I read some figures recently from Australian Super, which revealed that the average superannuation payout figure is around $120,000 for women and $200,000 for men. That doesn’t seem like nearly enough money to sustain you for a few years, let alone a couple of decades in retirement!

To build financial comfort, security and wealth to allow you a good lifestyle in retirement, many people turn to property investing.

It’s a great first step, but many of us are not even sure how much we need to spend, or how many properties to buy, in order to achieve a good retirement ‘nest egg’.

When planning for your financially comfortable future, you really need a clear idea of where you stand right now. To show you how this works in practice, I’m going to take you through a potential retirement real estate strategy for an everyday Australia couple.

Scenario: Megan and Nate

Megan and Nate are a married couple aged 38 and 42. They have three kids aged four, six and seven and they earn a combined wage of $180,000 per year. Nate is the primary income earner with a salary of $120,000, while Megan earns $60,000 annually.

They own their own home, which is worth $620,000, and they have a mortgage debt of $375,000.

Megan and Nate would like to retire with an income of $100,000 per year in today’s money.

First things first: financial planning

Note that I generally suggest to my clients that as a first port of call they should see a financial planner and get an understanding of the numbers, to ensure their property investing strategy aligns with their risk profile and other considerations.

By working with a financial planner you can get a handle on a number of things, including:

• How much money you’ve got in superannuation today

• How much you’re likely to contribute throughout the rest of your career

• How much you should salary sacrifice to increase your balance, if required/relevant

• How much you want to live on each year when you retire

• How much your superannuation will provide for you in retirement

If Megan and Nate do nothing more than pay off their own home loan, with plans

to live off their superannuation balance, then they will have quite a low standard of living in retirement

With all of this information, your financial planner can calculate how much you’re likely to be living off in retirement, based on your current superannuation and investments. They will adjust for inflation and then work back to today’s numbers.

This will give you a clear idea of the gap between where you are headed right now and where you would like to be headed.

Megan and Nate’s projected future

Let’s assume that Megan and Nate have been to a financial planner, who has done some forward-projecting and modelling which reveals that if they are living off their super in retirement their income will be around $40,000 per year (in today’s dollars).

They have already thought ahead and worked out that they want to travel, explore and enjoy their retirement years. They have set themselves a goal of $100,000 income per year in retirement.

The difference between where they are headed ($40k annually) and where they want to be ($100k annually) is substantial, but through some strategic property investment decisions they can transform their financial future.

If Megan and Nate do nothing more than pay off their own home loan, with plans to live off their superannuation balance, then they will have quite a low standard of living in retirement in 20 to 30 years’ time.

However, let’s think about this in property terms.Megan and Nate’s property-fuelled future

• Megan and Nate desire an income of $100k per annum in retirement.

• They are headed towards $40k per annum in retirement.

• Their shortfall is $60k per annum in income.

• Assuming a 5% per annum return on investment, they need a property portfolio worth $1.2m unencumbered – and in today’s dollars – to generate this income shortfall.

In this scenario, we can very simplistically translate their retirement goal into a number of properties.

Megan and Nate are aiming to build a $1.2m property portfolio (in today’s money), which they will need to own free and clear in retirement.

To hedge against lower returns and unexpected expenses, let’s aim for

$2m in property assets on top of their superannuation balance.

If they’re buying properties priced at around $500,000, they will need four unencumbered properties bringing in a net rental yield of 5%.

This means their retirement goal is:

• Four investment properties

• Valued at around $500k each

• Bringing in a net 5% yield

• Fully paid off by retirement age

While these are all very crude calculations, they provide an understanding of how, as an everyday investor, it’s possible to calculate your ultimate property portfolio – one that creates lasting wealth and an income stream to fund your retirement.

The goal is set – what next?

Already Megan and Nate are one step closer to a financially healthy retirement as they now have a concrete goal to work towards.

The next step is to put their investment goal into practice, which means they need to start taking action and investing in property.

This can be quite a complicated emotional journey when you’re starting out, which is what led me to create my business as a multistep support service. From strategy and finance to property selection, we work with our clients every step of the way in order to make sure they’re making educated and informed decisions that will move their financial situation forward rather than getting them stuck.

So our investing couple are aiming to own four unencumbered properties worth $2m, to deliver an annual income in retirement of $100,000.

The next thing they want to know is: how can we reach retirement with these properties unencumbered – in other words, fully paid off?

Fortunately for Megan and Nate, they have time on their side. Aged in their late 30s/early 40s, they have at least 20 years of capital growth ahead of them, which will allow them to build their wealth.

Still, even with time on their side, it’s important that they jump into the market and start buying properties as soon as possible. Time in the market is what delivers the most capital growth, and the more time you have until retirement, the more time your portfolio has to accumulate value.

At the end of the day, capital growth is what it is all about. Many investors chase positive cash flow, but to me that is a short-term play. To build your wealth for the long term and create a lasting income stream that sustains you in retirement, you need to buy good-quality growth assets that will appreciate in value over time.

Having said that, cash flow is an important consideration when making an investment decision. In today’s low interest rate environment, most property will be cash flow positive, but you need to factor in that at some point interest rates are going to rise and your property may become cash flow negative. And you need to know by how much.

The first investment

Back to our happy couple. Now that they have a plan, they are entering what I like to call the ‘accumulation phase’ of their journey.

The first step is planning; they have been through this stage and created

a goal of buying four investment properties. The second stage is accumulation, which will involve adding properties to their portfolio. This process begins by accessing equity in their existing property – their home – to use as a deposit on their first investment property.

By doing this, Megan and Nate will be able to enter the market sooner and leverage their growth into their second investment... and then their third, and then their fourth!

During this accumulation phase, which generally runs for five to 10 years, investors won’t build much equity in their portfolios because every time growth is achieved it is accessed to buy the next property. But remember, this is a short-term phase lasting only a few years. Once you’ve bought the number of properties you want, you stop accessing equity, you stop buying, and then the capital growth keeps growing.

This is where your equity starts building up. You need your capital gains to outgrow your debt in order to create wealth, which means selecting the right properties in the right locations where there’s good capital growth.

Megan and Nate do their research and access $65k in equity from their own home to use as a deposit on their first investment property – a house in Brisbane worth $460,000. The rental home they buy is a newer property with plenty of tax deductions and depreciation benefits, and after all is said and done it is neutrally geared.

There are many ways to access equity, and it is crucial to seek help to structure the equity extraction properly. It will make a lot of difference to your finances. One thing is for sure: if anyone suggests cross-collaterising your properties, walk away quickly. It is the worst way to structure your loans.

The couple purchase their first investment property in 2016. Two years later, they have enough growth in their portfolio (their own home and their first investment property) to withdraw another $70,000, which they use to purchase an apartment in Sydney for $500,000.

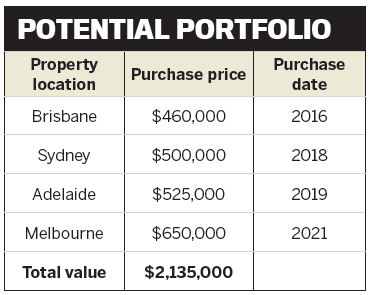

A year later, they use their savings to purchase an Adelaide investment property worth $525,000 – and two years after that, they acquire their final investment, a house in Melbourne, for $650,000, using a combination of equity and savings. Megan and Nate’s property accumulation experience looks like this:

Within five years they have an investment portfolio worth over $2m. Their next move is to simply wait for the magic to happen – the magic that is capital growth!

Waiting for capital gains

Once your accumulation phase is over, you’ll be into the next phase

of investing, which I like to call the transition phase.

In other words, you simply wait for capital gain to work its magic!

If you don’t have capital growth, in my view, then you’re wasting your time. If you buy cash flow positive properties that have limited growth potential, then they might put $2,000 or $3,000 a year into your pocket, but that’s loose change compared to the $25,000 growth you could have had on a $500,000 property that experienced capital growth of 5%.

Time in the market is what delivers the most capital growth, and the more time you have until retirement, the more time your portfolio has to accumulate value

If you’re trying to decide between a positive cash flow investment that puts a few thousand dollars in your pocket and a growth property that delivers $25,000 in capital gains – well, to me there’s no contest there!

It might be a good idea to start slowly repaying some of your mortgage debt now, your first priority being to pay off your own (not tax deductible) home loan.

Once you’ve repaid your home loan, this means you’ve got rid of your ‘bad debt’.

If you’re lucky enough to have plenty of time ahead of you (ie you’re around 25 to 30 years from retirement), then you can allow your rental income to pay off the majority of your investment property loans.

However, Megan and Nate have around 20–25 years of their working lives ahead of them, so it’s a good idea for them to start repaying their investment mortgages during the transition phase.

This will mean that by the time they retire their properties will be fully paid off.

You don’t need to make huge sacrifices to make this happen: even making small extra repayments, like an extra $100 per month, can cut your loan repayment term by one to three years and can shave tens of thousands of dollars off your mortgage interest bill over time.

If you have a smaller investment timeline ahead of you, such as 10–20 years, then you might want to sell one or two properties upon retirement so you can use the proceeds of those sales to reduce your mortgage debt on the rest of your portfolio.

The ultimate goal is to live off the rental income of your properties, so the mortgages need to be clear in order for you to achieve this.

3 FEATURES TO LOOK FOR IN RETIREMENT PROPERTIES

1. Located in popular, growing suburbs

Strong population growth, good infrastructure, and a population base that is large enough to generate new infrastructure are essential in a location. In my opinion, you need a population of at least 200,000 in a city to sustain the type of vibrant and growing community that will underpin long-term capital growth. You also want to see evidence of population growth year-on-year to underpin ongoing demand.

2. Diversified across Australia

In this example of Megan and Nate, there is a reason why I have suggested that they buy properties in different markets across Australia. This is a diversification strategy. I don't think investors should buy the same property type in the same location over and over again. Instead, they should aim to buy a mix of apartments, townhouses and houses in different locations. Every location in Australia has a different market cycle, and they’re always at different phases of their cycle. Buying properties across the board spreads your risk so that while one area is in a slow phase, another is booming.

3. Affordable to you

There’s no point in investing every last cent you have in your property investments; if you do, you leave yourself exposed to financial hardship if anything even slightly unexpected should happen. Ideally, you want to have a line of credit available to deal with any financial emergencies related to your investments, or at least make sure you've got plenty of savings or equity in your home. Don’t overextend yourself by buying too many properties too quickly, and work with an experienced, qualified mortgage broker who has experience working with investors so you can make sure you don’t bite off more than you can chew, financially speaking.

You don’t need to make these decisions on your own. It’s always in your best interests to talk to a number of professionals, including your financial planner, accountant, property advisor and mortgage broker, to make sure your money is working as hard as possible for you and is moving you in the right direction.

You’ll get several pictures of what you can do and where you’re heading, and then you can make some informed decisions. Education and self-awareness are key here: ultimately it is your money and your future, so nobody can or should make these decisions for you.

If Megan and Nate loosely follow this game plan, in just five years they will have a property portfolio worth more than $2m.

Assuming even slow capital growth of 3% per year (adjusted for inflation) to be conservative, their portfolio will be worth $3,560,000 by 2036 in today’s dollars.

Assuming a 5% rental return, this will generate an annual rental income of $178,000. Once superannuation income is factored in – and even once property expenses and income tax are accounted for – Megan and Nate will have more than enough income to afford a good-quality lifestyle in retirement.