DAVID KAITY believes that a smart and simple renovation is an essential part of the property selling process.

In fact, he’s an advocate of investing your funds in a renovation or refresh instead of forking out money to pay commission to a traditional real estate agent.

"It’s not always necessary to have an exceptional standard of presentation, as long as the property you’re selling is better than most of your competition, because when you put your home on

“After the refresh, our [property] sold for $25,000 more than the neighbouring unit”

“If your presentation is below par and there is not much to make your home stand out from the competition, buyers will focus on the price as the only remaining point of differentiation. This is why people who market a poorly presented home are likelier to have to accept a lower price.”

Having personally learnt the power of renovating to drive profits, David says this strategy is now the cornerstone of the business he and his wife operate, which is based on helping others to renovate prior to selling.

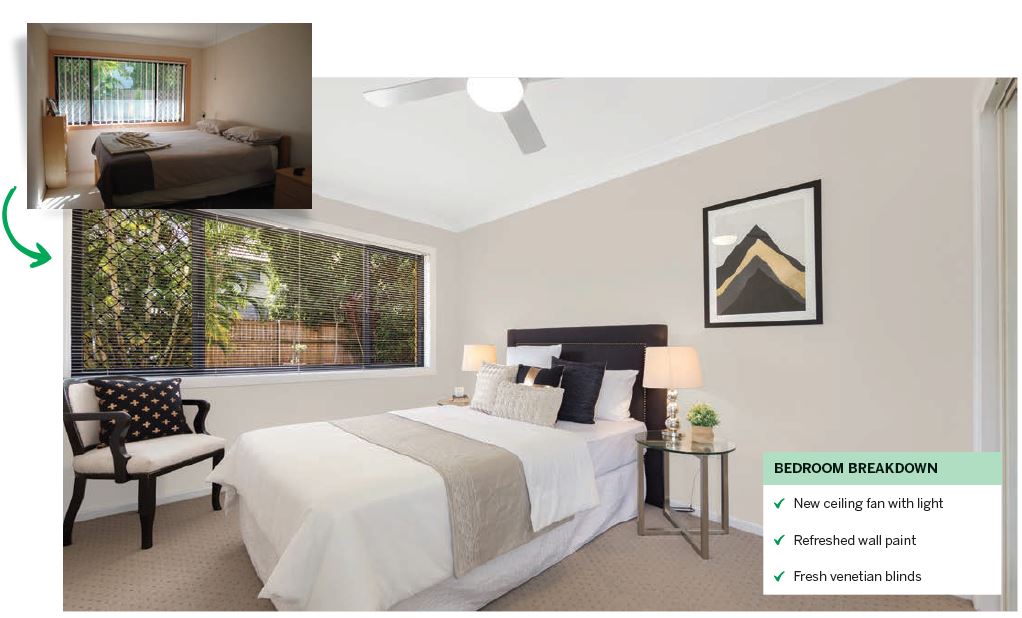

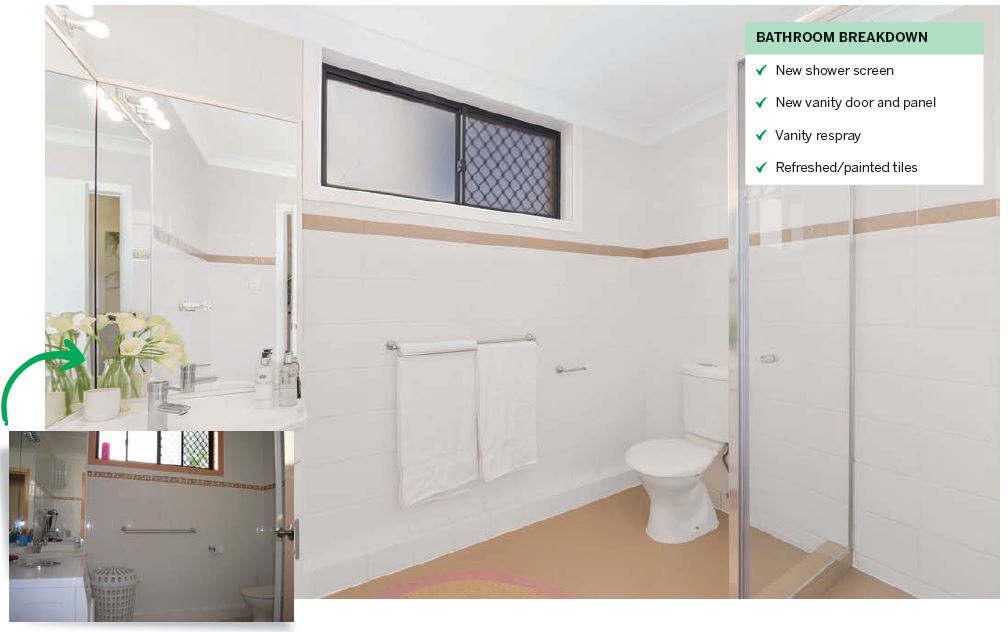

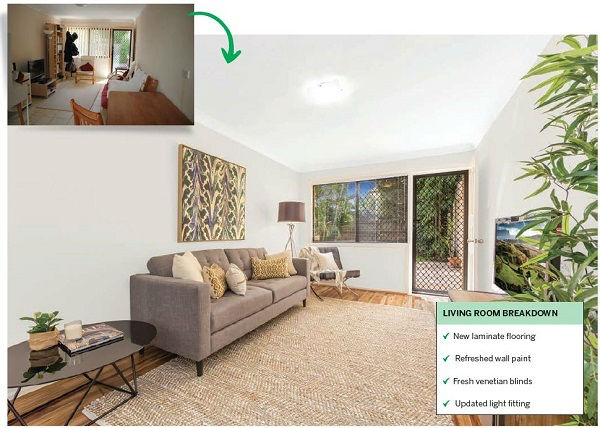

Well presented, neat and tidy homes not only sell more quickly, he advises, but they also generally fetch a higher price. To prove his point, David shares with us a simple one-bedroom unit renovation on a property located in Brisbane, in the inner-city suburb of Greenslopes.

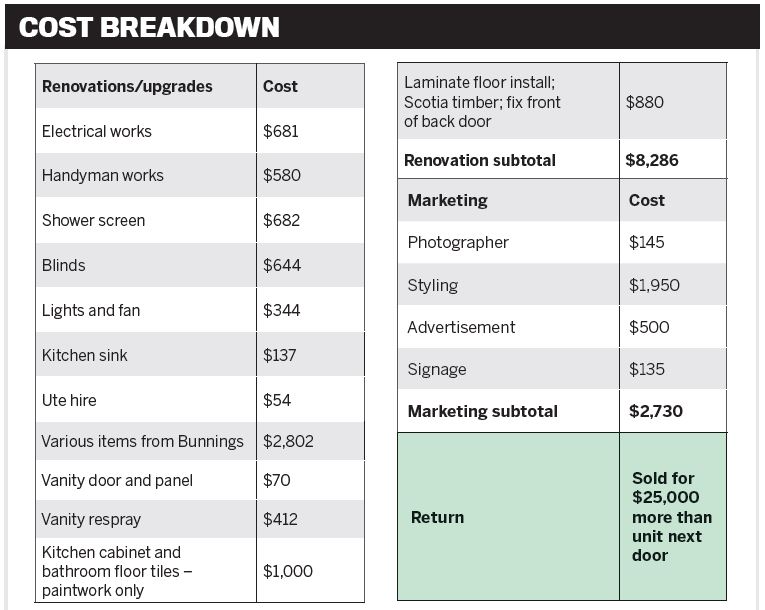

“Most of the work was carried out by handymen and other professionals, though we painted the kitchen splashback and did the final clean,” David says.

They achieved a swift sale in a market in which one-bedroom units were suffering, after renovating the property for less than $8,300.

“It was a unit we had held for a number of years; however, the comparison with the next door unit’s sale is a great source of comparison,” he says.

“It was a mirror image of ours in all respects and looked exactly like our unit before the renovations, but after the refresh, ours sold for $25,000 more than the neighbouring unit.

“More importantly, we pocketed about $30,000 more than the owner of the next-door unit after all expenses, including real estate commission, were accounted for.”