In recent times there has been more and more discussion around the topic of principal and interest (P&I) and interest-only (IO) lending options, to the point where regulators such as APRA (Australia Prudential Regulation Authority) and ASIC (Australian Securities and Investment Commission) have become concerned about the increasing number of households choosing to adopt IO lending over more traditional P&I lending. They are concerned, and rightly so in some cases, that households are getting themselves into debt positions they may not be able to get themselves out of.

In recent times there has been more and more discussion around the topic of principal and interest (P&I) and interest-only (IO) lending options, to the point where regulators such as APRA (Australia Prudential Regulation Authority) and ASIC (Australian Securities and Investment Commission) have become concerned about the increasing number of households choosing to adopt IO lending over more traditional P&I lending. They are concerned, and rightly so in some cases, that households are getting themselves into debt positions they may not be able to get themselves out of.

But from Empower Wealth Ben Kingsley’s own observations as a professional working in this area, he is seeing a different story, a story of more and more households learning a great deal about their lending options through education being provided to them via magazines and the internet and through greater access to mortgage professionals.

To understand why some borrowers elect to operate some or all of their loans as interest only, Kingsley says you first need to sure up your knowledge on the basic mechanics of how a loan works.

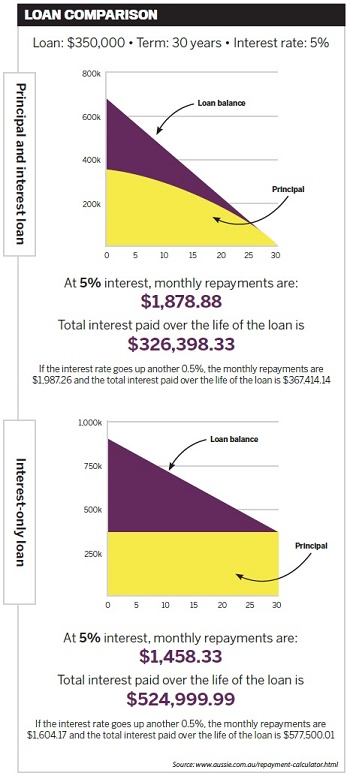

“Let’s take a look at a $400,000 home loan at a 5% interest rate and compare the difference between a P&I loan versus an IO loan,” he says.

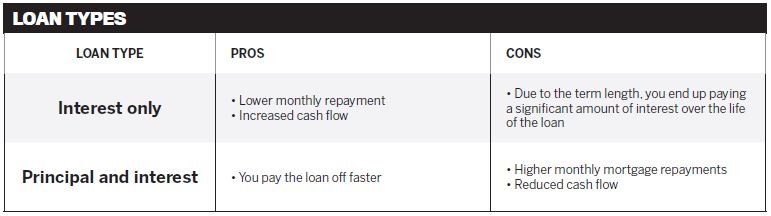

Interest only

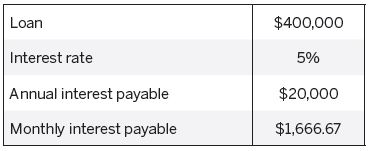

If we start with an IO loan, the calculation is to simply take $400,000 and multiply it by 5%, which equals the annual interest payable over a 12-month period ($400,000 x 5% = $20,000).

To then work out the monthly repayment you simply divide the $20,000 by 12 months ($20,000/12 = $1,666.67 per month).

“So, if you continued to only pay this amount each month indefinitely you would never pay the original balance of $400,000 off,” he explains.

Principal and interest

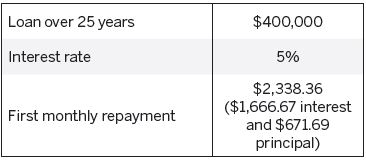

Calculation of the P&I component is not so straightforward because the idea of a P&I loan is to pay the loan off over a certain period of time, usually 25 or 30 years.

“This is referred to as the loan ‘amortising’ over this period of months (25 x 12 = 300 months or 30 x 12 = 360 months),” Kingsley says.

“So, if we were to calculate the P&I repayments on a shorter loan term, the greater amount of principal is paid back each month.”

If we look at our example of a $400,000 mortgage over a 25-year period, the first of the 300 monthly loan repayments would be $2,338.36, and given we have just learnt that $1,666.67 is the interest component, the remaining portion is paying down the principal amount ($2,338.36– $1,666.67 = $671.69).

If we follow this logic, then each month the amount of principal we are paying is slowly getting greater and greater, until the final repayment is technically all principal and no interest.

If we take a look at the same scenario but increase the term of the P&I loan to 30 years, the monthly repayment is $2,147.29.

Using the interest amount we worked out earlier, the calculation looks like this: $2,147.29–$1,666.67 = $480.62. So we are only paying down this amount of principal each month, the loan lasts longer and the borrower ultimately pays a greater amount of interest for this longer-term loan.

From the above example and basic loan mechanics, Kingsley highlights the following as important:

• If you only pay the interest portion of the loan you will never pay down the principal balance.

• The longer the time period you have a P&I loan for, the greater amount of interest you pay the lender.

Loan feature: Offset accounts

Loan feature: Offset accounts

Philippe Brach of Multifocus explains that an important part of any loan structure is an offset account.

“An offset account linked to a loan will work very differently in each case,” he says.

“An offset account is a fully transactional savings account linked to a loan. The lender will ‘offset’ the balance in the savings account before calculating the interest owed on the loan. So, in effect, you earn interest on your savings at the same rate you pay on your mortgage. It is a very efficient way to manage your finances.”

If it is an IO loan, then the bank will simply look at the loan balance, the offset account balance, net them off and charge interest on the net amount, hence the name ‘offset’.

“As a result,depending on how much sits in the offset account, the interest charged (which is also the periodic repayment amount) can vary greatly. In the extreme case where the amount in the offset account is equal to the amount of the loan, the lender will charge zero interest. In effect the loan is repaid without being repaid.”

If the loan is P&I then the periodic repayment will remain the same regardless of how much you have in the offset account.

“However, the more you have in the offset account, the more of your repayment will be used to repay the principal of your loan,” Brach says.

“In the extreme case where the amount in the offset is equal to the amount of the loan, then 100% of your periodic repayment will be allocated to reducing the principal of your loan.”

If your goal is to pay off your PPOR, then using an offset/IO loan can have positive tax benefits

Using our prior example, if we had $50,000 in an offset account, then the interest calculated that day is based on the difference between $400,000 minus $50,000, so in this case the interest charged by the bank that day would be calculated against $350,000.

Kingsley explains that this type of account effectively replaces the need for redraw and paying your loan repayment more frequently, like fortnightly or weekly, because the offset account works every night to reduce your interest costs.

“Furthermore, with an offset account (or several of them, as some lenders now offer borrowers the choice for more), the whole concern of having an IO or long-term P&I loan and paying too much interest is effectively redundant, because the interest is being saved every day,” he says.

Kingsley adds that the combination of IO loans and an offset account is a game changer for those smarter money managers out there, because it gives them the greatest amount of control over their own liquidity and cash flow position at any point in time. It therefore allows them to plan more strategically for:

• short-term cash flow events – like starting a family, where there might be a period of reduced income

• increased cash flow – by only making IO repayments, you release greater cash flow to potentially invest in appreciating assets, such as property, which from a big-picture planning perspective will hopefully go a long way in building a passive income stream and greater personal wealth

• flexibility – building up the amount in your offset account, while saving on interest, gives you flexibility. An example of this might be a scenario in which you buy your first home, but it is not your dream home, so you build up your funds in your offset account, which you will use for the deposit on your next home, with a view to turning your first property into an investment property

• tax benefits – if your goal is to pay off your principal place of residence (PPOR), then using an offset account and/or IO loan can have positive tax benefits

While an offset account does have some attractive benefits, Rebecca Hona of wHeregroup says it is important to note that having extra funds held in a loan redraw account is not the same as having funds in an offset account. These are two very different things.

“This becomes a concern to the Australian Tax Office when investors take money in and out of redraw and use the funds for personal use, and not for investment purposes,” she says.

“The interest on the withdrawn funds used for personal reasons is then not tax deductible if this occurs. But, if they are withdrawn from an offset account, then you are still able to claim 100% of the interest deductions. Always check with your accountant in relation to matters like this.”

Borrowing capacity

Both Philippe Brach and Rebecca Hona explain that investors must be aware that the loan they choose will ultimately affect their total borrowing capacity for further investment.

“An IO loan will lower borrowing capacity as the lender will assess serviceability on the monthly repayments after expiry of the IO period,” says Brach.

“These periodic repayments will be higher than a normal P&I loan as you have to ‘catch up’ with the period when no principal has been repaid.”

Personally, as a mortgage broker Hona likes to ask people how much they can afford per week/month and then from that figure determine their maximum borrowing capacity based on that budgeted repayment per week/month.

“You’d be surprised how big the difference is between the ‘dream’ loan amount and what they can actually practically afford to repay,” she says.

“I also like to show clients what their repayments would be when interest rates rise. And I do this in increments of 1% increases, right up to 9%. I personally do my own budgeting for all my own investment loans at 9%. If I can afford it at 9%, then I continue to invest.”

Depending on your investment goals, you need to put in place a strategy that works for you. Hona says wHeregroup advisors recommend their clients should always be paying off debt in some way or another. Even if they have no home loan, then they should be paying down their investment loans.

“Just pay one loan until it’s gone then start on the next,” she says.

“The more you pay off the more your portfolio becomes positively geared and the sooner you can retire. Some investors even choose to make their investment loans P&I so that they are always repaying the loan.”

For those property owners who receive bonuses or commissions or have the ability to repay their home loans ultra fast or in lump sums, using their homes’ rapidly growing equity to invest is a great way to get ahead financially.

But Hona is quick to point out that there are some tricks you need to know.

“There is no point redrawing funds from your redraw or home offset account and putting down a cash deposit on an investment property,” she says.

“This means your investment property has a lower loan, meaning less tax deductibility, and you increase your home loan balance at the same time. You need to add a step in-between, and that is to split your home loan into two. As you have paid a lump sum, you can lower your home loan to the new balance and have a split loan that would equal your extra repayments amount.”

So now you will receive two statements with two account numbers. This new loan can then be redrawn and used as your deposit loan for the purchase of an investment property.

“The great part is that this new loan is tax deductible and you have at the same time reduced your home loan balance,” Hona says.

“It’s a win-win situation all done by structuring your loans correctly from the outset. This is where having a great mortgage broker who is also an avid investor can pay dividends in the long run.”

Which loan is right for you?

The answer to this comes down to your personal strategy, Brach says.

“Common wisdom is that you opt for a P&I loan on your PPOR, and IO loans on your investment properties,” he says.

“The reason behind this is that there is no tax benefit attached to a PPOR loan, so it is best to pay it off as soon as possible. In contrast, the interest payable for an investment property loan is fully tax deductible, so IO is the way to go.”

For someone earning, say, $100,000 annual income, it means that for every dollar of interest paid the cost to the investor will only be 61 cents, as 39% (37% + 2% Medicare levy) of the interest will be claimable.

“Obviously the other consideration is cash flow, which is king in the world of investors,” Brach says.

Ross Le Quesne of Aussie Home Loans agrees with this sentiment and says roughly 70% of his property investor clients opt for an IO term to increase their cash flow.

“The variance in repayments can often mean the difference between adding one or two more properties to their portfolios,” he says.

“It all comes down to serviceability.”

What are the risks?

Obviously, if you have an IO loan, no principal is repaid, and therefore you are not making any progress in repaying your loan. However, as discussed above, having an IO loan and an offset account can achieve the same result, but you need to be disciplined in the use of your offset account.

In the case of an investment property, it is generally a deliberate choice to pay interest only so more cash can be devoted to repaying the PPOR loan. If the investor has no PPOR loan or is renting, then there is a case for moving to P&I, although in the accumulation phase of a portfolio it is common to keep your loans on a IO basis.

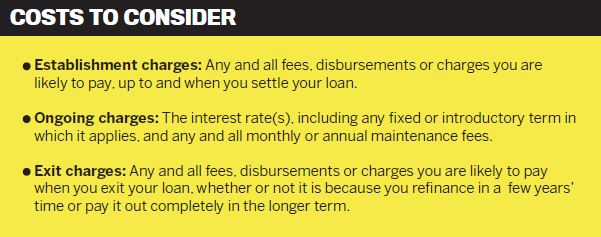

Banks are good at mitigating risk, so they are a good gauge as to what you should be worried about.