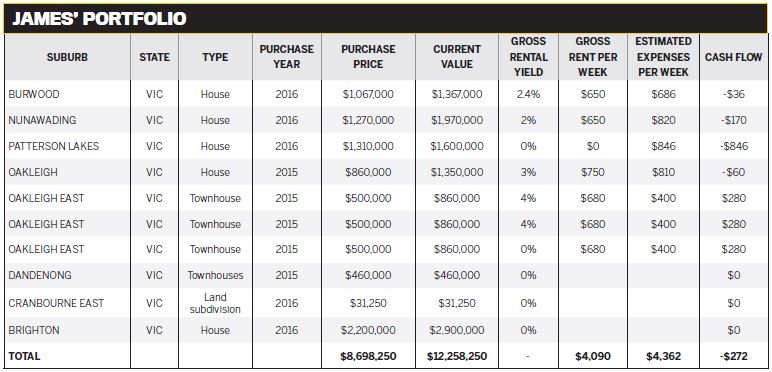

For this young gun, success in the real estate game has been all about mastering property development. He only began investing a couple of years ago, but already he’s generated a multimillion-dollar profit – and he’s nowhere near finished yet. James Dong, was our 1st Runner-up in Your Investment Property magazine’s Investor of the Year Awards 2016.

So far, the way I’ve been going in this industry, I’ve been able to produce three cash flow positive properties every 18 months, with a capital investment of about $100,000. This is through buying a block of land under market and building three to five townhouses on it,”

James explains.

“I’m already on to my sixth deal, which means that even if I don’t make any more acquisitions and just finish what I have going already, I will end up with 15 townhouses in less than 24 months. The total gross value of my current projects will be around $15–20m, with net wealth of about $10m. They will generate a positive cash flow of approximately $200,000/year, which will be relatively tax-free due to depreciation deductions as well.”

James is using an aggressive strategy to get ahead in the property game, and so far he’s having great success. Clearly, he personally has a high-risk profile to be able to comfortably manage several development projects at once without getting fearful about the large financial commitments he is making.

His method of ‘buy old house, obtain a three-unit permit, build, and rent for positive cash flow’ is highly repeatable and has so far generated fantastic profits.

Blocking out the naysayers

It was a desire to overhaul his lifestyle that initially led James to become interested in investing in property.

“I used to work 50 hours a week on the road as a salesperson, and I was making good money, but my life was all about work,” he explains.

“I wanted some way of producing a leveraged income stream so that I didn’t need to work as many hours. I now work full-time in property and I work from around 10am to 3pm every day, which gives me freedom and flexibility. My life is less stressful and I literally have time for all the things I never had time for before.”

It all started with a pot of funds of around $400,000 that James used to launch his first deal. Key to his success has been a willingness to move forward with his bold property development plans, without getting caught up in well-meaning but often-misguided advice from friends and family.

“A lot of people claim to be experts, but they haven’t actually got the runs on the board to be qualified, so their advice doesn’t mean too much,”

James says.

“I learned very early on that people around me were quick to give me advice and warn about the ‘dangers’ and ‘risks’ of investing. You can acknowledge their intentions and love them for wanting to help and caring – but then go and find out how it’s actually done from the right people.”

This is precisely what James did, which proved to be a difficult task, especially as he was relying on his parents to help him fund his first foray into property.

To get into his initial development deal, James refinanced his parents’ home and withdrew several hundred thousand dollars. This allowed him to buy a property in Oakleigh East, Melbourne. His plan was to build three townhouses on the site to create an ongoing income stream.

Fortunately, all went well – so well, in fact, that the deal went on to make $1.1m in equity and is now cash flow positive to the tune of around $50,000 a year, after expenses.

In that one deal he has created an annual income. He says if he’d listened to those around him who were constantly talking about the risks and pitfalls of developing, he may have been too apprehensive to take action.

“You need to be very careful who you let influence your thoughts,”

James says.

“Don’t listen to the person who has never done what you’re aiming to achieve, because although that advice may be coming from a place of care and love, it can also come from a place of ignorance and a lack of knowledge.”

Facing risks head-on

James has enjoyed fantastic results to date, but there’s no denying that his highly ambitious strategy is not without its risks.

What if one of his development projects fails to generate the profit he has forecast? What if he chooses the wrong location and the market falters during development, and the value of his development falls? What if he gets slugged with sky-high land tax bills due to the heavy concentration of buying only in one state? What if he has trouble securing finance to propel his next deal forward?

These are all genuine risks and concerns with real-world outcomes that could force James to grind his investing plans to a halt.

For these reasons, he has employed a number of risk management strategies to help him come out on top.

For instance, he has begun looking into business and commercial financing so he is no longer restricted by the borrowing criteria of retail lenders.

“Bank funding becomes a challenge when using retail loans to facilitate the transactions. I’m only restricted by my borrowing capacity so long as I stay within the retail space, so the solution, which is my next step, is to move into business banking. This way, it’s the deal itself that needs to meet serviceability criteria and not my personal income,”

James says.

Furthermore, he always seeks out motivated sellers and negotiates hard to ensure he buys well under market value, to make sure there is always some “value hedge” in the deal to protect him financially.

“All the properties I’ve bought have been well under market. For example, I bought in Oakleigh East for $737,000 when market was $900,000. This figure is justified by bank-engaged valuations and is not a made-up, pie-in-the-sky number. If you buy with a market value hedge, you will always be able to sell down quickly without losses,” he says.

“In the past two years I have generated over $1m in equity just by buying right. This intrinsically provides downside protection as well as velocity in funding if I ever needed to jump out of a property, because I would be able to get my purchase price plus stamps and other expenses back, if not a little profit, if I had to sell at a moment’s notice.”

“Money ultimately creates freedom and choice so that we don’t have to endure the stress of peak-hour traffic, or office politics, or being treated unfairly by an employer”

Buying under market value also protects James from market volatility. In his first deal, he purchased a block of land for $690,000 when the market supported a sale price around $200,000 higher.

“As I gentrified the land into a higher and better use, the land became more valuable. My total cost for this project was about $1.5m, but the total end value of the townhouses is around $2.6m – the market has to crash about 38% for me to just break even, let alone lose money. It goes without saying that a market crash of 38% would be extremely unlikely in the Australian property market under today’s conditions.”

“On a project once, I engaged the wrong consultants who were ‘yes men’ people, who told me what I wanted to hear, rather than what would get me the result I wanted. I was very disappointed about that process and ended up wasting around six months on additional holding costs across three projects, which cost me roughly $50,000–$60,000. I eventually sat down with the main contact who I was working with, who had let me down, and had a honest conversation about how and why I was disappointed. He said that no one had actually treated him with such dignity and respect despite the circumstances, and we amicably ended our engagement with no hard feelings. Fortunately, due to the large development margins I had factored in, in the grand scheme of things the financial loss wasn’t too bad, but I definitely learnt a lot during that process.”

Freedom and choice

While James has made strong headway and built immense wealth through property in a short space of time, he says there have been steep learning curves along the way.

He has made mistakes and admits that managing his cash flow and coordinating settlements within short spaces of time has been challenging.

“The lessons learnt were to space out settlements and expand at a more controlled pace. I expanded too quickly and I’ve now gotten to the point where I need to realign my focus in potentially selling down some assets, and move toward commercial investments for stronger yields and less hassle with tenants,” he says of his future plans.

James is passionate about property, but the exact type of real estate he invests in, whether residential or commercial, is less important to him than the benefits that strategic property investing brings to his life.

“Money is a tool that can be used to derive freedoms and choice. Money buys me more time with my family and friends, because I don’t need to work a nine-to-five job – or more like seven-to-seven for most people – and as a result I can spend more time with family, I can go on more holidays, and I can drive in a nicer and safer car,” he says.

“My wife doesn’t need to work and she can look after the children and spend more time looking after her parents. Money ultimately creates freedom and choice so that we don’t have to endure the stress of peak-hour traffic, or office politics, or being treated unfairly by an employer.

“It’s those things that actually make a material impact in our lives and bring us happiness, and that’s what drives me. If you make the reason for your pursuit solely about making more money, then you will never be happy or be satisfied with your results.”

Location: Oakleigh East

Property type: House – which was developed into 3 townhouses

Purchase price: $1,500,000 (including construction costs)

Purchase year: 2015

Current value: $2,580,000

Current rental return: $680 per

townhouse; $2,040 total

JAMES’ DEVELOPMENT BLUEPRINT FOR SUCCESS

- Buy under market value

- Aim for a 20% discount

- Add value by running a planning process to generate the ability to construct multiple dwellings on the parcel of land, creating a higher and better use for the land [Note: Many people opt out of the process at this point and sell the block of land with development approval, enjoying a healthy profit for their efforts. Builders will pay a premium for land that is ready to build and turn over.]

- Engage a builder to construct units

- Have each unit separately titled and valued at the end of the project

- Rent out each property to enjoy a strong cash flow, or sell one, two, or all three properties, depending on your strategy

– Clint Greaves, Real Estate Investar

.JPG)

– Tyron Hyde, Washington Brown

.JPG)

– Tim Lawless, CoreLogic

JAMES’S $10,000 PRIZE HAUL

As the 1st Runner-up in the 2016 Investor of the Year Awards,

James wins an amazing prize pack worth $10,807, including:

- $500 eftpos® card from DHA Australia

- $500 cash from Multifocus Properties & Finance

- A 12-month subscription to CoreLogic’s RP Data Professional Investors Package, which off ers subscribers unlimited insight into every available property, street, suburb and state in Australia. Valued at $2,340 each

- A full 6-month membership of Real Estate Investar’s Portfolio Builder, allowing subscribers to manage, track and optimise their portfolio’s performance with powerful and easy-to-use tools, valued at $1,494

- A platinum 12-month membership of NMD Data, the online property listing website that exclusively lists mortgagee foreclosure, deceased estate and housing authority properties. The only comprehensive national database of its kind in Australia, valued at $199

- 2 x Residential Depreciation Reports from Washington Brown Quantity Surveyors, valued at $1,320

- A 12-month subscription to Your Investment Property, and a selection of our bestselling special reports and e-books, valued together at $889.85

- A copy of the bestselling book, The Armchair Guide to Property Investing, by Ben Kingsley and Bryce Holdaway