4/8/2016

Questioning the advice of his accountant and educating himself on property investment has led to sound investment decisions and a successful portfolio

After realising early on in adulthood that his yearly income and career path would not fulfil his financial aspirations, Warren Borg turned to property investment to change his trajectory.

“I found property investment to be the light at the end of the tunnel,” Warren says.

“I knew I could get my foot in the door with a first property, and if I was patient enough, over time I could have a portfolio successful enough to enjoy both capital growth and a healthy income stream.”

And that is exactly where Warren has ended up.

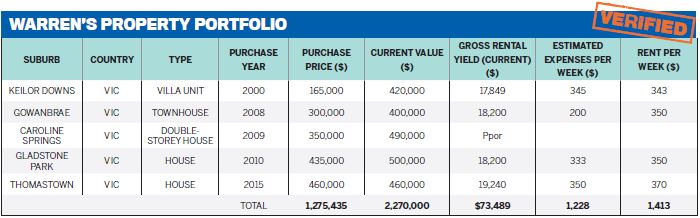

With patience and a constant drive to educate himself, Warren has amassed a portfolio worth over $2.2m.

“I could see back then that it was possible to live the lifestyle I wanted through property investment,” he said.

“I found that by being patient and wise enough to hold on to properties long term, it would be a much better, lucrative and safe investment as opposed to shares or relying on super or the pension.

“Investing in property has allowed me to live the lifestyle I dreamt of, both in the present and in the future – if I go about it the right way.”

One of the biggest motivators for Warren today is knowing that his family will be financially secure and will not have to rely on government handouts. With a sound investment strategy and constant dedication to research and education, Warren can sleep easy knowing he is taking control of his own financial future.

Taking the plunge

Warren explains that when it came to his first property, he did not want to overcommit – it was simply a stepping stone to, firstly, getting into the property market, and then holding it long enough to use the equity to purchase a second property.

“I purchased my first property in 2000, which was a villa unit in Keilor Downs, Victoria, for $165,000,” he says.

“I lived there for around seven years and then rented it out for two more.

“After holding on to it for nine years the property was valued at $400,000 and I went on to use the equity to build a second property in 2009 – a brand new house in Caroline Springs for $350,000, which was valued at $450,000 in 2010.”

“I found that by being patient and wise enough to hold on to properties long term, it would be a much better, lucrative and safe investment as opposed to shares or relying on super or the pension"

.JPG)

Before buying this property, Warren admits that he hit a minor speed bump that caused him to re-evaluate and proved to be one of the most important lessons to date.

“When I was ready to purchase my second property, I received advice from an accountant that I would be fooling myself if I thought I would be able to keep and rent out my first property and purchase another one on my wage and the fact athat I was single at the time,” he says.

“I remember leaving his office feeling gutted.”

Warren says it was only a short time later he found out that particular accountant mainly dealt in shares and was in fact giving incorrect and negative property investment advice.

“I learnt that you always need a second opinion and that you need to arm yourself with as much knowledge as possible by speaking to proven property investors, by reading books and attending seminars to gain the confidence and the drive in yourself before relying on other people’s ‘experience’.”

Warren explains that after the first hiccup they went through a few different accountants and real estate agents until they found a team they could trust and were confident in.

“I have been lucky enough to work with the same experts now for 10 years, and I have full confidence in their professionalism,” he says.

“I have peace of mind going to bed each night knowing that my properties are in good hands, being looked after ethically.”

Manufacturing wealth

Knowing that there would be room for capital growth, Warren has purchased all of his investment properties under the median Melbourne house price with a view to hold long term.

“If you buy a house anywhere above the median house price there is therisk of paying too much, which in turn affects future growth,” he says.“I found that as long as I do my homework and look for areas the government mentions in their strategic planning policy from now until 2030 – activity centres that have planned population growth, jobs, new roads, hospitals, public transport, etc – this gives me the peace of mind I am buying into an area that will do well in both the short term and the long term.”

Besides this strategy, Warren explains that he and his wife currently look for properties with development potential.

LITTLE-KNOWN FACTS ABOUT WARREN

LITTLE-KNOWN FACTS ABOUT WARREN- I have a Maltese background, while my wife, Rose, has a Sicilian background.

- I work for a global shipping and cruise company as a shipping agent. My wife is a primary school teacher.

- I am passionate about health and fitness, and enjoy working out at the gym.

- I love my sports – mainly soccer and AFL (I have been playing soccer since I was five years old).

- I am well-travelled and look forward to more travelling in the future.

- I enjoy letting my hair down and catching up with family and friends, as well as spending time with my young daughter.

- Overall, I am a passionate guy who wants to get the most out of life.

In 2010, Warren had enough equity in the Keilor Downs and Caroline Springs properties to purchase a house in Gladstone Park, Victoria for $435,000, which was recently valued at $500,000.

“One of our goals in purchasing this property was to find a big block with a possibility to build up to three units on it in the future,” he says.

This is one way Warren and his wife found they could grow their portfolio – by adding properties with redevelopment potential.

“Using the equity in our existing properties, we bought a house in Thomastown this year,” he explains.

“This particular property has also got redevelopment potential.”

On top of these sound strategies, Warren has all properties completely covered by landlord insurance, as well as substantial coverage on his principal place of residence.

“Over time, we have also managed to build up a healthy buffer in a redraw account, cash savings, two incomes and rental income, which gives us peace of mind that we can cover all expenses for the rental properties and our home,” he says.

Looking back

Warren explains that if he were to have his time again, he would choose to distance himself from accountants and financial advisors who are not heavily or personally involved in property investment.

“In my experience dealing with advisors who specialise in shares or superannuation, when I asked for advice regarding starting a property portfolio, they were very negative by telling me I don’t earn enough or they would tell me it’s too risky as an investment choice,” he says.

“They tried their best to persuade me to invest in shares rather than property.”

It was only after Warren started seeking advice from specialists who were passionate about property, and who had proven success in property investment, that he began to acquire the knowledge, confidence and motivation to start to build a property portfolio for himself.

On further reflection, Warren admits that if he was to start again, he would aim to enter the market at an earlier age.

“I purchased my first property when I was 25, but looking back I should have aimed to get into the market even earlier"

“I purchased my first property when I was 25, but looking back I should have aimed to get into the market even earlier,” he says.“The earlier you purchase the first property, the better off you will be, because holding on to your first one and using the equity/capital growth will give you the stepping stone to purchase a second property.

“Then, you will be well on your way to creating your own property portfolio.”

TOP 5 PROPERTY MANAGEMENT TIPS

1 Try and surround yourself with people who are passionate, driven and have had proven success in the area of investment that they have chosen. Learn from them.

2 Be patient and wise with your investing and you will be rewarded sooner than you think.

3 Be careful who you receive advice from, as not everyone has your interests at heart and are looking out for themselves. Always get a second opinion if you’re not comfortable with the advice/information you’re receiving.

4 Try and educate yourself as much as you can in the area you’re investing in so you’re not relying totally on other people’s advice.

5 Always have a back-up plan and evaluate your risks so that if something should go wrong, you have peace of mind throughout the challenging times.