From a young age, Paul Glossop had always been interested in real estate. After finishing school, he completed an initial diploma in architectural technology, but it wasn’t until his second degree and subsequent opportunities abroad that he realised how property was going to influence his life.

It was an education degree that allowed Paul to live and work in London for two years where, in 2006, he became exposed to the local real estate boom.

“Living and working in London reignited my interest and love for real estate, although I became much more interested in how investors were using property as a vehicle to create wealth whilst continuing their chosen vocation,” he says.

Set stretch goals and objectives for the short, mid and long term. Align yourself with successful investors and take your time – it’s not a race. Understand investing from every angle and not just the property you’re buying, but how that property is going to help you achieve your short-, mid- and long-term goals. Don’t be afraid to buy where you wouldn’t want to live – it’s a nonemotional purchase.

“I arrived back in Sydney in 2008 with my now wife and with $2,000 to our names... We both decided to get serious about buying our first property”

“This is where I became very accustomed to the term ‘make your money in business and park it in real estate’.”Paul explains that London, albeit on the other side of the globe, has a very similar market to some of our Australian major cities – tight supply issues, high demand and strong yields.

“At the time of their previous growth cycle, they had a strong economy – that was until the GFC exposed those too highly leveraged,” he says.

“But, as history will show, London came out of the GFC, investors took advantage of a depressed market and they have made serious returns of 60- 80% since 2009.”

This is where Paul first recognised the power of research, property cycles and investing in fundamentals.

“I arrived back in Sydney in 2008 with my now wife and with $2,000 to our names,” Paul says.

“At the time, we both decided to get serious about our careers and about buying our first property – with the intent of investing sterically to create a property portfolio that would sustain capital growth into the future and also create a desired passive income position within 15 years.”

During this time, Paul worked in the pharmaceutical industry while his wife remained a teacher.

“We made our first investment at the bottom of a depressed market in Sydney (Cronulla) in 2010 with a $20,000 deposit,” he says.

Paul attributes this first purchase as the beginning of their success and the beginning of his new career as a property investor and founder of a successful property investment advisory firm.

Strategising

Paul explains that, on a personal level, he prefers to continually evolve his strategy while the end goals and objectives remain the same.

He explains that every property investment journey is unique and there is no one size fits all approach.

“The strategies we set for our clients are always bespoke to their situations and what they are trying to achieve,” he says.

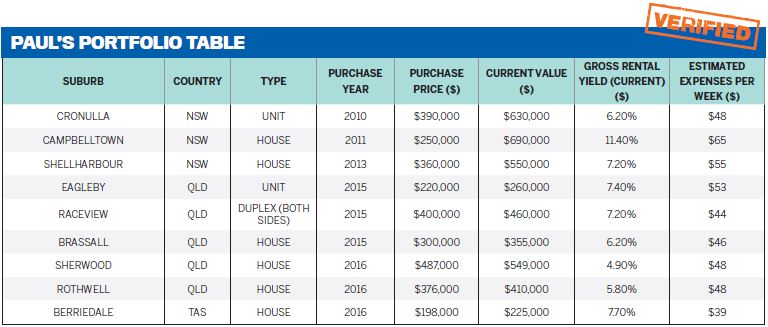

“We have bought everything from one-bedroom units in areas dominated by young professionals with tight supply, to free-standing suburban houses with strong yield and long-term investment strategies, right up to small development sites turning a single property into a multiple townhouse investment, creating strong equity and cash flow.”

TOP 5 NEGOTIATION TIPS

1 Understand the motivation of the vendor. This is the key to understanding how much they truly need to sell.

2 Look to utilise contract negotiations in your favour to gain a reduced price or settlement conditions, which will also allow you to show prospective tenants prior to settlement to maximise cash flow.

3 Avoid competition where possible as this invariably means increased demand.

4 Get your finances sorted before you start your search.

5 Use a trusted and qualified buyer’s agent to maximise the savings on purchase price.

LITTLE-KNOWN FACTS ABOUT PAUL

I once backpacked solo across the USA at the age of 17. I quit my

high-paying corporate job at the age of 33 to establish my company (enabled through previous property investing). And I’m a massive believer in doing what makes you happy.

“We work with our clients to educate them on how to better leverage their income and equity to invest in highperforming properties. The strategies are easy to understand but extremely powerful,” he explains.

In terms of experience, Paul attributes his success and large portfolio to the industry insight and personal education he has acquired along the way.

“My background was not a financial one,” he says. “However, I am a tertiary educated teacher and have worked within some of the biggest companies in the world, in both sales and education settings.

“This experience taught me a large amount about what true success and true knowledge look like – both from a personal perspective and also from a client experience perspective.”

Making plans

Paul reveals his future plans for his company involves pushing the Australian property investment buyer’s agency space into the mainstream professional market.

“I want to build a reputation in the industry so that my company is a benchmark for both property investment outcomes and industry-leading education. [I want to] enable every investor to create successful and sustainable property portfolios which are aligned to their goals and objectives.”

On a personal level, Paul says his ambition is to continue to build their portfolio over time in a sustainable fashion.

“We have already created an extremely successful portfolio and are looking at opportunities such as small developments and equity gains,” he says.

“The medium-term goal is to build our portfolio to around 20 properties, $6-7m in value, and then consolidate in our 40s with the option to sell down and generate a $250k passive income stream by our late 40s. We are definitely well on our way to achieving this.”

In the current market, Paul says his strategy focuses on areas that are showing strong infrastructure spending, both now and in the future.

“We are always looking for properties that don’t rely on any negative gearing to turn a cash flow profit and are anywhere from a 10-35km radius of major metropolitan cities,” he says.

“We look for areas that have a tight supply to demand ratio and always showing a sub 2.5% vacancy rate, amongst other things.

“In short, we are buying in a wide and varied scope of the Brisbane market, and parts of the Hobart market. We see opportunity in the future for parts of Perth and also areas within Adelaide.”

Looking back

Without wanting to sound cliché, Paul admits that there is always a certain amount of regret with any journey.

“My biggest lesson early on in the piece was buying a property within the Hunter Valley based on one- to two-dimensional economic drivers,” he says.

“I only did this once and I have learnt a great deal from that decision. It has not lost us money, but what it cost was the opportunity to invest elsewhere at the time – and who knows what that could have achieved for us.”

“The small amount it costs comparative to the investment is by far the best money we could have ever spent,” he says.

Passing on his wisdom

Paul explains one of the most important lessons for anyone looking to start their own business is to not underestimate the time and commitment it takes.

“It should not be a ‘lifestyle’ decision, as I work more hours now than I did in my corporate career,” he says.

“However, it is an absolute passion, and if your heart is not in it, your head will not allow it. Also, I personally work off a company mission that ‘good enough is not good enough’. I’m a very firm believer that if you are satisfied with close enough, you will only ever achieve a close enough outcome.”

He explains that one of the many benefits of running his own business is the constant exposure to the next markets to grow.

“We obviously always have great properties come to us at excellent price points, so from a personal portfolio perspective, it gives us the opportunity to buy great properties ongoing.”