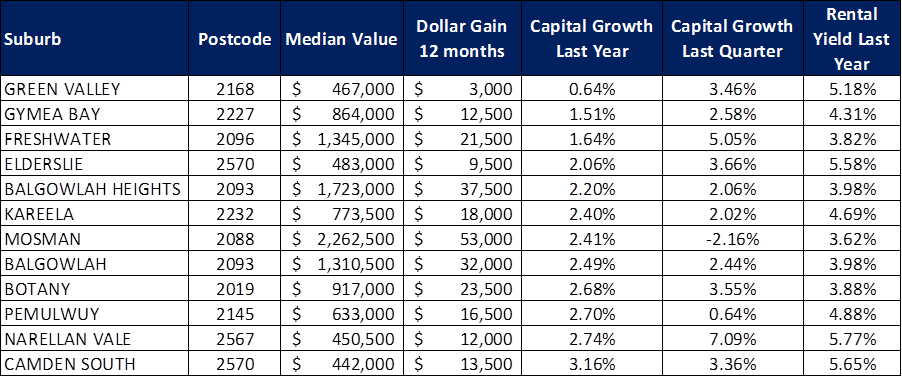

Capital Growth: Worst Performing Suburbs – Houses:

Source: Onthehouse.com.au / Residex

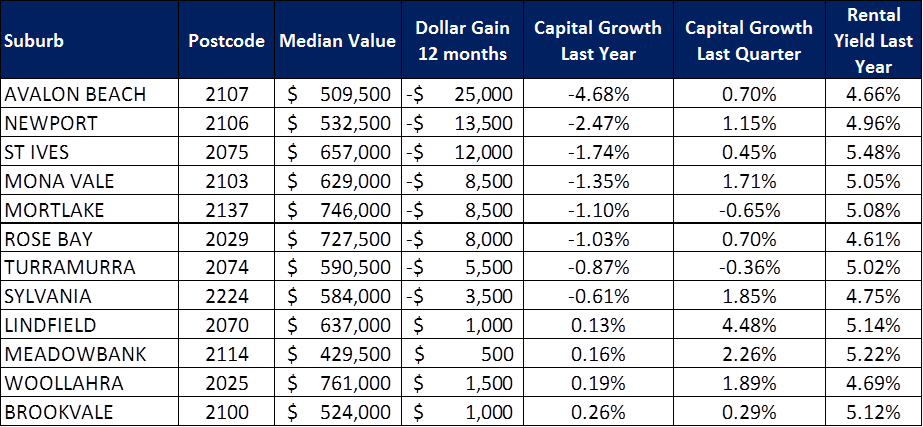

Capital Growth: Worst Performing Suburbs – Units:

Source: Onthehouse.com.au / Residex