It was that very value that a mentor can provide which helped 29-year-old Philip Shin become the proud owner of three properties in less than a year. However, it was Philip’s keen interest in investing, his motivation to learn new things, and his determination to create a stable passive income that got the ball rolling.

Indeed, it would be fair to say that Philip’s life changed dramatically after he attended the Sydney Property Expo last October.

Back then, the energy trader had no family background in property investing and had spent much of his 20s focused on buying a car and other lifestyle luxuries.

While at the Expo, Philip set his sights on finding a mentor to advise him and making a plan to get started. “I needed a mentor to help me be inspired, set a goal and give me the confidence to start,” Philip says.

“I had no idea where to buy. I spoke to Ian [Hosking Richards] after listening to his presentation, bought him a coffee and ended up spending a lot of time speaking to Lindy Lear [Ian’s colleague] about investing. “I followed their advice and guidance on investing and decided to take some action. I now have two fantastic mentors!”

Philip is also now well and truly on the path to achieving his dream of affording a better quality of life and accumulating enough wealth to financially assist his parents in their retirement.

Making up for lost time

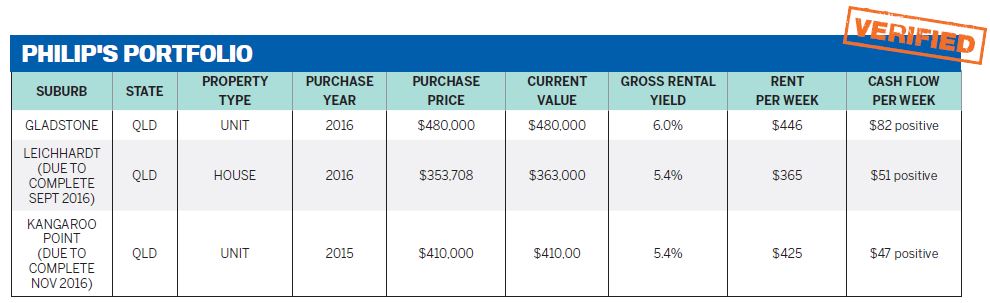

In just eight months Philip has bought an off-the-plan apartment in Kangaroo Point (2km from the Brisbane CBD), a house and land package in Leichhardt (43km from the Brisbane CBD), which is currently under construction, and a two-bedroom apartment in the Central Queensland port city of Gladstone. Keen to make up for lost time, his goal was to buy as many properties as he could afford as quickly as possible, while not being stressed out by multiple settlements.

How did he manage to do that? “I bought one property that was ready to tenant straight away, one property to be built over six months, and one property off the plan requiring only a 10% deposit with a loan not required until 2017,” Philip explains. “I wanted the properties to be cash flow positive so they did not cost me money and impact my lifestyle.”

“I look for new properties that attract good tenants”

Philip also wanted his properties to have solid capital growth potential so he could further grow his portfolio by leveraging off equity in the properties over the next one to four years. Therefore his main strategy is to buy and hold for equity growth in the long term.

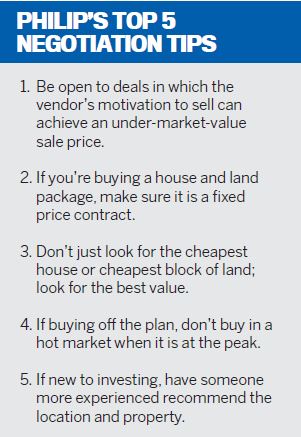

Philip also wanted his properties to have solid capital growth potential so he could further grow his portfolio by leveraging off equity in the properties over the next one to four years. Therefore his main strategy is to buy and hold for equity growth in the long term.“I wanted quality new properties that would not cause me problems and would look after themselves,” he says. Another part of Philip’s buying strategy is to seek out properties that are under market value and can provide some instant equity.

“I also want higher rental yields and depreciation benefits to give me the positive cash flow,” he adds. “By buying off the plan in an undervalued and rising market I can hold the property during the 12-month construction period with no costs until settlement, with the potential upside of capital growth during construction.”

Philip’s most successful purchase

The property Philip is the most proud of is the new apartment in Gladstone that he bought in March 2016. Gladstone is 550km north of Brisbane and 100km southeast of Rockhampton. The Port of Gladstone is the fifth largest multi-commodity port in Australia and the world's fourth-largest coal exporting terminal. Aside from mining, Gladstone is known for its retail sector, tourism, and primary production, including beef cattle and timber. Gladstone also has its own airport and is a major stop on the North Coast railway line.

“The Gladstone market had opportunities to buy under value as the market is in a period of downturn,” Philip says.

“I found a vendor who was motivated to sell, so I achieved a below-market purchase price. It also had a guaranteed rental for two years, giving me a positively geared property and some instant equity.”

In hindsight, Philip would not change his overall strategy one iota, as it has allowed him to buy three properties in eight months, and put him on the pathway to even more.

Philip’s purchases have set him up nicely to fulfi l his goal of entering the Melbourne market by the end of this year. When he does this, he will be looking for diversity in location and to take advantage of a different property cycle.

Wherever he chooses to invest, what is paramount for Philip is that he finds affordable properties in areas that have yet to go into a growth cycle, and that have a low entry point in order to capture the highest possible growth in value.

Philip’s biggest regret? “It’s the procrastination I went through during my 20s, and not starting earlier due to fear of making a misinformed investment choice,” he says.

“The reason I procrastinated for so long was that I did not have a goal to aim for and hence I had no motivation. I have learnt that following the examples of established and successful investors is the best way to get started.” Or as the author Bo Sanchez once put it: “Getting a mentor is the shortcut to success.”