Picture this, it’s happened again. The economists were wrong and there has been another rate cut. Official interest rates may be going down, but you want to buy a property, so your level of personal interest is through the roof. Now you sit back and see which lenders decide to pass on some savings, so you can think about where to apply for a loan.

The problem with this picture is that too many borrowers think rates are the be all and end all when it comes to choosing a home loan. They assume that other than a difference of a few basis points here and there, lenders are all the same. Sure, the loans might be different; there’s standard variable, basic variable, fixed interest, line of credit and so on; but these are much of a muchness right?

The real story is completely different. Today’s home loan market is extremely competitive and flooded with hundreds of products. The loan with the cheapest rate will often end up costing you more money due to a lack of flexible features. It may also come with a more conservative lending policy, making it harder to have the application accepted. In order to find the best loan for you, you need to comprehensively research as many products as possible. Here is where time becomes an issue.

The broker’s perspective

Imagine that you want to buy the perfect pair of shoes, but your city has hundreds of shoe stores. There’s no way you’re going to all of them; you might go to two or three and when you find a pair that are near enough, you think it’s good enough. A day or two later, you have a blister on your heel and are wondering if you should have gone to one or two more stores.

Now, imagine if all you had to do to buy the perfect shoes was sit in one store, where the sales assistant showed you pairs in your size from every store in the city. Then you would truly know you had found the best available pair for you.

This is the difference between going to a broker, or directly to a bank for a home loan. Well-established brokers these days have sophisticated computer databases and software that can be used to narrow the field depending on your own needs.

“If someone walks into an ANZ branch, they will be provided with ANZ products,” says Joe Sirianni, executive director, Smartline Personal Mortgage Advisers. “They’re not going to tell you if another lender has a more suitable product. A broker with all the major banks on their lending panel can be a consumer advocate, rather than a product advocate.”

You might argue that a broker has a vested interest and will only match you with one of their favourite lender’s products. This may be the case for some brokers, but remember that the majority of their business comes from referrals, so customer satisfaction is the key to their success. Also, you should ask yourself if your own research would give you any more scope. Would you look beyond the 10 or 20 best-known lenders when searching for the right product?

The range of policies, processes, products, fees and rates means there is a dramatic difference in what the banks offer to customers. For each of those products, Smartline measures 108 features on their system to help clients select their ideal option and save them the lengthy process of making the enquiries individually.

Will you be accepted?

The tighter lending policies of banks can see your loan rejected for a myriad of reasons, some of which have nothing to do with you. For example, if a lender deems the property you are purchasing will be hard to sell if you default on your loan, you might find your application rejected outright.

“Banks give brokers full access to their policy manuals,” says Smartline’s NSW and ACT state manager Michael Daniels. “We enter the policies into our system, so the system will tell us whether your loan will be approved.”

Knowing your chances in advance will ensure your credit rating doesn’t suffer from too many lender checks.

“Banks all ‘credit score’ now,” says Daniels. “One of the things that contribute to the credit score is how often the borrower shops around. If you go to three different banks, there will be three different credit checks in a few weeks. That will negatively affect your ability to get your loan approved.”

Once a loan application is rejected, your options will be severely restricted, so if you suspect you might not be the perfect borrower, you should get upfront advice.

The elimination process

Once you have met with a broker and discussed your savings, the size of the loan you will be able to service, your likely Loan to Value Ratio and your credit history, it’s time to narrow the field. With 22 million people in Australia and no two the same, a comprehensive range of needs must be accounted for.

“This is the last step before we select the product,” says Daniels. “We’ve got 500 products, so we try and eliminate the ones that don’t fit the client. For example, there’s no point giving an offset loan to a client with very little savings, because they won’t have that spare money. So, we deselect that feature and the software eliminates those types of products. You might call this a needs analysis.”

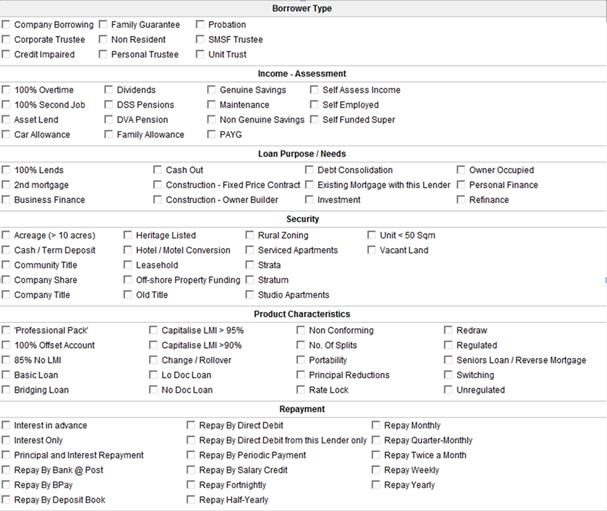

At the elimination stage, a broker is met with a drop-down screen, which is filled with the unique characteristics of potential borrowers. As the broker ticks boxes, the software excludes loan products. This is made possible by the pre-filling of each lender’s policy into the system.

Turn to the next page to see what the 108 measures are

#pb#

The 108 measures

Borrower type

The first category focuses on the type of borrower you are. If no boxes are ticked, the program assumes you are a standard case. If for example you are a non-resident (from overseas); or a SMSF trustee (buying a property through super); or you intend to use a family guarantee (a family member offers their own property in lieu of your deposit); only lenders whose policies allow those borrower types will be included in the next stage of selection.

Income assessment

This category looks at the types of income you are planning to use to service your loan. Lenders differ greatly on which forms they will accept. You might be surprised to learn for example that even though you have been working hard in a second job to boost your savings, a bank might not be willing to consider 100% of that second income in your assessment. Likewise, they may not consider family allowance payments, overtime pay, or other sources of income that you rely on in life.

“Most lenders won’t accept maintenance payments from a divorced spouse as income,” says Daniels. “A client could go to three different banks that don’t accept maintenance and come to the conclusion that they can’t get a loan, but we can find the ones that do straight up.”

Loan purpose

The most common loan purposes will be for owner-occupier or investor purchases, but if you plan to use the loan in another way, this category will let you know immediately which lenders have a product for you.

Security

The security section allows for just about every type of property you might imagine borrowing to invest in. The majority of these are types of security that banks have placed in the ‘hard to sell’ basket should they need to foreclose. Some will do loans with lower LVRs, while others may avoid them altogether.

Product features and repayment

Once you have a list of willing lenders, the remainder of the categories cover the types of product features that you need, as well as your loan repayment options, any fees you will have to pay, available lender facilities and discounts or special promotions. These final stages allow you to fine tune your shortlist so that you can find a product that is as close to ideal as possible.

The lender’s perspective

Lenders may seem to set the bar ridiculously high for loan approvals, but this is because they are required to be extremely conservative by law. The prudence of Australian lenders is one of the reasons why Australia has staved off financial disaster, while countries like the US are facing a housing crisis.

“National Consumer Credit Protection (NCCP) legislation dictates lenders conduct a greater level of assessment than perhaps ever before,” says Heidi Armstrong from State Custodians Mortgage Company. “Lenders need to be sure that the characteristics of the borrowers and the security property fit within their acceptable risk profile. This is to ensure the loan is repaid and doesn’t fall into arrears; the loan fits mortgage insurance criteria if required; and the loan is rated well as a pool of funds that is either securitised or remains on the lender’s balance sheet, thereby contributing to the overall health of the lender’s financial position.”

Lenders don’t just have to look after themselves however. The legislation requires they take responsibility for the borrower too.

“Lenders have the added responsibility of ensuring that any loan they provide is ‘not unsuitable’ for the borrower,” says Armstrong. “This means they must go beyond their own perspective and consider whether there is a benefit to the borrower in taking out the loan; and whether the loan is likely to cause undue hardship on the borrower.”