To avoid investing in a low-performance property, set strict selection criteria and use checklists when assessing properties so you take any emotion out of the process.

Then you can negotiate like a pro and keep your ego out of it. This means knowing the rules of engagement in each state or location, having strong terms and conditions that suit the vendor as much as is practical so you can strengthen your offer and, lastly, knowing the comparable sales in the area as you can use them as a point of reference with the agent so you can avoid paying too much.

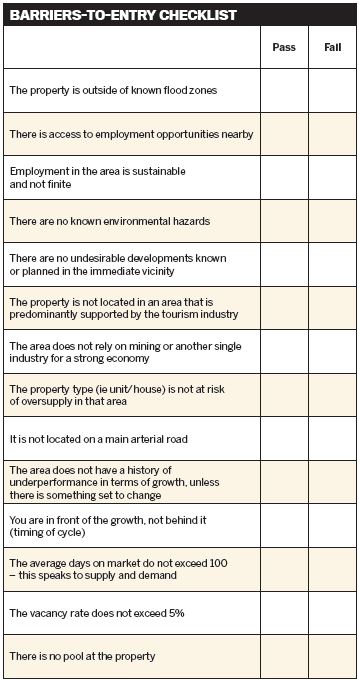

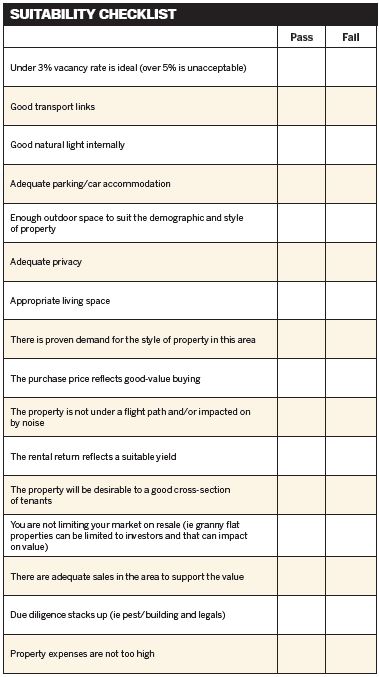

To ensure a potential investment property is up to scratch, Anna Porter, principal at Suburbanite Property, uses the checklists shown here to review real estate.

How the scores work

The property you are considering investing in needs a 100% pass rate for the barriers-to-entry checklist, and at least an 80% pass rate for the suitability score.

If your property passes these two thresholds, then it qualifies for further due diligence. If not, Porter says, then it’s back to the drawing board to start again!

It may seem strict, but this firm criteria is one way to ensure you invest in the best-quality properties your budget can buy – and avoid accidentally investing in a dud.