4/5/2014

6 simple steps for setting up a SMSF

Step 1: Draw up a trust deed

The process of creating a SMSF starts with preparing a trust deed for the fund. This will explain how trustees were appointed and what their powers are. The deed must also set out when and how fund contributions and benefits will be paid. Most importantly, since the fund is being set up to invest in property, the trust deed must detail that property investing is allowed.

Step 2: Nominate trustee(s)

The majority of SMSFs have two members, though single membership and funds with three or four members are not unheard of. Either way, a common place among SMSFs is that all members of the fund are trustees. A trustee is legally responsible for the actions of the fund, which means he must log annual tax returns, prepare accounts and have the account audited.

Step 3: Clear the tax issues

At this stage, you will need to choose if the SMSF will be a regulated or non-regulated fund. Being regulated means the fund will be eligible for an array of tax benefits, foremost being that money coming into the fund will be taxed at a minimum rate of 15%.

Making your choice is as simple as completing an application form, normally available at the Australian Business Register (abr.gov.au). After submitting the form you will be issued a tax file number for the fund and an Australian business number.

Another point to consider is whether or not the fund will be subject to the Goods and Services Tax (GST). For SMSFs that source yearly income from commercial property that exceeds $75,000 a year, GST is mandatory. Registering is optional for all other funds.

Step 4: Create an investment strategy

The law requires trustees to have an investment strategy for their fund. Theoretically, this does not have to be in writing, but fund auditors often ask to see typed out hard copies.

The strategy should consider the risks and potential returns from different investments in the fund, the fund’s expected cash needs and its ability to meet any existing or future liabilities. There should also be a mention of the make up of the fund’s investments and the amount of diversification there will be.

Step 5: Open a bank account

The last thing official step you need to take in setting up the SMSF is to create an account with a bank, credit union or building society. To decide which account will work best for the fund, look at the fees and minimum balance requirements, as well as the interest rates on earnings.

Step 6: Put money into the fund

Now that the fund has been started, you need to put money into it. Transferring the existing money in your superannuation fund into the new SMSF account can take some time, but as soon as the money appears on the account balance, you can start buying property.

Have questions about investing through Super? Click here to talk to one of our experts.

What about making the points “no entry” signs or any traffic sign that indicates “don’t do”

SMSF no-go areas

According to superannuation legislation, when using a SMSF to invest in property you are not allowed to:

- Make personal loans to fund members or their relatives

- Use the fund for business finance

- Access funds until you are 55

- Buy residential property from a fund member

- Allow a member or relative to live in property owned by the fund

SMSF green lights

Investing in property through a SMSF gives fund members the power to:

Invest in any property type or sector

A SMSF can purchase just about any type of property, including vacant land, which includes residential, commercial, factories, medical suites, office space, and so forth.

Buy your business property

An SMSF is allowed to invest in, or buy your business premises, provided it is used wholly and exclusively for the business.

Benefit in the super tax environment

Because contributions and investments in the fund are preserved until retirement, they enjoy the beneficial superannuation tax regime. Should the fund hold an asset longer than one year and then sell it, CGT drops from 15% of the gain down to 10%, and if sold in pension phase, CGT is zero.

Borrow to buy property

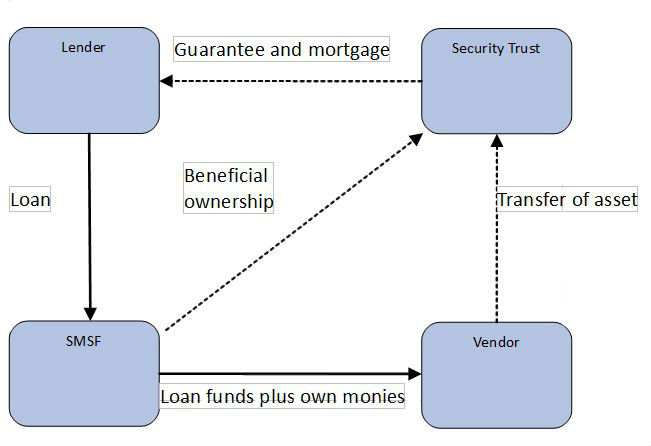

SMSFs can borrow to acquire a property as long as:

- The money is borrowed to buy an accepted asset

- The asset is held on trust so the fund acquires a beneficial interest in it

- The SMSF has a right to acquire legal ownership of the asset by making payments after acquiring the beneficial interest

- There is limited recourse (the rights of the lender against the SMSF for default on the sum of the borrowing and related charges are limited to the asset)

Borrowing to buy property

Source: Graeme Colley, OnePath, and Peter Burgess, SPAA, presentation on Using SMSFs borrowing to invest in property.

Self-managed superannuation funds are fast becoming a popular option for investing in property, but let’s get one thing straight: there are better things to research on a Sunday afternoon.

For many people, the sheer amount of information on the topic is so overwhelming, that it’s a sure cure to insomnia. That’s its biggest challenge. Like a soft-spoken, mono-syllabic teacher at school, the problem isn’t that the information is difficult to understand – it’s the presentation.

With this in mind, Your Investment Property brings you a concise, easy to understand guide to what is, in actuality, a very exciting way to build a property portfolio. So before you let the mere mention of SMSF investing coerce you into more exciting activities like washing dishes or that three hour TV special on the history of the ballpoint pen – consider the wisdom right in front of you, gleamed from top investment experts.

Which investors suit it?

Wealth advisory agencies that specialise in SMSF might have brochures showing jolly pensioners and cute couples with their Frisbee catching Labradors – all proclaiming how SMSFs are the ultimate in property investing – but don’t believe a word of it.

Investing in property with a SMSF is not for everyone. In the opinion of Graeme Colley, national technical manager of investment advisor OnePath, it is best suited to people who have already built up a significant amount of capital in superannuation.

“People in their late 40s to late 50s might find that they are best suited to investing in property with a SMSF,” he says. “By that age, they’ve probably accumulated enough capital in the fund to consider purchasing. On the other hand, those who are about to retire or have already retired should work out if it’s still a good idea. If they need to draw a lot of money out of the fund for property, it could severely limit their pensions.”

Other people who should probably steer clear of using a SMSF to invest in property are those who are not familiar with property as an investment, Colley adds. “These days, property markets are a lot more volatile than they have been in the past and investors who already have some experience purchasing property outside of a SMSF will have an advantage.”

Colley says that investors who are in business or operate small businesses might also be a lot more comfortable using a SMSF as a vehicle to buy property. They will be used to having structures put around their businesses and will not feel as daunted with some of the similar procedures they will be required to go through to set a SMSF up.

Which properties suit it?

While not every investor is suited to purchasing through a SMSF, not every property purchase is either. Under some circumstances, buying under your name could be a much better choice.

The real benefit of investing through a SMSF is being able to legitimately reduce your tax on investment income and capital gains. Members of a SMSF pay just 15% in tax on the taxable income in their funds, versus up to 46.5% when investing in property personally.

However, if the intention is to negatively gear a property and use the annual loss to offset income tax on other income, owning the property personally provides a much better outcome. Because SMSFs only pay tax at 15%, any loss as a result of negative gearing only has a 15% tax benefit.

Property investing using a SMSF only becomes a more attractive option when the property is positively geared. “You need to choose a property that will have a good continual flow of rent coming in,” says Colley. “That’s why it’s important to look at the ability of the property to be continually tenanted. It’s also important to think carefully about properties that might require significant repairs and maintenance down the line and affect the property’s cash flow.”

What work is required?

It is no secret that investing using a SMSF requires some work. “It’s straightforward, but it is not easy,” says Michael Jaeger, general manager of Capital 360 and Your Investment Property’s reader’s choice Property Investment Advisor of The Year 2010.

He adds that what makes this investment type a challenge is the amount of attention to detail that’s required. “The paperwork has to be spot on and there are a number of considerations that every investor will have to examine in detail.”

Many investors engage professionals to help them set up a SMSF – including accountants, fund administrators, superannuation consultants, auditors or actuaries. When using the SMSF to invest in property, this can also include real estate agents, property managers and mortgage and insurance brokers.

Whichever they choose, members are ultimately responsible for the smooth operation of the fund. This will require them to:

- Ensure the fund complies with superannuation laws

- Report on member entitlements

- Prepare annual accounts and reports

- Lodge tax returns

“A key responsibility of having a SMSF is making sure your fund continually meets its obligations. If you find this daunting, you really need to have a second look at SMSFs as an option,” says Colley.

What are the benefits?

For investors who are suited to buying property through a SMSF a wealth of advantages are available. According to Martin Murden, a founder of the Partners Group and author of How to Invest in Property Through Your Self-Managed Super Fund, these are:

- In the event of bankruptcy or litigation, your benefits in a SMSF are protected, even if you withdraw some of this to live on

- There’s less tax on rental income

- Capital repayments on loans can be sped up by increasing the amount of contributions going into the fund

- Property you already own can be transferred into the fund to unlock cash to invest in other assets

However, one thing to keep in mind is diversity. According to Jaeger, any investor considering this option should remember that investing using a SMSF should form part of broader investment strategy.

“At the end of the day, a SMSF is nothing more than a tax structure. You’ve got to consider it on the grounds of how it will suit your individual needs.”