05/11/2015

05/11/2015As a result, Ben and his wife Lisa have experienced more than their fair share of “cracking horror stories”, he reveals. But the Sunshine Coast-based investor is philosophical about his missteps and mistakes, instead choosing to recall the experiences as learning opportunities.

“I don’t look at them as being a negative thing,” he explains. “All of these [scenarios] were 100% learning experiences.

None of this stuff is very meaningful in the big picture; it’s all part of the risk and reward of this business.”

This is quite an admirable approach to take, especially when you consider Ben’s very first property experience: it involved several joint venture partners, an ill-researched property purchase, and a tenant with an undesirable drug habit.

What to do when your drug-addicted tenant fails to pay rent?

Ben’s first investment property was purchased as a joint venture between him and two close friends. The group was

excited about the possibilities of profiting through property, but Ben admits they didn’t do a lot of research prior to selecting their investment.

“We bought our first investment in Miranda in the Sutherland Shire in Sydney, which was within 10km of where we grew up,” he says.

“Our research was basically browsing properties on RealEstate.com.au, and when we found the property we liked, we

pretty much bought it at market value.”

To gain access to the First Home Owner Grant, Ben lived in the property himself for the first six months. Then, because

they lived so close to the property, the trio decided to try self-managing the property.

“We listed it on Gumtree and the tenant we found was fine for the first four months. But then he slowly started falling behind on his rent.”

Eventually they stopped hearing from the tenant altogether, and it became “more and more difficult to get payment” for the rent.

After five months they arranged an inspection of the property – their first since the tenant had taken possession.

“His lifestyle choices were pretty evident,” Ben says tactfully, “so we attempted to get him out. At first I was trying to work with him to get the money that he owed us, but when I realised it wasn’t going to happen, we pushed harder for him to leave. We didn’t have a formal tenancy agreement and property manager working on our behalf, so it was difficult, but he finally moved out a few weeks later.”

Out of pocket roughly $1,200 in missed rental payments, the investment partners decided to use the vacancy period between tenants as an opportunity to renovate.

“We had been planning to cosmetically renovate anyway, so we went straight in after he left and did it up,” Ben says.

“One of our co-owners moved in at that point, and we didn’t have any further troubles. But while that was all going on, we began having issues with our second investment property.”

Rebuilding after your property floods

Ben’s second investment, a house on the Central Coast, was bought with just one other joint venture partner.

A little more strategy went into this purchase as the pair purchased a Residex Top 100 Suburbs guide in order to isolate 10 suburbs that appealed the most.

After finding and settling on their desired investment property, they embarked on a quick cosmetic renovation and quickly found a tenant. All seemed to be moving along smoothly – until the property became flooded, that is.

“Two weeks after we finished renovating, we discovered there was an issue with the drain overflow. If there was a storm, the water should have drained away naturally, but the drain was blocked,” Ben explains.

After a particularly wet weekend, the property flooded. The carpets were saturated and the walls sustained some water damage, but fortunately Ben’s friend in the carpentry trade was able to assist.

What could have been a very costly repair bill came in at under $1,000, as his carpenter friend repaired the walls for next to cost price, while an industrial dryer was used to absorb moisture from the carpets.

“We moved the tenants upstairs for 10 days while everything was being repaired, and we cut their rent in half for that period,” Ben explains.

“In the end it wasn’t worth going through insurance to fix it, and we’re lucky the cost to repair it wasn’t higher.”

Raining down from above – inside the home

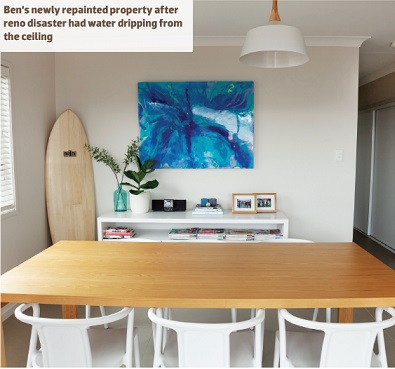

By 2013 Ben felt confident that he’d learned enough lessons ‘on the job’ and was ready to tackle his first complete renovation. But when he purchased a property on the Sunshine Coast with plans to add value through strategic renovations, he wasn’t prepared for the profit-chewing incident that had water dripping through the ceiling and down the walls!

“We bought a three-bedroom, one-bathroom property and it was our first full renovation project,” Ben explains.

“Towards the end, after we’d had a painter through and we’d done the kitchen and bathrooms, we had a tradie – a friend and a professional painter – come in to repaint the roof. He used a gurney to clean the roof prior to painting it.”

However, instead of spraying the gurney down the tiles so the water would drain off into the gutters, he sprayed up and under the tiles, which allowed the water to seep through to the ceiling.

“The water drained through and destroyed the newly painted ceiling, which was crazy, because it was his job, so we thought he’d know not to do that!” Ben says.

“He eventually replaced the sheeting and repainted it for us, but we had to supply the materials, so we were out of pocket around $2,500.”

Today, with a portfolio of six properties and growing, Ben says he doesn’t regret any of the mistakes or stumbling blocks he’s encountered along the way.

He now works in property fulltime, and he says everything that has happened in the past has helped him to grow his knowledge and make more informed decisions for the future.

“What I’ve found is that many people don’t take that first step with investing because they think they have to get it perfect or know everything before they start, but you can’t know everything. Everyone has that fear about making mistakes, but the key to success is to balance that fear by being confident to make a decision and move forward. At the end of the day, you live and learn.”