Erin Nash has a knack for following her passions at a young age and mastering them later in life.

After beginning ballet at the age of four, she later became a dance teacher specialising in classical ballet.

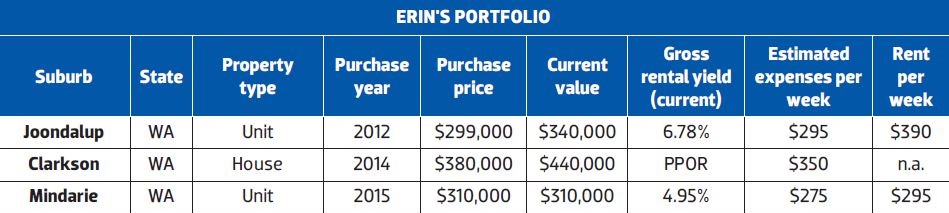

After reading about real estate as a teenager, she later became the owner of three properties collectively worth over $1m.

In fact, the 26-year-old bought her first property five years ago in Perth, when she was just 21. At the time, she was growing frustrated as she watched her hard-earned money go towards rent.

“I started to research buying a property to live in,” she tells Your Investment Property. “In calculating the repayments, I realised I wouldn’t be any more out of pocket weekly as a homeowner than I was renting in the city.”

Erin adds that saving money for her first property was challenging, yet achievable once she put her mind to it.

“Step one was paying off my car loan, and then the saving started,” she says.

“Travelling, working abroad, and weekends away – that other friends my age were doing – had to be put on hold. I was determined to get my foot on the property ladder first.”

That determination became a reality, as Erin saved up $30,000 for a deposit on her first purchase.

After six months of looking in her desired suburbs in the Perth market, Erin bit the bullet and became more realistic about what she could afford.

What she found was the evolving suburb of Joondalup, 30 minutes outside of the city. Moreover, she discovered that a new complex of units had been built there, right next door to the up-and-coming ECU University.

The one-bedroom apartment she had her eye on was a 10-minute walk from the train station and less than 5km from Joondalup Hospital.

With the help of the First Home Owner Grant, and not having to pay stamp duty, Erin was able to afford the unit, which she bought for $299,000.

“I encourage people to really make the most of government incentives. They are there for a purpose, so use them,” she says.

“It helps you get a foot in the door faster, so you can start building your wealth sooner.”

Just 18 months later, the property was valued at $40,000 more than the purchase price.

“I thought to myself: I have just made $40,000 by simply owning this property,” Erin says.

“I was hooked. It was then I knew that I wanted to be a property investor.”

Further, the infrastructure that’s popping up in the Joondalup area is showing positive signs of future capital growth for Erin’s apartment:

● There has been a massive overhaul of Joondalup's major shopping centre, adding a Myer and more upmarket shops and eateries.

● A new business park has opened up in the area, which includes a Bunnings.

● Joondalup has a free CAT bus that runs regularly past Erin’s apartment and throughout the Joondalup CBD.

All these features help attract a range of tenants looking for a low-maintenance home close to where they study or work, such as students, university staff, doctors and hospital workers.

“I don’t think I will ever have an issue in finding a tenant for this property,” says Erin.

A new home

Two years later, Erin financed her second property by taking equity out of her Joondalup apartment to pay the deposit. This was a property in Clarkson, an outer-northern suburb of Perth, which she bought for $380,000.

Since then, the project has certainly been quite a journey for Erin.

“When I built my house in Clarkson I had the absolute bare minimum in the contract with the builders,” Erin says.

“The day I moved in I had concrete floors, unpainted walls, no blinds and no landscaping. The house was surrounded by sand!

“I wanted the mortgage on the house to be as low as possible. I also knew I could contract the unfinished parts of my house in a more cost-effective way than if I had used the building company with their extra mark-ups on everything.”

Over the past six months, Erin has slowly finished the house, which has become her PPOR.

“It wasn’t much fun living with towels on the floor for carpet, or wearing my sunglasses in the kitchen while making my coffee each morning because I had nothing keeping the sun out,” she says.

“My plans are to rent this property out and hold on to it for the long term. I think I would be able to get around $420 a week for it currently.”

Buying off the plan in Mindarie

Following the success of her first apartment, Erin knew that she wanted to purchase a second.

“Although a one-bedroom apartment limited the amount of potential tenants

I could attract, in comparison to a two- or three-bedroom unit the rental yield was a lot higher,” she says.

Indeed, Erin calculated that two-bedroom apartments would potentially attract an additional $20–$30 rental income per week but would cost an extra $100,000. Therefore she decided on another one-bedroom unit.

And since the strata fees were reasonably high on her Joondalup apartment, Erin wanted to find something that was in a smaller complex and didn’t have all the bells and whistles (pool, gym, bulk rubbish collection, etc) in order to keep the fees down.

This time she found some off-the-plan apartments for sale in Mindarie, an outer coastal suburb of Perth.

“The apartments were advertised off the plan in March 2014. I paid a $10,000 deposit to the developer, with the remainder due on settlement, which took place in October 2015,” she says.

“There are only 20 units in the double-storey complex, and my corner apartment on the second floor has ocean views from the balcony. Air conditioning, NBN, security alarm and undercover parking were all included in the fully finished property that was ready for handover to a new tenant on the day of settlement.”

Buying off the plan also meant she had a choice in selecting some colours and flooring. Since it was an investment, Erin made sure colours were neutral, with darker carpets and hard-wearing floors.

“With the market slowing here in Perth, I currently have it rented at $295 per week on a six-month lease. However, as demand in the area increases I foresee the rent increasing to $350 plus over the coming years,” she says.

Looking back, Erin says she had many “freak out” moments with this property. However, she believed in the area, she believed in the property, and she had done her research. Her conclusion was that the property was great value and had a well-reputed developer.

“I just had to keep remembering to back myself, and believe in my decision,” she says.

“A few years ago, Mindarie would have been considered one of Perth’s most northern suburbs. But as urban sprawl moves up the coast of WA, it just becomes more and more central.

“And with the Mitchell Freeway extension currently underway, Mindarie will become even more accessible once this opens up in 2017.”

Looking back

One obstacle that held Erin back from investing even earlier was paying off a large and unnecessary car loan. Indeed, Erin says this delayed her first purchase by just over a year.

“When I first saw a broker he basically turned me away, saying that even with a deposit and my income there was nothing he could do until I had cleared my debt,” she says.

“If I had known that when I first bought the car, I would have chosen something more affordable to get on the property ladder sooner.”

Erin says her biggest challenge as a property investor has been holding on when things have got tough.

“It is hard not to get caught up in the hype and keep yourself up at night,”

she says.

“Perth has seen a massive shake-up over the past 12 months with things slowing down in the mining sector. Although I have a million-dollar portfolio, I am also in a staggering amount of debt for someone my age. Often that gets quite scary if I overthink it.”

Looking forward

Erin’s main goal in investing is to become financially secure. She adds that she would consider investing outside of WA but would need to do lots of research and find a trusted property manager in the area before she did.

In the next 18 months, Erin is looking at diversifying into commercial property and is currently researching properties in the up-and-coming Ellenbrook area, a northeastern suburb of Perth.

“I am still only young, and see myself building my portfolio in the next five years and then holding the properties till retirement,” she says.

“I'm just a normal girl, with a normal job, who has found success through property.”

Erin’s strategy

“Buy and hold in secure areas with growth potential. It is good knowing there is the option to sell something if I need to take time off to start a family,” Erin says.

“It is important to me that properties are cash flow positive. I do not have a huge personal income that I am trying to offset by negative gearing. I am interested in property investing in order to make money, not lose money to offset tax.

“Buy something you know, and something you believe in. Invest when it suits you, not when the TV says so or when your neighbour says so. Every Tom, Dick and Harry is going to have their opinions on your investments and your strategy. It is important to focus on educating yourself, finding what works for you, and working towards your own personal goals.”

Top 5 negotiation tips

• Don't be afraid to negotiate. The worst thing they can say is no.

• Put a timeframe for expiration on your offer. Take the pressure off yourself and put it on them.

• Be honest with yourself about what your budget is, and stick to it. Don't be pressured out of your

comfort zone into something you will regret later.

• Always have some kind of pre-approval or at least speak to your bank/broker before looking at a property, let alone making an offer.

• Don't be afraid to take the plunge. I always quote an old Chinese proverb: ‘The best time to plant a tree was 20 years ago. The second best time is today’. The same principle can be applied to property.

1. I grew up on a farm in country NSW.

2. I have always loved numbers (maths was my best subject in school) and if I wasn't a ballet teacher I would be an accountant.

3. I burst into tears upon handing in my first offer on my first house. I was so overwhelmed and terrified at the time, but look back now with no regrets.

4. My favourite thing to talk about is real estate. I could talk for hours, and happily do so with anyone that will listen.

1. Use a professional property manager. Don't just do it yourself!

2. Don't be afraid to shop around until you find the right property. When I decided to rent out my first apartment I contacted eight different real estate agents. Only a handful got back to me, most of whom I was not impressed with. Luckily, a customer at work recommended someone right before I was ready to give up. She is an amazing support for my property portfolio. One of my tenants had no hot water on Christmas Eve and my property manager dealt with it swiftly and professionally without me having to lift a finger.

3. Request that your property manager sends photos of your inspections so you can see first-hand the state of the property. Therefore there are no nasty surprises at the end of the lease.

4. Negotiate a better rate with your property manager if they are managing multiple properties.

5. Keep your property manager informed of your plans if you are looking to purchase another property – they might be able to help.

Top 5 negotiation tips

• Don't be afraid to negotiate. The worst thing they can say is no.

• Put a timeframe for expiration on your offer. Take the pressure off yourself and put it on them.

• Be honest with yourself about what your budget is, and stick to it. Don't be pressured out of your

comfort zone into something you will regret later.

• Always have some kind of pre-approval or at least speak to your bank/broker before looking at a property, let alone making an offer.

• Don't be afraid to take the plunge. I always quote an old Chinese proverb: ‘The best time to plant a tree was 20 years ago. The second best time is today’. The same principle can be applied to property.

4 little-known facts about Erin Nash

1. I grew up on a farm in country NSW.

2. I have always loved numbers (maths was my best subject in school) and if I wasn't a ballet teacher I would be an accountant.

3. I burst into tears upon handing in my first offer on my first house. I was so overwhelmed and terrified at the time, but look back now with no regrets.

4. My favourite thing to talk about is real estate. I could talk for hours, and happily do so with anyone that will listen.

Top 5 property management tips

1. Use a professional property manager. Don't just do it yourself!

2. Don't be afraid to shop around until you find the right property. When I decided to rent out my first apartment I contacted eight different real estate agents. Only a handful got back to me, most of whom I was not impressed with. Luckily, a customer at work recommended someone right before I was ready to give up. She is an amazing support for my property portfolio. One of my tenants had no hot water on Christmas Eve and my property manager dealt with it swiftly and professionally without me having to lift a finger.

3. Request that your property manager sends photos of your inspections so you can see first-hand the state of the property. Therefore there are no nasty surprises at the end of the lease.

4. Negotiate a better rate with your property manager if they are managing multiple properties.

5. Keep your property manager informed of your plans if you are looking to purchase another property – they might be able to help.

Top 5 finance tips

1. Us ea broker because they are there to make our life easier. Getting finance is a whirlwind of paperwork and a broker can assist with this process.

2 Educate yourself. Don't just let the broker hand it all to you on a PDF or spreadsheet. Make sure your understand the information in front of you.

3. Call your bank and ask for a discount on your interest rate. If they say no, then call back in a fortnight and ask again. The worst-case scenario is that they say no again, you keep your interest rate, and the world continues spinning.

4. Look for home loan products that offer an offset account. That way you pay less interest but can still access the funds for a rainy day or a new property purchase.

5. Keep organised. and have a clear end goal in mind. Always know where you are at financially, and never take your finger off the pulse.