But if you invest strategically with an ultimate goal in mind, you’ll be able to work out what type of investor you are, based on those aspirations.

Your income level is a key issue initially, says Nick Khachatryan, CEO of New Real Estate Properties.

“An individual earning $52,000, with dependent children and a monthly mortgage, pays approximately $8,000 income tax annually. Once you minus their mortgage repayments and living expenses, it leaves very little room for a comfortable lifestyle,” Khachatryan explains.

“This is where cash flow property becomes very attractive, because the property pays for itself and can deliver anywhere between $4,000 and $10,000 in passive income annually.”

If you can avoid using that passive income to cover living costs, you could reinvest your cash flow returns into actively paying down your mortgage. Set your portfolio up with five of these cash flow properties and pay them all off over a decade or two, and you could enjoy a profitable portfolio that sustains your income in retirement.

Steve Jovcevski, property expert at Mozo, points out that your age when you begin investing is another important consideration.

“There are two types of investors who are likely to take up a cash flow strategy, and these are young investors who are looking to enter and understand the property market better; and the older demographic, who are nearing retirement age and want a stable rental income to live off and cover their expenses,” Jovcevski says.

“Older investors are not too fussed about the value of the property increasing and are happy to simply maintain the value of their asset indefinitely, as the cash flow is the more important aspect to them.”

Meanwhile, growth assets are ideal for those investors who earn a good income, as they don’t require a high rental return and can afford to put extra cash towards the property holding costs.

“Capital growth properties can provide in excess of $200,000 in capital gains over a 10-year period, and because they are often negatively geared, capital growth properties can be used for tax offsetting,” Khachatryan says.

With figures like this on the table, it’s clear that if you can financially support the negatively gearing shortfall and you have an investment timeline of at least 10 to 15 years, then growth investments may be the more suitable strategy.

That said, it’s important that you feel confident that your circumstances “are not likely to change in the near future”, cautions Adriana Filipowski, director, Village Finance.

“My brother fits into this category. He’s living and working overseas and he is able to save A$8,000 per month, so he has the cash flow to purchase more expensive properties while still saving for a deposit for the next property,” she says.

“Investors who are established with good cash flow can look to purchase properties in strategic locations for the future growth, as they’re not requiring the cash flow from the properties at this time.”

Regardless of which type of investor you are, the worst thing you can do is to wait around, trying to work out what action to take next – as this type of ‘analysis paralysis’ can cost you dearly.

“I know a guy who is chasing both capital growth and cash flow at the moment, and because of that he hasn’t invested in anything at all over the past three years,” says Christine Williams, principal, Smarter Property Investing.

“He has missed out on both opportunities by ‘chasing the golden egg’. My message here is to get into the market, as you will get both eventually.”

Should you chase growth or yield in 2017

Are you confused about whether you should be embracing a cash flow or capital growth strategy in order to create wealth as a property investor?

To help you work out which strategy could best suit your personal situation, now and in the future, Brendan Kelly, director of Results Mentoring, shares his advice:

“In all the years I’ve been mentoring, many property investors have asked me: ‘OK, we’re one-on-one now. Tell me the truth … which is better, positive cash flow or capital growth investments?’

“The answer is not always obvious, and to figure it out it’s important to understand the big picture about how investing works.

“The primary objective of almost every dedicated property investor I’ve spoken to is ‘the comfortable retirement’ – or the ability to enjoy a reasonable and reliable source of passive income to sustain you for the rest of your life.

“The best property investing strategy is therefore the one that allows you to create the most amount of capital in the shortest amount of time, with the least amount of risk and the lowest amount of effort.”

The positive cash flow option

What would happen if you were to choose a path of accumulating positive cash flow properties to generate your desired income?

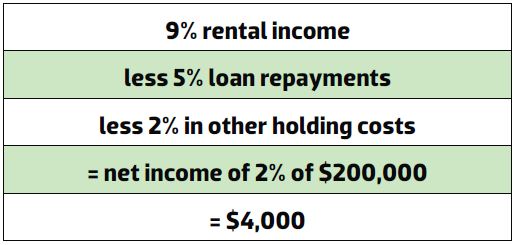

You’d get stuck, Kelly advises – and very quickly! “Let’s say you found a property for $200,000 in an area that currently yields a 9% rental income. Let’s also say that you have been able to secure a loan for the property at an interest rate of 5%.

“If you take into consideration additional expenses to hold the property, such as rates, insurances, and some nominal repairs perhaps, then it might be reasonable to expect that such costs would represent about 2% of the value of the property.

“In effect, you are buying a property for $200,000 that allows you a positive cash flow of approximately $4,000.

“This means you would need to ensure you have 25% of the value of the property in cash or equity – in this case $50,000 ($200,000 x 25%) – to buy it.

“In this circumstance, you are investing $50,000 into a property to create a passive income of $4,000 per annum. That’s an 8% return. It’s much better than what you can get from the banks at the moment!

“If we want to create an income of $100,000 per year, then all you need to do is to buy 25 properties generating a return of $4,000 per year.

“In order to buy 25 properties, you’d also need access to 25 x $50,000 deposits, or $1.25m. Easy!”

Clearly, this represents an exhausting way to replicate your income and deliver a financially healthy retirement. So, is the answer to simply buy for capital growth and create capital as fast as possible?

The capital growth option

Just like adopting a single-minded approach to positive cash flow, if you were to choose a path of accumulating growth properties in order to generate the capital you need to earn the desired income, then you’d also get stuck, Kelly says.

“Most growth properties exist in areas of low rental yields, meaning you end up having to pay money out of your pocket to service the expenses of holding the property.

“As a consequence, you end up with less cash for deposits, less income for borrowing and less money every week to live off. Investing in growth properties only, you would hit a financial brick wall eventually and the banks would simply stop lending to you.

“Only when there has been enough growth to justify an increase in the rent, and enough growth to increase the equity to enable us to draw down, could you go again. Add to this that market growth is never consistent and you have a rather uncertain outcome.”

The long-term outlook

By choosing to commit to a long-term buy-and-hold strategy, investors have the best chance of creating and enjoying a profitable investment portfolio, Kelly says.

“By adopting a blended approach of growth properties and positive cash flow properties, there is more reliability for achieving your desired outcome,” he explains.

“The cash flow properties will help to offset the hold costs for the growth properties, and the growth properties will allow an accumulation of equity over time so that you can continue to buy more properties. Using this strategy, retirement can in fact be accomplished sooner and more comfortably than what superannuation alone can provide.”

This type of blended approach has the capacity to offer more capital in a shorter period of time, with less risk. “And,” Kelly adds, “possibly a lower amount of anguish than either strategy on its own!”

Where can you find quality, positive cash flow investment?

It’s widely known that regional markets abound with high cash flow investments; some can even return figures in the double digits. But these are often considered among the riskiest real estate purchases you can make, as regional markets and economies are less diverse than their city counterparts.

The safer bet then is to buy in capital cities, Kevin Lee advises, as the high-yield opportunities are there, if you’re prepared to dig for gold. “You do have to look in the lower socio-economic areas,” he explains.

“We tend to look for properties where 80% of the population can afford to pay the rent and the same proportion could afford to buy, so that if you ever did want to sell, your property is affordable to the broadest possible market.”

Finding quality opportunities “basically comes down to experience and local market knowledge”, adds buyer’s agent Peter Sarmas.

“I think it’s actually tougher than ever to find and buy the right property at the moment,” he says.

“What buyers need to understand is that the fastest way to make money on a new purchase is when you negotiate the purchase price below market value, and that happens at the beginning, not the end.”

Look for areas that have good infrastructure and are considered highly ‘liveable’ and ‘walkable’ for the ultimate convenience, and you’re on the right track, Sarmas adds.

“Buy below the median value for the area and look for property types that have a high-value land component.

For my investor clients, I always look for a property that has some type of ‘X factor’ as well, no matter the age of the property,” he says.

“We target properties that are established, perhaps a little old and dated inside, then we look at the supply of these properties in the area, and tenant demand. We are constantly on the phone to our property manager discussing the demand for this type of property, ensuring it is strong at time of purchase. High demand in an area for a certain type of property will help improve rental returns, and this is what helps to balance the need for capital growth and cash flow.”

5 risks of investing only for positive cash flow

Cash flow positive property investing delivers cash in your pocket today, while capital growth is ‘a future unknown’. “It can be a very good strategy for those who truly need cash flow today, as positive property can earn much higher yields than any term deposit,” says Gina Neoh, finance and investment specialist and founder of NeoChats.

But if you’re frittering the additional income away on living expenses, and the property doesn’t give you capital growth, then you’re ultimately creating zero wealth. Here, Neoh shares some of the other risks of investing only for cash flow:

RISK 1: Positive cash flow locations are less desirable

Most positive cash flow properties are located in regional areas or mining towns where rents grow faster than values, due to the greater demand from renters than purchasers. “Should there be a downturn in the economy, these areas tend to be hit harder as people relocate to find jobs, and the local economy, being less diverse, is more unstable,” Neoh explains. “Areas closer to CBDs or large job nodes tend to see more stability in population and are less risky.”

RISK 2: Capital growth is sacrificed for immediate cash

“In general, pent-up demand for housing is what drives up rents in positive cash flow areas. You could reasonably expect property prices to also rise when there is more demand for housing; however, these areas generally have plenty of land, so developers simply build more houses,” Neoh says. “Price appreciation over the long term is likely to underperform when compared to properties located where there is a shortage of land.”

RISK 3: Cash flow may dry up if you stop working

If you stop working for any reason and therefore cease to have an income to deduct your property expenses against, a cash flow investment can quickly turn sour. “If the tax credits or benefits are stripped out, you may actually have a property that costs you money each week,” Neoh says. “This is fine, as long as you’re aware that it’s your tax credits that are propping up your cash flows. But if you’re considering quitting your job, you will lose the ability to claim those tax deductions and you’ll be left with a property that costs you more than it earns.”

RISK 4: Obtaining finance can be more difficult

Properties located in some regional or single economy areas, such as mining towns, may be considered riskier from a lender’s perspective, and so it can be harder to secure finance. “Lenders often impose postcode restrictions in towns with smaller populations and less diverse economies,” Neoh advises. “The result is lower leverage, which could reduce your return or make it harder to buy.”

RISK 5: Every component of positive cash flow is uncertain

"Rent is variable and there may be months where you have a vacancy, while expenses like strata and council rates can go up. Interest rates are also variable and can change the cost of your repayments,” Neoh says. These variables can transform a positive property into a negative one, leaving you with a low-growth asset that costs you more money to hold than it generates in profits."

5 risks of investing only for capital growth

RISK 1: Low cash flow can impact on your borrowing capacity

Lenders generally consider up to 80% of gross rental income in assessing loan serviceability, so the lower the rental income, the lower your borrowing capacity.

“Capital-driven investments attract a premium price, and although lending institutions may look at this security favourably, perceiving it as low-risk, there is more reliance on the borrower’s income for loan serviceability,” says Michael Tuchin from Assertive Financial Group. “Therefore, borrowing capacity can be significantly reduced, dependent on individual circumstances.”

RISK 2: Borrowers are more susceptible to lender risks

When your strategy relies on tax deductions and lender discretion, you run the risk of these external influences stopping your investing in its tracks.

“With the recent regulatory recommendations from APRA surrounding investment lending, some lenders may no longer consider negative gearing when assessing applicant affordability, which may further impact on orrowing capacities,” Tuchin advises.

RISK 3: Building a deposit keeps you out of the market

“The biggest risk in buying property for capital growth is the time it takes to build a deposit to fund the purchase,” explains Peter Sarmas, director of Street Advocate.

“For a property priced at $600,000, a 20% deposit will cost the buyer a significant amount: $120,000 plus stamp duty. Trying to save such a large sum of money in a rising property market and with our current lifestyle can seem an impossible task.”

RISK 4: Continually leveraging growth assets can be dangerous

Failing to pay down your mortgage, and continually leveraging your equity and tax returns to buy more property, can be “a trap for the naive property investor”, says Louise Lucas, CEO of The Property Education Company. “You should use every cent you can to pay down your debts, as this is what you will need to live off in your retirement,” she says. “This is a fatal mistake people often make when fooled into thinking a tax deduction is the main aim of the game. Investing for tax reasons will not make you money long term.”

RISK 5: It’s not suitable for every life stage and age

If you are in your late fifties or older, a negatively geared capital growth property “is not ideal”, says Sonali Rodrigo, financial advisor at The Advice Exchange. “I spoke with a client recently who has paid off her mortgage entirely, but she has no other assets and doesn’t have any super. She’s going to retire in five years so a growth property would not be suitable, as she’s going to have no income to support it,” she explains. “Age is a major factor and you’ve got to look at property as not being a short-term investment; for growth properties, you need a minimum timeframe of 15 years.”