However, he’s been a busy man and has built a portfolio of five properties across three states in that time.

But despite his proactive buying strategy, Dan feels he’s already left a few opportunities on the table.

Like many investors, early retirement is the goal for Dan as he plans for the passive income generated by his properties to replace his nine-to-five employment.

With a portfolio worth $2.38m to his name after less than half a decade in the game, it would appear he is well on his way to that goal. Still, Dan believes a few small mistakes here and there have left him behind the eight ball.

“My journey started in 2012 after analysing the property market for a couple of years,” Dan says.

“I didn’t know what I was analysing and not much changed other than the price of the properties going north, so I delayed my entry into the investment club for no real reason at all.”

While waiting to buy may have cost Dan a bit of money, it wasn’t such a huge regret that he pulled the pin on the entire journey.

“For as long as I can remember, I have been interested in property,” he says.

“I did what most people have to do and sacrificed life and saved for a number of years to get into a position to purchase. After the first one, though, I was hooked.”

DAN’S TOP 5 INVESTING TIPS

• Aim to invest in good solid growth areas.

• Always be active in the market.

• If the numbers add up, go for it.

• Build a good asset base by buying into various markets.

• Get advice and/or mentors.

Off to a flying start

While it took Dan a little while longer to get started than he would have liked, he did come out of the blocks strong.

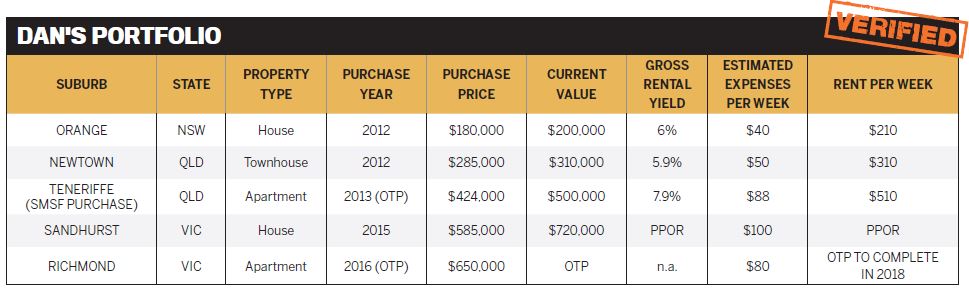

His first purchase, in 2012, was a house in Orange, a major regional centre in NSW’s Central West, for $180,000.

Staying somewhat regional, Dan then focused on Newtown in the Queensland city of Ipswich and picked up a townhouse for $285,000 in the same year.

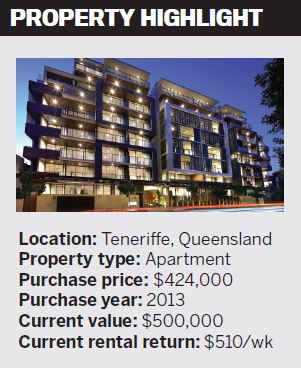

Dan stayed in Queensland for the next purchase and moved into the capital city market with an off-the-plan apartment purchase in Brisbane’s Teneriffe in 2013.

After the initial pace he had set, there was a bit of a gap before Dan’s next purchase, which was his family’s principal place of residence: a house in the outer-Melbourne suburb of Sandhurst, which he bought for $585,000 in 2015.

Melbourne was then the target for Dan’s most recent investment play, when he added an off-the-plan apartment in Richmond, worth $650,000, to his portfolio in 2016.

Hindsight is 20/20

Looking at what Dan has achieved, it would seem that he got off to a strong start. He has built a diverse portfolio of properties in strategic locations across the country.

But in hindsight Dan says there have been some periods when he could have made an even bigger splash.

“My biggest mistake was not being in a position to start investing sooner, but I also regret not actively seeking investments to purchase for two years from 2013 to 2015, even though I was in a financial position to do so,” he says.

To avoid making further mistakes or missteps on his investment journey, Dan has been working with the team at Positive Real Estate. A firm believer in the value of good advice, he cites the saying, “You will pay for your education, whether you choose to or not”.

Like all good investors, Dan has learned from his perceived mistakes and he believes those lessons will now form part of his investment strategy going forward.

“Lesson learnt – always be active!” he says.

“You don’t have to be buying investment properties all the time, but you do need to be active with the properties you do have, to ensure you are getting the most out of your investment.”

Success in spite of the regrets

While he may have missed a few opportunities here and there, the moves Dan did make seem to have been the right ones.

All of his purchases have increased in value, and his plans for a passive income stream seem well developed, with all of his rental properties returning very respectable rental yields.

It also appears that his experience is starting to pay off as Dan rates his two most recent purchases as his best.

“I’d have to say our family home in Sandhurst, Victoria, is our most successful transaction so far.

We purchased it just over a year ago and we have realised great equity already. We have also just signed a contract for what I believe is my best purchase yet [the off-the-plan apartment in Richmond]. I recently visited the display suite, and the design specs and features are amazing,” he says.

“I like to invest in good solid growth areas, so my aim is to be active in the market – and if the numbers add up, go for it”

I recently visited the display suite, and the design specs and features are amazing,” he says.Believing that he’s finally hitting his stride as an investor, Dan isn’t about to take another break from the market.

“[My plan is to] keep investing and keep abreast of how each property is performing, and access equity for purchases,” he says.

“From here, I plan to take advantage of the availability of funds and invest when the opportunity presents itself! I like to invest in good solid growth areas, so my aim is to be active in the market – and if the numbers add up, go for it.”