Ready to sink their teeth into the property market but not quite cashed up enough to do it alone, Gold Coast siblings David Christopher and Sascha Haddon decided to pool their resources and buy a property together. The duo wound up splitting their risk while their apartment doubled in value

Most siblings are familiar with the concept of sharing: from a young age they’re encouraged to share toys, food, friends and sometimes even bedrooms.

So, by the time they’re all grown up, it makes sense that they might consider sharing the responsibility (and the rewards) of owning a property together.

This was the attitude that Gold Coast siblings David Christopher and Sascha Haddon adopted when they bought their first property together over a decade ago.

“We decided to find an apartment that we could move into and live in for the first 12 months, so we could access the First Home Owner Grant, which at the time was worth $7,000,” David explains.

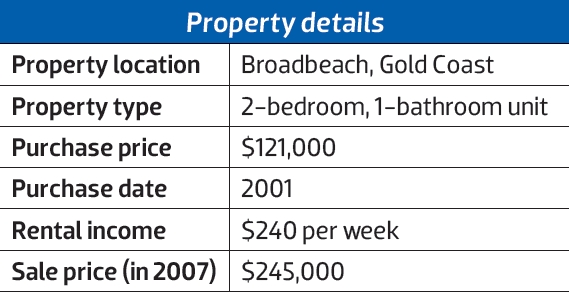

They began researching properties in their desired location of Broadbeach, and within a matter of weeks they had whittled their search down to a shortlist of three properties.

Their first choice sold before they had a chance to make an offer, so they moved swiftly on their next best choice. The two-bedroom unit was on the market for $121,000 and they paid the full asking price, which required them to pitch in just $10,000 between them, as the FHOG covered a good chunk of their 10% deposit and buying costs.

The pair embarked on the venture as 50:50 partners, meaning every expense – from the original deposit and legal fees to ongoing mortgage repayments, council rates and body corporate notices – was split down the middle.

And although they didn’t use a lawyer to create a formal partnership agreement, they did put in place a number of systems and procedures to help them manage their new property.

For instance, at the beginning they established a joint bank account from which the mortgage was automatically deducted each month. They also created a budget and agreed to contribute a set amount each week to their joint savings account, to help manage their ongoing property expenses.

The one thing they hadn’t discussed was an ownership timeline. This had the potential to create some headaches when Sascha told David she wanted out of the investment in 2004.

“I wasn’t ready to sell as it was a great investment, but Sascha was ready to move on. It was actually a little complicated as we’d taken out the loan in both of our names,” David explains.

In order to buy his sister’s share, David had to refinance the property into his own name, a move that incurred bank fees and legal costs, and also triggered payment of additional stamp duty. This is something investors considering a joint venture should be mindful of, as they’ll need to fund these additional expenses if they plan to eventually buy out their JV partner.

Fortunately, thanks to a mini boom in property prices, the apartment had grown in value and David was able to buy his sister out in a fairly straightforward manner. Based on this growth, the bank was happy to back David in his bid to take full ownership of the property.

He made plans to buy Sascha’s share for $40,000, a figure they settled on after liaising with local real estate agents to ascertain a fair market value of $200,000.

“I was bit concerned that my bank wouldn’t lend me the full amount I needed, but because the unit’s value had increased by around $80,000, there was enough equity for me to refinance the loan to a 70% LVR,” David says.

After becoming the sole landlord of the property, David moved interstate and managed his investment remotely for a number of years. It ticked along without incident, earning a solid rental return that increased over time from $180 to $240 per week, until David also decided he was ready to move on.

He sold it in 2007 for $245,000, achieving a sale figure worth more than twice what the siblings originally paid.

While he doesn’t have any regrets, David confesses that if he had his time again, he may have held on to his first property investment.

“I sometimes wish we’d held on to that property, as those units are now valued at around $330,000,” David says.

“But I think everything turns out how it was meant to. I now own four properties, and if I hadn’t sold that unit I wouldn’t have had the funds to continue investing and buying the properties that I have, so there’s no point in looking back.”

Moving forward, David would “definitely consider doing a joint venture again, if the right opportunity came along”, and would even consider jumping back into partnership with his sister on a future property deal.

“The biggest challenge for me is to save up a deposit, and with a joint venture partner you can cut your waiting time in half and get into your next investment sooner,” he says.

“I think JVs are a great way to reduce your risk and build your portfolio more quickly.”

Before setting sail on a property joint venture, “every role and expectation needs to be clearly defined and documented”, advises Michael Yardney from Metropole Property Strategists.

“Approach your property investment plan in the same way you would a business plan, with all partners agreeing to every aspect of the deal,” he says. This includes getting clear on the following five points:

Goals:

How many properties do you plan to buy together?

Responsibilities:

Who will liaise with the banks, property managers and real estate agents? Who is going to negotiate purchases and sales?

Financial contribution:

How much is each partner contributing?

Profit distribution

What cut will each partner take?

Timeframe

How long will you hold the properties? When, if ever, do you plan to sell?