In 1998, Anne Morelli took four months off from her job at the bank to ride around Australia on a Harley Davidson. She set off with her partner Malcolm, but things went awry when she had accident in the north-west Queensland city of Mount Isa. She suffered bad concussion and still struggles to remember much about the incident.

“The whole front of the Harley was destroyed and I had massive headaches,” says Anne.

“We thought it was going to pose a big risk to our trip, but it didn’t and we managed. There was a fantastic garage out there that got us going in two weeks.

“We met some wonderful people and had a great adventure.” Interestingly, her passion for long journeys on the Harley is a lot like her attitude to property investing.

Firstly, set yourself a challenging goal. Secondly, focus on the end result you want to achieve. Thirdly, enjoy the experience and reach out to people along the way. Fourthly, if you have a setback, pick yourself back up and keep going. Finally, appreciate the reward at the end of it.

“The basic training for motorcycling is to focus on where you want to go and that’s where you will end up,” says Anne.

“If you don’t, you will never get there.”

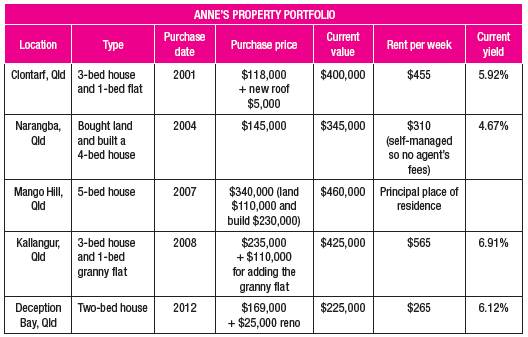

These days, Anne owns five investment properties in the outer suburbs of Brisbane and despite being retired her focus is now set on buying even more …

Early challenges

The ability to make money out of property first caught Anne’s eye in her early 20s and the deeper she looked into it, the more it fascinated her. However, the context of the time was not one which would encourage her ambition.

“I am 65 now, but when I started work girls got paid only a fraction of what boys got paid,” she says.

“Girls were not considered able to contribute much and were expected just to leave school and work for a couple of years and then get married and have children.” But Anne foresaw a different path for herself. When she looked around at the people who were financially successful she discovered they had one thing in common: property.

“That was the initial trigger and then when I monitored the real estate section in the papers I saw the prices creeping up and up and up. From a young age I was observing this,” she adds.

Anne bought her first block of land when she was just 21 and another when she was 32. She sold both to meet debts, but the experience was essential in building her confidence for the hurdles to come. The year was 1992 and Anne was going through one of the toughest periods of her life. It was then that she split up with her husband and was looking for somewhere to live with her three teenage children. She was working part-time as a bank teller, but made the bold step of buying a block of land at Warwick (130km south-west of Brisbane) for $12,000.

As Anne could not afford to build on the land she decided to invest $35,000 in two transportable homes from Toowoomba which she would situate on the Warwick property. The consequence was that Anne and her family had to live in one of the homes.

“It was a really tough time, particularly as I was a single mother on a part-time wage with three teenagers and a mortgage,” she says.

With the help of her mother and brother she renovated the other property and rented it out.

Fast-forward five years later and Anne sold both properties, while making a $70,000 profit. This extra money allowed her to buy a property in Boondall, 15km north of Brisbane.

It was at that point that Anne realised the potential of owning cheap properties which are positively geared.

“My advice for investors starting out is to not be afraid of buying country properties which are positively geared. The cash flow enables you to get finance to buy other properties which are closer to the city that might have the potential for greater capital gain,” she says.

“At the end of the day, the capital gain is really the big thing.”

Two in the one suburb

Anne has one strategy in particular that’s worked wonders for her. It involves buying two properties in the same suburb, or buying a property and then adding a granny flat. The result is she has two income-producing assets that reap the benefits from the suburb’s natural capital growth.

“If you buy one property in an area and do all that research - beating your brains out getting that information - you might as well buy two,” she says.

It is a process she has used time and time again in Queensland. For instance, she built two houses in the same street in Narangba, not to mention buying two established homes in Deception Bay and Mount Morgan, in addition to two blocks of land in Kulpi.

And then there’s the success story of her property at Kallangur, where she bought a three-bedroom house for $235,000 in 2008.

It was at this time she discovered that if the land was more than 600m2 she was able to add a one or two-bedroom flat.

“Before I added the granny flat to the Kallangur property I went to the council with my proposal and they said ‘well it doesn’t really fit but let’s look at it’.

“And then we met the next week and came up with a different scenario and a different solution and it all went ahead.”

She spent $110,000 building the one-bedroom granny flat and carport, and today the house and granny flat are worth $425,000 and have a combined rental income of $525. “That property is a real little money-spinner,” says Anne.

Helping others

One of the best words to describe Anne’s love of property is contagious.

For instance, Anne has mentored her daughter Tania in the art of investing and helped her buy five properties. Tania ended up selling two country properties at a profit, which helped her buy properties closer to the city with greater potential for capital gain.

“I also mentored a friend to buy and sell several properties when everyone else was saying ‘you’re mad!’ We proved them all wrong!”

Moreover, after the 2011 earthquakes in Christchurch she took in a family who lived with her for three months while they got settled.

“We got on like a house on fire and became firm friends,” she says. “My passion for property investing must have rubbed off, as they have become active and passionate property investors themselves.

“I will talk to anyone about real estate and I am pretty passionate about it because I have seen the benefits.”

Anne is also a big believer in helping out her tenants where possible.

Anne is also a big believer in helping out her tenants where possible.

One example is the three-bedroom, one-bathroom house she bought at Deception Bay. She paid $105,000 for it, but it had a few problems to say the least. Namely, there were holes in the walls, there was rubbish all over the grass, the toilet was not working properly and the taps in the kitchen were broken.

“There was a poor old fella living in it,” says Anne. “I felt sorry for him as he was living on a pension and his son was giving him a terrible time.”

“I went over there with a man in a big truck, fixed it all and cleaned it all up.

“He also had these awful neighbours next door who were absolutely feral and used to throw all their rubbish over the fence into his yard.”

Consequently, Anne informed the agents who were managing the neighbour’s property and put an end to that.

“The poor old fella was afraid to say anything because he didn’t want it to get any worse,” she adds.

Additionally, the lady on the other side was constantly troubled by a big tree on Anne’s property which dropped leaves on her roof and filled up her gutters.

“I didn’t really need to get rid of it, but she had asked every owner who had ever owned that house to get rid of it,” says Anne.

“I thought to myself I don’t intend on keeping this house more than 12 months and I felt sorry for her, so it cost me $800.”

Twelve months later, Anne sold that property for $215,000, which was more than double what she paid for it - a result Anne attributes to karma.

“You do someone a good turn, it may not come back from that person, but it will come back to you multiplied. It has happened to me time and time again.”

Spending time with family

Anne has not done much investing since 2010. It was then that her partner of 15 years Malcolm passed away, after battling lung cancer for 15 months.

“It was a terrible blow emotionally, but I was so grateful I wasn’t having to deal with the pressure of my old job at the bank,” says Anne.

“Without my property investments I would not have been able to be with Malcolm full-time and support him through those 15 months.”

Anne also enjoys spending time with her 88-year-old mother and doing work in her house and garden.

“Most of my time is spent with family and friends and I have the time and money to support those people who are important to me,” she says.

“I have got friends all over Australia and New Zealand and I am very happy being around them.”

Further challenges

Anne is somebody who has a sentimental attachment to all her properties, but she accepts that the financial reality demands selling them from time to time. This was the case when Anne’s partner passed away and she was left with debts that she had to take care of.

“I went into a bit of panic and I sold the three-bedroom house at Caboolture,” says Anne.

Anne bought it for $105,000 in 2002 and sold it for $175,000 in 2012.

“I made $70,000 on it so I’m not complaining, but if I held onto it for another six months I would have got well over $200,000 for it,” says Anne.

It was a challenging property to own at times, especially as Anne hoped to put a granny flat on it which never eventuated because she couldn’t convince the local council.

“The people on the front counter were great, but the people on the next level – you couldn’t even get to them. They wouldn’t discuss anything, they wouldn’t negotiate, they wouldn’t give you advice, it was just a ‘no’,” she says.

“So dealing with different councils can be difficult. That’s why I have also not added a granny flat to the Deception Bay property as yet.”

More properties on the horizon

Despite already achieving so much with so little, Anne still hopes to buy even more properties in the future. And if there’s one thing for sure, it’s going to be in Queensland.

“I like to be able to keep an eye on them and do some of the work myself,” she says.

“When you have problem tenants you can go in yourself and do a clean-up. All my properties are like my babies.”

Another thing that’s almost certain about Anne’s next purchase is that it won’t be a unit.

“I hate body corporates, you are just really restricted,” says Anne.

“In saying that, in some areas people prefer units. It is all about buying them at the right price and getting a good product.”

Whatever and whenever she purchases, Anne has the time now to make a decision without a lot of the pressures she has experienced in the past.

“Having the time and money to be with family and friends in need, or just have fun, is always lacking when we are tied to a regular job.

“I have always loved the freedom that property investing gives me, and always encourage anyone who I talk to about the subject, to go for it!”

Anne’s tips to retire early:

- Don’t be afraid to buy in country areas which are positively geared. The cash flow will enable you to buy properties closer to the CBD which might have the potential for greater capital gain.

- Do a lot of research. Read books and magazines, go to open homes, drive around the streets and talk to real estate agents. I usually spend three months looking.

- Make sacrifices early on. I grew my own food, worked a couple of jobs and took in borders to help me reach my goals.

- Be aware of the council’s rules and regulations before buying. Some are more difficult to deal with than others. You should be particularly mindful of this if you’re contemplating adding a granny flat.

- Don’t be discouraged if you’re on a low income. I was a part-time teller and a single mother, and through a strict budget and hard work I was able to do it.

- Add a granny flat where possible to get that dual income.

- Start today, but preferably yesterday!

- Anne has retired from her day job, despite being on a low income throughout her life.

- She enjoys travelling and spending time with family and friends around Australia and New Zealand.

- Anne mentors friends and family about property investing and has helped them towards their own paths to financial freedom.

- She has been able to spend time and money on charitable causes that she is passionate about. This includes supporting the Salvation Army and housing for the disadvantaged.