The YIP team asked deprecation expert Tyron Hyde for the low down on tax benefits from renovation.

Whether you’ve purchased an investment property recently that requires ‘a little attention’, or your existing property is getting a bit ‘tired’, you will most likely have, at some point, considered renovating.

Great! We know that this will likely increase the equity in your property and improve your rental return, but the benefits don’t stop there …

Many people don’t realise they can claim depreciation on renovation works, and therefore miss out on potentially thousands of dollars in tax deductions.

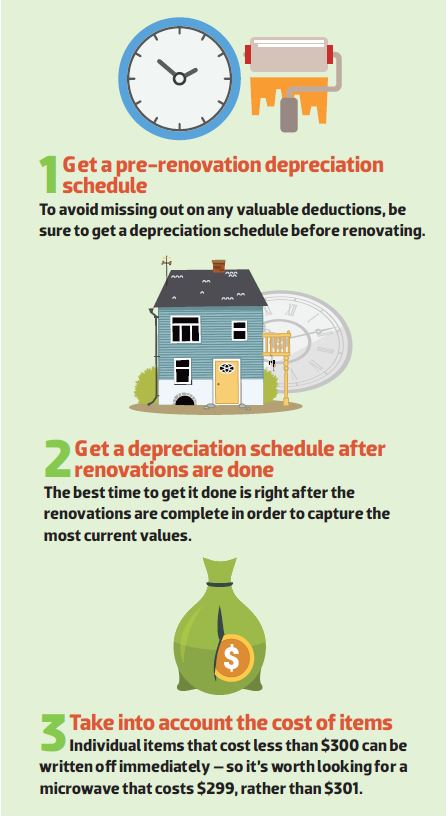

Depending on the item itself, some common renovation inclusions can result in ongoing yearly tax deductions for the next 40 years. Also, items that cost under $300 can be deducted in full straight away, which immediately boosts your tax deductions for the year. Due to their nature, kitchen and bathroom renovations typically yield the greatest depreciation allowances.

Even if you’ve purchased a property that previous owners have renovated, you may be able to claim a depreciation benefit. In accordance with ATO requirements, as long as you are using the property for income-producing purposes, you are entitled to claim depreciation on renovations completed after July 1985, regardless of who paid for them.

In addition to being able to claim on the new items associated with the renovation, you may also be entitled to claim the residual value write-off deduction or, as we call it, the ‘scrapping’ value.

Essentially, scrapping is claiming a deduction for plant and equipment items (ovens, dishwashers, etc) and capital works deductions (tiles, bricks, vanity units, etc) when you throw them away or demolish them.

If these items still have a residual value attached to them in the eyes of the ATO, this value can be claimed as a deduction in full, in the financial year they are removed – the proviso being that the items must have been used to generate income for the owner prior to being removed and after the new renovation is completed.

If you have already gone ahead with your renovations, or will not have time to get a quantity surveyor in, then any photos of the items ‘in situ’ from before the are useful. Even the skip bin’s contents or the pile of things being thrown out can help.

Another noteworthy point is to make sure you are keeping a record of the costs and items associated with the renovation. A great way to do this is to keep an up-to-date spreadsheet as the project progresses. This spreadsheet should list items/works, expenditure and dates. This is not only good from a budgeting perspective; it will also assist the quantity surveyor to ensure you receive the maximum tax benefit from your expenditure.

To demonstrate how the above applies, here’s an example. Let’s say you have an income-producing investment property that you purchased in 1996. It’s now 2016 and the kitchen is looking unimpressively dated.

Because the ATO has determined that a kitchen should

last 40 years (or until 2036), you still have 20 years’ worth of available capital works and plant and equipment deductions. For a kitchen originally valued at $15,000, that’s a $7,500 immediate residual value deduction when you remove it. If the new kitchen that you put in cost $30,000, it will attract an approximate first-year deduction of $2,500.

In this example, claiming the scrapping value and depreciation will result in an additional $10,000 deduction that financial year!

In summary, if you’re going to renovate, remember the following tips and you are well on your way to ensuring the maximum tax depreciation benefits.

Tyron Hyde is the CEO of Washington Brown and is considered one of Australia’s leading experts in property tax depreciation. He is also a registered tax agent.