The latest Sydney boom has created so much new wealth for property owners. A new generation of property owners have amassed equity for the first time in their lives while the older generation of property owners are now sitting on an even higher mountain of equity.

Equity what?

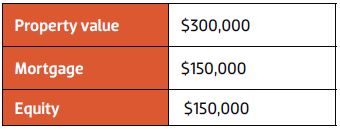

So, what exactly is equity and why should you care? Equity is a rather simple concept. Simply put, it’s the difference between your debt and the current value of your property.

Let’s assume you have a property worth $300,000 and you owe $150,000. You would therefore have $150,000 in equity. This is generally a non-physical amount of money; in other words, paper money or a theoretical amount, until it’s ready for use. I’ll explain more shortly.

For example, as rates change, your servicing capability changes, so you may not be able to borrow as much against your equity as you could have previously, even though the equity exists. The value of your property may also fluctuate, and you could end up with a lower level of equity if property values drop in your suburb.

Right now, Sydney prices are very high due to a runaway market and four years of fantastic uplift. We have seen properties go from $400,000 to $800,000 in some areas.

The new $400,000 added value is there for you to access, but if you don’t lock it in with your lender and create a new loan, then that $400,000 will float. We are already seeing a Sydney correction, and for many people that $400,000 has slipped to $350,000. While still a healthy profit, it can drop unless the money is locked in.

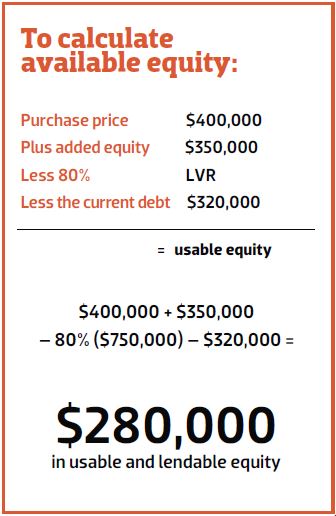

Complicating the system even further, if you want to borrow the available equity, the bank will only lend 80% of the new amount. This is assuming that you have the income to support the equity.

So, let’s go ahead and lock in your equity at 80%. This means you have to take out a new loan and create an offset account for use for a specific purpose or as an open line of credit.

This effectively becomes a source of funds that you can readily tap at your discretion. With the line of credit, you only pay interest on the money you use. So, if you only use 40% of the total amount, your interest payment is on the 40%, not on the whole amount. However, you may be required to pay an unused-line fee, often an annualised percentage fee on the money not withdrawn. So yes, you can have your equity ready and waiting.

Let’s assume you have an original loan of $320,000 for the purchase of a $400,000 property, based on an 80% LVR (loan-to-value ratio).

You don’t have to be a finance genius to be a great property investor, but in addition to finding a great finance professional, you should have at least a basic understanding of how the equity aspect of property investing works.

Using other people’s money – the bank’s

Yes, you can buy an investment property using other people’s money. In fact, you should do just that! Well, mostly other people’s money – you may have to kick in at least 10–20%, but that just means you’ll have more deposit or equity from the start.

So, now we have the $280,000, what can we do? This is where most people misunderstand the power of equity. Many believe it’s not possible to leverage that $280,000 now. In fact, most people don’t use their equity to reinvest, thinking they don’t have enough. But of course they do.

If you have a reasonable income, you can use your $280,000 equity to borrow $1,120,000. That is easily two or even three great properties. The easy maths I always use is to multiply my lendable equity by four.

Of course people’s propensity to take on risk and debt is very different. But as you can see, if you were to get another $1,120,000 worth of exposure in the right areas, you would be well on your way to financial freedom.

Game plan for accessing your equity

Let’s create an equity plan so you can master your equity and build a better financial position. The seven-point equity plan checklist:

1. How to prepare for a valuation

2. How to be equity-ready

3. Lending trap

4. Having a buffer

5. Debt reduction creates equity

6. Reverse mortgages

7. Basic equity strategy and fast-track equity strategy

How to prepare for a valuation

It’s usually a good principle to take stock of values in the area yourself so you can argue when the bank suggests your property is worth less than everyone expects. To borrow money, the valuer typically is instructed by the bank, so you have to go off their rules, not common sense.

One of the best times to get a current valuation is when you have, say, two or three recent sales that are very similar to the property being valued and you believe they are a good, high price.

When you have the valuer around, or if you’re working though your mortgage broker, one idea would be to put together a written report detailing three or more comparable sales within about 500m of the property over the past six months. They most likely already know this information, but it cannot hurt to do your own research. Local realtors can be a great source, along with some online tools.

Some valuers like to see a copy of your municipal/council rates. They vary from one place to the next, but there will generally be a ‘site value’

or ‘unimproved land value’ figure reflecting the value of the land only. Sometimes there will also be an

‘improved value’, based on the land and building.

Those (values) are calculated based on a statistical analysis. So it’s not accurate but gives the valuer a ballpark and a pretty good idea of where the property is sitting in the marketplace.

If it’s your home and the valuer is visiting so you can release equity, make sure the place is looking good, clean and tidy.

A typical three-bedroom home would take a prudent valuer not much more than 10 minutes to inspect inside and out, so don’t feel you have to speak to the valuer to make sure they haven’t missed any part of the property.

Some owners feel the need to follow the valuer around, pointing out every feature of the dwelling, but don’t try to sell the property to the valuer. While you may be pointing out features you feel add value to the property, it’s best to leave it up to the expert to decide which are the salient features. If you waste the valuer’s time with lots of chatter, you may get in the way of them doing their job as thoroughly as possible.

If you want to make sure the valuer has all the information they need, perhaps at the end of the visit you can ask whether there are any matters the valuer isn’t sure of.

Don’t ask the valuer what they think the property is worth. After visiting it, the valuer needs to go away and undertake at least two separate methods for determining the property’s value. Two of the most common methods for residential property are ‘direct comparison’ and ‘summation’.

Direct comparison involves analysis of recent sales of similar properties in the area. It may be a straight comparison, or a comparison of the rate per square metre (which is the sales price of each property divided by the land size).

In this method the valuer takes into account factors that differentiate your property from those in the comparison sample, such as location, size, quality of the dwelling and views.

Using the summation approach, the valuer assesses the land value and then includes the ‘added value’ of the improvements on the land (ie buildings). The added value is based on market evidence and is sometimes analysed on a rate per square metre basis.

The valuer probably won’t be comfortable giving you an answer until this analysis is complete, and more often than not the valuation is the bank’s information, not yours.

There is a saying in real estate, “there is God and then there are valuers”, so don’t get too upset if they downplay the value of your property and make things slower and harder for you to get more money out. Sometimes you will even have to wait another 12 months longer than you should have to as the banks ease up. Try to do your best at the beginning to have working knowledge of the market and your property.

How to be equity-ready To be equity-ready you need a plan.

How to be equity-ready To be equity-ready you need a plan.

I like to review equity in all my properties every 12 months. Once you have done your own examination of the value and feel there is some hidden treasure to unlock, then it’s time to take action.

Most people fail to use equity because they keep their financial particulars in a very messy state. It’s a good idea to be up to date with your tax returns, your payslips and all your rates and levy notices.

Banks will not allow you to access your equity if you can’t demonstrate good financial management, and that starts with good bookkeeping practices and ensuring that your application for a loan is easy by providing the best content possible about yourself. You wouldn’t apply for a job without a great CV, so don’t let people look at your credit file without knowing what they are doing and being ready.

What lending traps do I need to know about?

When it comes to accessing your equity, often you have to use the same bank over and over. The problem with that is it increases your risk profile and ability to borrow more money. Also, if the market slows or one of your properties is performing poorly, it drags down your ability to access equity from your performing properties. In other words, if one of your properties is going backwards by $50,000 and one of your properties is going well and is up $50,000, in practice your equity is at zero by using the one lender. Alternatively, if you have a few lenders, your loss may not affect your gain as the money is coming from two separate sources.

Cross-securitisation is one trap to be aware of, when a lender uses all of your properties as collateral for extending finance. In other words, all of your properties are under one or more blanket loans with one lender.

Better choice

Spread your loans among a variety of lending institutions by creating redraws and moving money to other banks. This gives you much more flexibility in handling your finances. You’ll have the ability to choose which properties you want to strip equity from, which can be put towards continuing to grow your portfolio. Crossing is not the end of the world, but it does need to be watched, particularly as property markets cool, as it will be harder to get equity.

Using equity as a buffer

Did you know that only 3% of Australians own three or more properties?

Although most Australians know that property investing is one of the best ways to create wealth, they are afraid of paying the shortfall. One of the best things you can do is to create a good buffer for yourself.

Let’s say you have $100,000 in equity. As a rule of thumb, park 20% of that in a ‘do not touch’ account. This is your buffer for unexpected issues such as loss of rent or extra repairs. Don’t think of this as losing money, because capital growth should be more than what it’s costing you to keep the property into the future.

Reduce your debt to create more equity

Mortgage reduction creates equity. It’s pretty simple but prudent to assess. The less debt and the more wealth you have, the better your chances of having lots of equity. One way to create equity if the market isn’t growing is to pay down debt then use your equity via debt reduction to begin with.

My recent equity story

I like to keep LVRs low in my portfolio. One property I bought in 2008 in Dulwich Hill Sydney has served me well. I paid around $415,000 for the property and had a loan of $330,000. Today that property is worth around $775,000. Having lots of equity in

the property and wanting to invest, I withdrew $201,000, so my total loan is now at $531,000 (still around 68% LVR, which is at the lower end).

I decided to buy a property with the $201,000, and planned to build a duplex in Newcastle. I have now invested my $201,000 into a property that I purchased for $670,000. I did this on a 70% LVR, mainly due to the fact that I was doing a small development application and NAB liked a 70% LVR. So I borrowed $469,000 and invested $201,000, effectively all borrowed.

On completion, the duplex is expected to be strata titled, increasing my ability to create value. The two sides of the duplex are expected to be valued at $420,000 each. This means my two newly created properties should be worth about $840,000 against a debt of $469,000 on the two newly built properties. My new equity position on this property will be $371,000, less my borrowed equity from the Dulwich Hill property of $201,000.

I have just created in 12 months another $171,000 for my overall equity and life … Not bad at all. Will I use it? Not yet, but it is sitting there to be used one day when I find the right property.

My example comes from my years of experience and good equity to start with. The more you have, the faster you can create more exciting and profitable opportunities.

https://www.nab.com.au/personal/loans/home-loans/home-loan-calculators/equity-loan-calculator

Most of us can’t, as a starting point, buy real estate with a 70% LVR and do a small development, but if you do have a little equity it is time to invest. These days you can get 90% loans and offer small deposits to try to create equity.

Equity returns are the fundamental instrument for building a successful property portfolio. As you may now understand, you have to recycle your equity and reinvest it – if you buy the right property and have a good strategy for equity return. Give yourself three years to recycle your equity and go again.

A word of warning: all markets and deals are different, so do your research. Losing money in real estate is common, so research skills are more important than ever.

There is one recurring theme that dominates this article: equity. It is as intriguing to me now as the first time I found it. The ability to use its influence is unmatched, and others who don’t have it marvel at it. Having equity commands opportunity. Equity can create deposits, which is the seed capital for investment. Its use is elementary, yet to obtain it requires unbridled determination. Equity rules our world. Everybody wants it and is working in one way or another to get it.

You now have the foundation to take action, so go win the equity race.

Traps of cross-collaterisation

• Your ability to borrow is tied down if all of your properties are financed with one lender. If, for example, you want to borrow more than 80%, the premium for the LMI is calculated on all of the monies you have with that lender, not just the amount you’re currently seeking. This potentially adds thousands to your borrowing costs.

• If you want to sell one of your properties and keep the equity you’ve earned, the lender could require that you use all of the monies you gain through the sale to repay your debt, rather than allowing you to only pay off the portion that was secured by the property you sold.

• The ‘all monies’ clause as part of cross-securities (which most loans have) gives your lender the option to reassess the risk you present to their interests at any time. For example, let’s say you want to borrow to purchase a new property, the ‘all monies’ clause gives the lender the ability to revalue all of your properties, risking the possibility of properties with lower valuations offsetting those that are higher, resulting in a significant reduction in your available equity.

Top tips for boosting equity

• Buy property with a great design. It’s more in demand and will grow faster despite flat markets.

• Follow property markets so you don’t invest at the peak of the market and get stuck. Ride the property bull if you can find it occurring

• Buy in low-supplied suburbs where there is lots of demand.

• Buy property well; haggle and try to get a competitive price – it will increase your ability to fast-track equity release later.

• Find benchmarks near your property of more valuable real estate. Buy at the lowest price in the best areas or the worst house on the best street.

• Add value to the property: try a small renovation or improvement as long as it creates new value and is not overcapitalising.

• Build for profit: try to create equity by building and designing a great home for someone.

• Buy a property off the plan in a market that is ready to grow in value. This requires a sharp eye but can be a very good way to create wealth. Eighteen-month off-the-plan contracts and 12 months after completion is a good way to extract equity.

To quickly calculate your equity, go here:

https://www.nab.com.au/personal/loans/home-loans/home-loan-calculators/equity-loan-calculator