An investment property’s strength is fundamentally determined by its ability to make an income. So, finding and keeping good tenants is obviously a top priority for property investors.

An investment property’s strength is fundamentally determined by its ability to make an income. So, finding and keeping good tenants is obviously a top priority for property investors.

How do you ensure that the long-term investment value of your asset is underpinned and attracts good tenants?

As a landlord, it’s a good idea to view your investment property as a potential tenant and ask yourself, would you want to live in it, is it in good condition, and is it ‘well loved’?

It is also important to bear in mind the location and rental vacancy rate of your investment property.

Dr Andrew Wilson, Senior Economist for the Domain Group, said ‘Vacancy rates are a function of supply and demand and are a great gauge of a property market’s health.’

If rental vacancies sit at just one or two per cent of all rental stock, it means that there is not a lot of choice for prospective tenants. This brings about competition that leads to rent increases. If the rental vacancy rate moves above two or three per cent, there is less competition among prospective tenants for your investment property and downward pressure is then exerted on rents. This may cause lower yields and less incentive for investors to purchase property. Less investors means downward pressure on the prices of property.

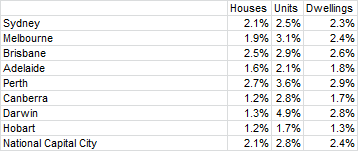

What are the rental vacancy rates in Australia at present?

‘Australia’s capital city rental markets remain tight, despite an increased supply of rental properties from investors and developers,’ Dr Andrew Wilson said.

‘Drilling down, in Sydney we are seeing a slight easing of vacancy rates in houses there—generally over two per cent in Brisbane and Melbourne, ongoing building construction activity is working its way down into an easing of vacancy rates there.’

Rental vacancy rates in Australia in April 20151

Avoid the financial pitfalls associated with vacancy rates by investing with Defence Housing Australia:

Defence Housing Australia (DHA) builds properties for Defence members and their families and sells them to property investors on a lease-back arrangement. It’s a property investment proposition that has really come into its own since the early 2000s.

They aim to deliver on aspects attractive to both tenants and investors alike—location, amenities, integrated communities and facilities (not just for Defence tenants), and innovative and sustainable living—aspects that will continue to work in your favour, even at the end of the lease.

The sale of their properties works like this: DHA builds a property and sells it at market value to an investor. They then lease the property back from the purchaser at an independently assessed rental rate for up to 12 years.

DHA’s property portfolio currently comprises 18,500 properties, located across Australia and valued at about $10 billion.

Property management issues? Not with DHA

As a DHA property investor you’ll have no tenanting obligations. DHA manages the tenants, guarantees the rental income and manages the property so that it is maintained throughout the lease term. This security of income makes Defence housing particularly attractive. You don’t have to be concerned about rental vacancies and are paid rent even if your property is vacant1.

DHA also arranges a licensed independent valuer to annually review the property’s market rent and adjusts it accordingly. But, while the rent may vary, it will never fall below the starting rent for the term of the lease.

So what do all these benefits cost? DHA charges a service fee as part of its Property Care service. The fee is calculated as a percentage of the rent and is taken from your monthly payments. It varies depending on your property type; freestanding houses are charged a flat fee of 16.5 per cent (including GST), and for properties where a body corporate is responsible for some items, DHA charges 13 per cent (including GST). This may initially seem high when compared to typical real estate agent management fees, which are usually in the range of 6.6 to 11 per cent. However, DHA’s fee is all-inclusive which means the overall cost of managing a DHA investment property is usually lower.

According to a 2014 independent report by BIS Shrapnel, comparing DHA’s service fee of 16.5 per cent of rent with that spent on all costs associated with traditionally managed residential investments, DHA’s property management costs represented a 15 per cent saving.3

Best of all, when your lease agreement comes to an end, DHA returns your property in good order, so that you can either move straight in or lease it privately. You’ll even get new carpets and flooring, and a fresh coat of paint on the property depending on the lease agreement.

Purchasing an investment property with DHA is a sound long-term investment strategy, and the rental income under-pinned by the Australian Government is a comforting inclusion. But, as with any investment decision, be sure to get independent financial advice to make sure you make the best decision to suit your specific needs.

Learn more about property investing with Defence Housing Australia or enquire online.

References and Disclaimers:

[1] Dr Andrew Wilson, Senior Economist with The Fairfax-owned Domain Group.

2 Rent is subject to abatement under limited circumstances.

3 Comparison is based on medium cost scenario for a property renting for $450 per week.

Investment is subject to DHA’s lease terms and conditions of sale. Investors retain some responsibilities and risks, including property market fluctuations. The advice contained in this article is for general information only and prospective investors should seek independent advice.

Disclaimer: while due care is taken, the viewpoints expressed by contributors do not necessarily reflect the opinions of Your Investment Property.