Just because it can be a little complicated, it doesn’t mean you should disregard this strategy altogether.

Matt Jones, founder of Property Resource Shop, is a huge proponent of generating profits through subdividing, having embarked on several successful projects over the last decade.

“My strategy is a little different in that I’ve been happy to subdivide the property, renovate the home at the front and then sell off the land at the back to realise a profit,” he explains.

“There’s far less time, risk and work involved, and using this method I’ve been able to pay down the loan on the front house by using the profits from the subdivision.”

This is an ideal strategy for those investors who are new to property development and may not have the time, money, resources or experience to handle a large-scale project.

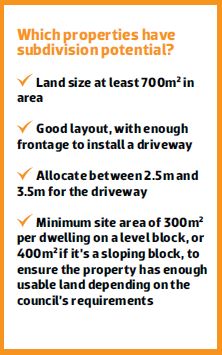

That said, regardless of whether you plan to build on the land yourself or offload the property to another buyer, there are a number of criteria a properties must possess in order to have subdivision potential.

There’s no ‘one size fits all’ answer to this question, as the minimum land size required to develop land will depend on your local council guidelines, says experienced investor, property lecturer

and author, Peter Koulizos.

“As a general rule, you want to find a property that is at least 700m2 in size, but size isn’t everything,” Koulizos says.

“You also need to consider frontage, slope and driveway width.”

In other words, you’re not just looking for a block that is big enough, but one that has an agreeable layout with enough frontage to install a driveway. There must be enough room between the edge of the house and

boundary line to construct a driveway, and Koulizos points out that the minimum requirement here varies between councils.

“Some councils will let you go down to 2.5 metres, while others want 3 metres plus half a metre for landscaping, so you’ll need to allocate between 2.5 and 3.5 metres for the driveway,” he says.

Slope refers to the angle of the land; in development circles, a flat block is far easier, cheaper and less complicated to work with than a sloping block.

enough usable land,” he explains.

“The other issue is that if it’s not a level site, you’ll have to either cut into it or fill it up, which is going to cost a lot of money in retaining walls and engineering.”

To make matters even more complicated, each council treats the calculation of land differently, says Koulizos.

Some councils will factor in every inch of land on your property when calculating your total block size, while others exclude driveways and easements.

“Let’s say you’re working in an area where each dwelling must be 300m2, and you’ve found a block that is 600m2. The existing house is well positioned with plenty of land at the side and back and the property seems to have strong development potential,” he says.

“The problem with this is that many councils won’t include the driveway servicing the back block when assessing the square footage. If you’re planning to run a 3 metre wide by 30 metre long access driveway along the side of

the house, then you’ve now only got 510m2 to play with – which means your development is dead in the water.”

Most council plans have guidelines for battle-axe or hammer head allotments, which will detail whether the driveway is included or excluded in the final land calculations.

“This can stump a lot of people, because you think you’ve got land to work with until you suddenly realise that you don’t,” Koulizos warns.

“It’s important to get this information at the outset from council, but don’t just rely on someone’s word. Ask them, ‘Which page of the planning guidelines is this information is on?’ You don’t want to misinterpret it, as the consequences can be costly, so get

it in writing.”

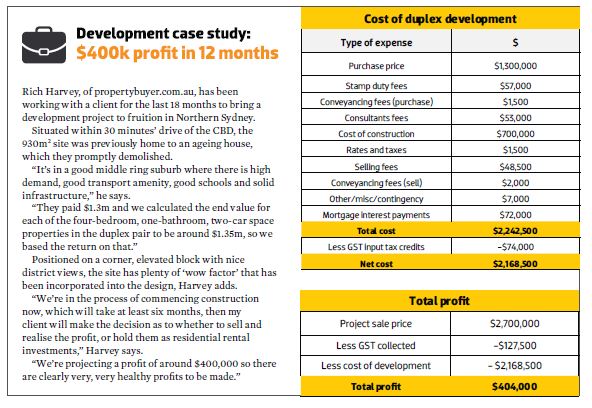

Breakdown of costs to subdivide and develop:

Developer Contribution: $30,000 to $40,000

The biggest planning cost you’ll have is what’s commonly known as council or developer contributions. This money goes towards the funding of local infrastructure projects.

Subdivision costs: $50,000

Yes, it’s a hefty sum to legally split one block into two, but it covers “pretty much everything, depending on the complexity of the site,” says Jones. This covers your surveyor, town planner, document preparation for council, consultants, council fees, tree levels, works involved when installing new sewer lines, tapping into existing sewer and water lines, and installing power to the site.

Demolition costs: $20,000

If you need to demolish an existing property prior to developing, you should budget for around $20,000 to do this, says Rich Harvey, managing director of propertybuyer.com.au. “A client of mine recently went through this process and it was a little higher at $22,000, as the property had asbestos, which had to be handled by a specialist,” he says. Unforeseen expenses like this can weigh on your bottom line, which is why it’s essential to have a contingency.

Construction costs: $200,000 to $700,000

This figure will depend on the size, quality and scope of your project, but you can expect to pay anything from $200,000 for a three-bedroom house through to $700,000 for a high-end duplex pair.

Finance costs: sufficient to cover deposit and buying costs:

You’ll typically need a 20% deposit in order to gain finance for a development project, plus enough funds to cover stamp duty and other associated buying costs. “With developments, it depends on the lender as to whether you can borrow only enough to cover most of the construction, or whether you can borrow against the end-value, which is significantly higher,” Harvey says.

“You really must have a savvy mortgage broker who understands development to guide you through this process.”

STEPS TO SUBDIVISION SUCCESS

Step 1: Settle on a location

Finding the ideal location to execute your development strategy is “similar to choosing a really good quality investment property,” explains Harvey.

“You want to be close to schools, shops, hospitals, amenities and transport, near major employment hubs and within an easy commute to the CBD,” he says.

“The location is critical when you think about your exit strategy, because you’ve got to think about who is going to buy what you’re developing, and how much supply is already available. Speak to agents to find out whether what you’re

planning is suitable for the market.”

Step 2: Do extreme due diligence

Once you’ve isolated your location, it’s crucial that you get to know your neighbourhood exceptionally well, as you need to make sure there is demand for the type of project you’re planning.

“This is the case with any property investing strategy, but when it comes to a development project I always like to look for precedence,” says Jones.

He suggests that you drive around for an afternoon in the neighbourhood that you plan to have your subdivision development in, so you can look for similar projects to the one you’d like to undertake. Evidence of existing successful developments is a good sign of a proactive council, while a lack of many new builds can be a red flag, Jones warns.

“You don’t want to challenge council; you want to work with what they’re already willing to do, as you ultimately want to work with them, not against them,” he says.

“When I work in a new area, I take the time to talk to the council, so I can look for deals that suit the types of projects they want to approve.”

Step 3: Crunch the numbers and make an offer

Matthew Lewison, founder and CEO of Open Corporation Funds Management Ltd, advises investors to develop their own ‘one-page feasibility’ to allow them to quickly assess a site’s development potential.

“I’ve never met two developers using the same feasibility model, because everybody has their own particular slant on how it should work,” he says.

Things to consider will include the purchase price, conveyancing costs, stamp duty, site investigation, planning

design and consultants, constructing external services, building works, statutory charges, marketing, land tax, council rates, site maintenance, accounting fees, interest, borrowing costs, sales revenue, GST and agents’ commissions.

Step 4: Crunch the numbers and make an offer

When you find a deal that passes your initial feasibility criteria, it’s time to put the project through its financial paces.

“The most important variable at the end of the day is your target margin for risk,” Lewison says.

“If you can ascertain your net revenue and you deduct the costs, you are left with your margin. Calculate this as a percentage and assume 15% for the most risk-free development you can think of, and work from there.”

For instance, you might calculate that a purchase price of $600,000 equates to a ROI of 16%, while a purchase price of $650,000 generates an ROI of 14%. With these figures to guide you, you can be confident that you’re not biting off more than you can chew when making an offer.

Step 5: Get started on your subdivision!

Once you have successfully settled the purchase of your investment property, you can expect the process of subdividing the land to take anywhere from three to 18 months, Jones says.

“I’ve seen people do it in three weeks, and I’ve seen others take 18 to 24 months. Six months is a good average,” he says.

“On a simple project where a block is being split into two, with a council that is proactive and helpful, I would perhaps allow for nine months, as it always pays to allow more time needed than less.

“There are things you can’t control, and things often take longer than expected. Just make sure you don’t dawdle; if you get a letter from council requesting information, get it back to them straight away. A simple deal might be costing you $300 to $400 a day in holding costs, so take action and be proactive to move it forward.”

What happens if the council says no...

Nothing takes the wind out a developer’s sails quite like the news that council has declined their proposed project – especially if the devastating blow is delivered after said developer has spent a small fortune on planning expenses. One of the most common reasons for a knock-back is a planning or zoning change, which is more likely to happen if there’s an extended gap between buying a property and actually subdividing the land beneath it.

Property specialist Paul Wilson, founder of We Find Houses, has worked with several clients over the years who have bought with the intention to develop, but after they’ve bought it “life gets in the way, and they don’t follow up their intention to develop, but after they’ve bought it “life gets in the way, and they don’t follow up their intention with action to fulfill the project."

“You need to have the budget to buy, start and complete the project at the outset, because council planning changes or market changes can mean a once-promising development is no longer viable," he says.

“My biggest piece of advice to anyone considering a subdivision project is to ensure they take it to the very end. Subdivide and pay the fees, even if you don’t plan on developing or on-selling the land right away."

The experts weigh in

Beware the traps for the uninitiated

“There’s a lot of traps for the uninitiated when it comes to developing, so it really pays to get a professional consultant. I’ve done it myself and paying for an engineer or town planner has always been totally worth it. Without their advice and input, you can wind up with delays and every day costs you interest.”

- Rich Harvey

propertybuyer.com.au

Treat your project like a business

“You need to focus on the project like a business, as it’s really a full-time job. And make sure you have a good team around you, as you can’t know it all. My phone is my toolbox; I’m always ready to pick up my phone and call town planners, civil engineers and other experts to get their opinion when I’m looking for red flags.”

- Matthew Jones

PropertyResourceShop.com

Don’t be afraid to dive right in

“The first project I ever did was a development – I cut my teeth on it. I even took the council to the Environment Court to get my first project over the line! But it really depends on the person as to whether you have the drive and the time to get a successful project completed. Some people take on a project and they’re just busy being busy, so they get to the end and they didn’t achieve much more than they would have by purchasing a passive property investment.”

- Paul Wilson

We Find Houses

Get a fixed price, turnkey contract

“This is the riskiest of all property investing strategies. It can be rewarding and it can be a great way to make money, but it can also be a great way to lose money. My advice for those embarking on their first project would be to get a fixed price, turnkey contract that includes everything. It will cost you a little more, but this way there is only one person to liaise with; just consider the extra costs as a project management fee.”

- Peter Koulizos

Property author

Aim to fit into an established market

“Leave the trail-blazing to the big end of town. Large-scale developers can change a market by introducing new amenity, but for a small-scale development you need to fit into an established market. Look at what is getting approved and what is selling nearby, and use those developments as benchmarks to set your project alongside, rather than designing a unique product thinking you will create a market for it.”

- Matthew Lewison

Open Corporation Funds Management Ltd