Judge's comment

Judge's comment“Alfonso and Vanessa have a very clear strategy, such as using their equity from one property to invest in the next one, keeping LVR reasonable and dedicating their resources to making it work. They knew it would be hard at the beginning, so they sacrificed holidays and going out. They stuck to the plan and it now pays off. Great vision followed by dedicated execution of the strategy!”

– Philippe Brach, Multifocus Property & Finance

“I really liked Alfonso and Vanessa’s strategic approach to property investment. The way they look at suburb data to truly understand who is living in a market, how, and then use that to identify opportunity resonates. I also like their approach to tenants. Completing yearly inspections with their property managers is a great idea. I also like their approach to looking after the safety of their tenants through the installation of RCDs, smoke alarms, deadbolts and windows locks.”

– Justin Davey, Real Estate Investar

“Alfonso and Vanessa are definitely on the right track to financial independence through property investing. They have a clear proven strategy in place, focused on diversification, capital growth and strong risk management, including a high level of ethics. Right on track!”

– John Kovacs, NMD Data

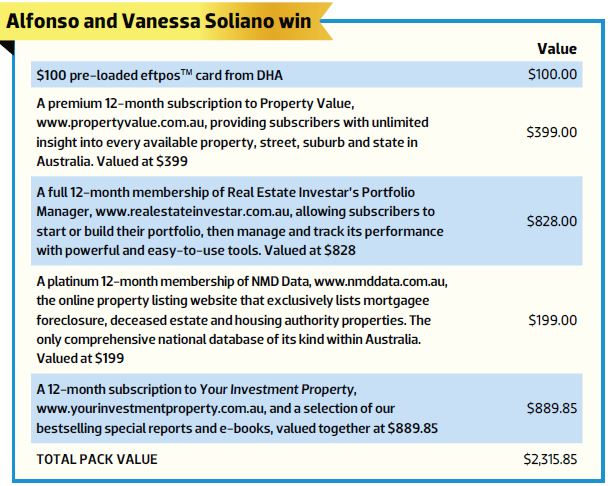

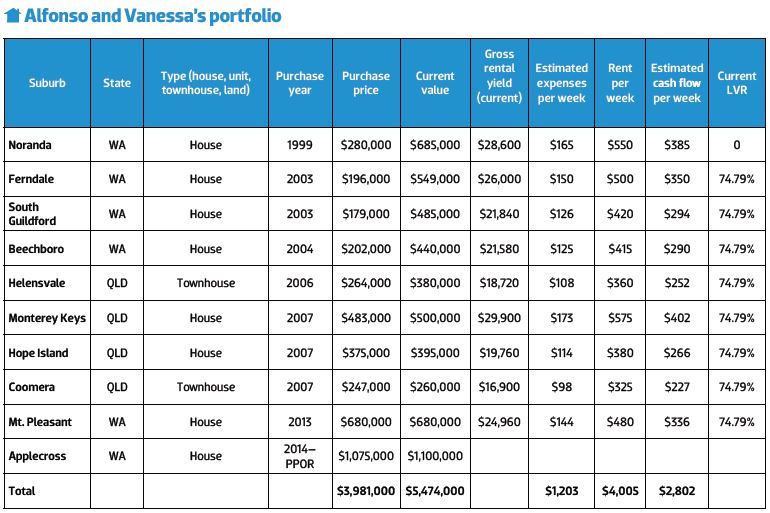

“With the goal of securing their retirement, Alfonso and Vanessa have built a portfolio of 10 properties with a value of $5.5m. A strategy of buy, hold and in some cases sell, where capital growth has been achieved, has enabled them to manage their debt levels effectively. They also manage their risks by inspecting properties once a year and maintaining properties regularly to ensure minor issues do not become major repair issues.”

– Madeline Dermatossian, DHA

“A common mistake investors make is not structuring their loans to maximise future borrowings and deductions. In Alfonso’s case, setting up a line of credit on his paid-off investment property could then be used for deposits on future investments. I also like that he cares about his tenants; after all, tenants help us to grow our wealth.”

– Helen Collier-Kogtevs, Real Wealth Australia

It started with a tiny spark, but sometimes that’s all you need to kick off something big. This was certainly the case for Vanessa and Alfonso.

“About 15 years ago, we were introduced to a couple of property investors. They were talking about the property they bought, how their portfolio had given them the freedom and lifestyle they now enjoy, and how they got started. After talking to them we thought, if they can do it, we can do it too,” recalls Alfonso. “Their success gave us an insight on how we can control our financial destiny as well.”

At that time Alfonso and Vanessa were still dating and living with their respective parents. They were so inspired by what they had heard that they decided to give property investing a go. Within a year they bought their first property and promptly got bitten by the property investment bug. There was no turning back.

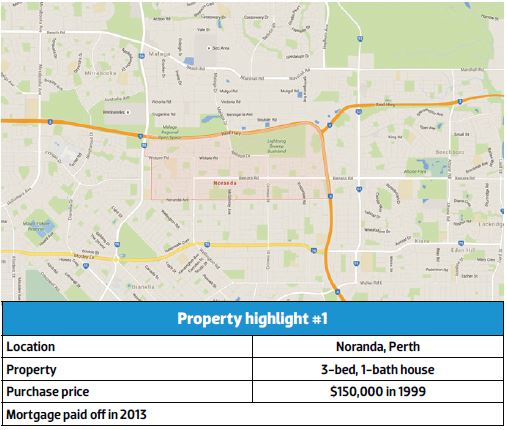

“Our first investment was a simple three-bedroom house in a middle-class Perth suburb, and we just went from there. We were really surprised at how easy it was to go through the process. Once the property was tenanted and got going, we decided to go again, and decided to keep buying for as long as we’re able to,” recalls Alfonso.

The couple’s successful foray into the property market didn’t happen by accident. Right from the start they were clear about what they wanted to achieve and how to do it.

“Our strategy was to buy property number one and then access the equity gained and use it as a deposit for number two. Then repeat as long as we could afford the repayments on our investment loans,” says Alfonso.

The couple, who have since married, also ensured that they put in place strategies to deal with the risks associated with investing. They started by creating an honest budget.

“The very first thing we did was to start a budget,” explains Alfonso. “This helped us pinpoint our incomings and outgoings.”

After assessing their financial situation, they established that they could live on one income and use the other income to buy a property.

“That’s when we worked out we could actually invest and meet the repayments,” says Alfonso. “At that time, we were still living in our parents’ houses. Thankfully we didn’t have much living expenses to deal with initially, so we were able to focus our energy and money on saving for a deposit and strengthening our finances.” Using the spreadsheets they got from the investors they had met earlier, they were able to forecast expenses and earnings.

Choosing the right area and property

Being on an average income means Alfonso and Vanessa were constrained by what and where they could buy. Despite this, they ensured they bought in desirable areas with solid fundamentals.

Specifically, they looked at suburbs where fewer than 20% of the properties were rentals, to avoid competition from other landlords. They also targeted properties with a land component.

“We wanted to buy in a good suburb where you didn’t have much public housing and that showed signs of gentrification. We like areas within proximity to the CBD or regional town centres and that have good access to public transport, shops and good schools,” explains Alfonso.

“Initially, we just chose the property based on price, because of our borrowing capacity. We were only able to borrow a maximum of $160k, but we opted to take out $150k instead.”

Just like many first-time buyers, the couple started by picking a suburb they knew by heart. “The first suburb we chose was Noranda, which is only 2km from my parents’ house and 3km from my wife’s parents’ house,” says Alfonso. “We wanted something close to our parents.

The couple’s research included checking the demographics of the suburb to find out what the dominant age group was and the proportion of renters.

“We were told not to buy in a suburb where rental properties made up more than 20% of the total housing stock, because you’ll be competing with other landlords. Noranda has only 11% rental properties. It took us six weeks to find the house we liked. The rest is history,” says Alfonso.

Expanding their portfolio

Using their strategy of buying in growth areas and accessing the increased equity, the couple were able to expand their portfolio more quickly than they thought. They did this by buying in areas further out of their comfort zone.

“We started looking at new up-and coming areas based on the information coming from the government and council about new schools, shops, roads, etc. We believed these would bring demand and corresponding capital growth. We wanted capital growth because this would allow us to build equity which we could use to invest further,” says Alfonso.

Their timing couldn’t have been better. They bought just before the housing boom in Perth, so they were able to ride the explosive growth in values. As soon as the boom started to unwind, they decided to buy interstate.

“We realised we’d got so much equity built up in our properties, and the rents were starting to cover the mortgage repayments and becoming positive. So we decided to venture interstate and on to the Gold Coast. We have a friend who lives there, so we went for a visit. We liked the climate and the environment and decided to look at a few properties. We also decided we wanted to retire there,” recalls Alfonso.

Their first Gold Coast property was a townhouse in Helensvale that they purchased for $264,000. This was followed by three more properties bought in Monterey Keys, Hope Island and Coomera.

“We thought the Gold Coast had the right fundamentals. Our strategy changed because we were now looking for a place that could become our retirement too. Initially, when we were buying in Perth, we were buying with our head, but when we bought in the Gold Coast we were buying with a bit of heart too,” admits Alfonso.

“You’re not meant to buy with your heart. But when we went to the GC, we were already comfortable with our five properties in Perth. We had diversified and were not paying too much tax. We had so much equity. We were not losing sleep.”

1 Do not delay maintenance issues uncovered by the tenants or property managers.

2 Perform personal property inspections with the property manager once a year, and make improvements where you see fit

3 Reward good tenants with unrequested improvements such as new carpets, blinds, air con or a garden spruce-up.

4 Secure tenants more quickly by asking for $5 to $10 below the market rate.

5 Be a fair landlord by negotiating ‘give and take’ agreements. For example, secure a 24-month lease with a guaranteed rent increase $20 after the first 12 months, in exchange for new carpets or new blinds, or air con for an ensuite, or some sort of improvement to the tenants’ liking.

Top 5 negotiation tips

1 Gain an approval in principle from your lender prior to house-hunting. This will dictate the suburbs you are able to look in.

2 Do your research on prices in the adjacent suburbs for comparison.

3 Set yourself a ’highest price

you would offer and do not exceed it. If you lost the house by not overcommitting, then it was not meant to be. Move on.

4 Have another one or two similar properties on your radar that you are willing to purchase. This will show that you are not desperate and the vendor might accept your offer for fear of losing you as a buyer.

5 e prepared to walk away from the negotiating table if you feel the asking price is too high.

1 Have a 'true to yourself' budget.

2 Invest for the right reasons.

3 Do not overextend your borrowing capacity. There's no point in having three

investment properties in three years but living on Maggi noodles.

4 Be disciplined when deciding how and why to spend your money.

5 Execute and follow through short-term sacrifices for long-term gain, eg by not taking overseas holidays for the first few years of investigating. From 1999to 2003, my wife and I sacrificed going out and having holidays in order to live off one income, while using the other income to pay off our home plan. This helped us build up equity to use as deposits for our investment property purchases.

Even when the Gold Coast property market began to suffer, the couple’s solid risk mitigation strategies shielded them from potential losses.

Because they had planned for these types of unforeseen scenarios, they were not compelled to sell. Instead they took this time to take a breather and refocus on their careers in order to boost their earnings and borrowing capacity.

“We decided to sit it out and wait for the Gold Coast property market to come back to life. There’s no point in selling when you can’t make big profit,” says Alfonso.

In order to protect themselves, the couple adopted the following strategies:

- Maintain an LVR below 80%.

- Be a fair landlord and maintain properties to an acceptable standard in order to keep good tenants. Repair or replace any hazards in and around the property.

- Install smoke alarms, deadbolts and windows locks.

- Carry out inspections once a year with the property manager, to minimise and repair maintenance

issues.

- Upgrade carpets, bathrooms, kitchens and so on, as needed.

Looking ahead

Having now accumulated a solid portfolio, the couple are in the enviable position of being able to embark on the next phase of their property journey.

“We bought our home late last year and are now looking to consolidate over the next 12 to 18 months before deciding what to add to our portfolio,” says Alfonso.

“At the moment, we’re keen to buy more land for future small development, and maybe build three units. We’re going to continue using the remaining equity in our portfolio to add value to our existing properties. We plan to hold on to our properties over the long term.

“Investing in property has been very rewarding for us. It gave us the ability to control our retirement future outside super. We also cherish the opportunity to provide rental housing to families who choose to rent, by being fair landlords.

Our biggest mistake

While the couple didn’t make any disastrous decisions along the way, they admitted to making a costly mistake.

“We paid off our Noranda property,” says Alfonso. “We should have put the funds in an offset account. As of 2014, Noranda has been rented out with the income fully taxed. Today our residence in Applecross has a home loan, but with an offset account attached.”

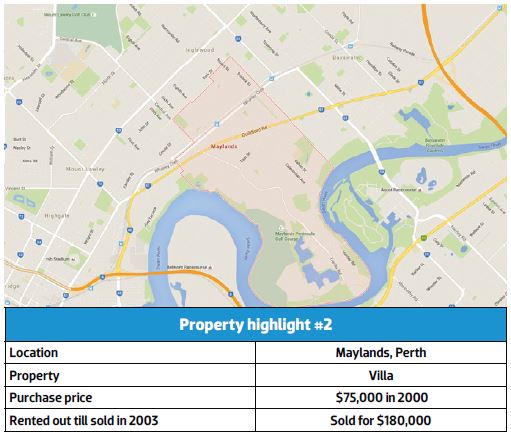

“We sacrificed going on holidays for four years to be able to afford to buy and hold this property,” says Alfonso.

“We paid off a $75,000 loan and used the profit to demolish and build a brand-new four-bedroom, two-bathroom house in Noranda. With this fully paid, brand-new 4x2, we were able to use the equity to purchase Ferndale, South Guildford and Beechboro properties within a 12-month timeframe,” says Alfonso.