developments and purchases simultaneously, baby boomer Leanne has been making up for lost time.

With their retirement years around the corner, Leanne is working on ensuring that she and husband Manfred – and their family – will be financially secure.

“We chose property as our security,” Leanne explains. “It means we don’t have to be reliant on an employer, and we can keep the lifestyle that we have now, even when we’re not working.”

But passion trumps financial gain for Leanne, who thrives on seeing a project through from start to finish, and watching the old become new again.

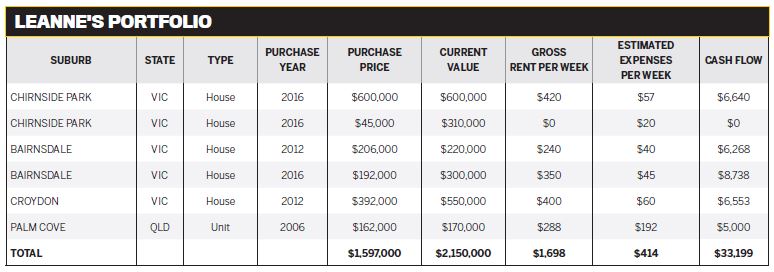

Leanne’s strategy of buying, subdividing and building has often involved bringing shabby original homes back to life. In the past 10 years she has turned over more properties than she can count, and currently holds a six-strong portfolio worth $2.15m.

Starting in the ’70s

Leanne first dipped her toe into property in the 1970s, when she and Manfred purchased a block of land for $10,000.

"We sold it two years later for $12,000,” Leanne recalls.

“This is my passion. There’s pain, and it’s hard work, but I wouldn’t change it for anything”

“It was in those days when finance was hard to come by. You needed a 30% deposit; we were earning $60 a week. It seemed like an awful lot of money!”

Over the years the couple purchased a number of small units but essentially put property on the backburner until 2006. However, Leanne remained immersed in real estate and finance as a bookkeeper, and did a short stint as a real estate sales agent.

“I’ve always been involved in property in some way, shape or form,” she says.

“For our properties, I love doing all the research and liaising with town planners and councils. Data tables and spreadsheets are key. I’d rather shop for houses than shop for clothes!”

Starting the snowball

The low-key property plans ramped up when a series of life events clicked into place.

Leanne found she had more free time as her children grew older, and she started her own part-time bookkeeping business. In 2005 her father was diagnosed with cancer and later passed away. Leanne raised more than $40,000 for the Alfred Hospital by paddling the length of the Murray River and walking back to Melbourne.

“I wouldn’t have been able to do that if I was working full-time,” she says. It was at that point that she wholeheartedly embraced property as a means of achieving future security.

“We are still heavily committed to Lions Australia, and our investing once again gives us the chance to put back into the community,” she adds.

Using her finance management skills, Leanne prepared a buying strategy based on risk mitigation and cash flow.

One of her subsequent purchases was a unit in Queensland’s Palm Cove in 2006, which now produces an excellent return of 9%.

With lenders wary of financing near-retirees because of the risk they pose when they stop work, Leanne says cash flow and yield are very important to them.

“As we are an older couple, we’ve recently refinanced to maximise our available equity, because we know this may become a problem in the future,”

she says.

“I’d rather shop for houses than shop for clothes!”

“We’re always very clear about what we’re doing and how much we can work with.”

Dividing and conquering

Leanne’s overall strategy has involved subdivision and new builds. One of her most successful property developments was in Croydon, Victoria.

In 2012, Leanne purchased a deceased estate there for a bargain $392,000, after negotiating a further $13,000 off the price because of minor building issues.

“We knew we wanted the property because it was ugly and smelly, but it was a certain subdivision and that is our key selection criteria,” Leanne explains.

The transformation of the original home was nothing short of a miracle. While Manfred and their son took on the lion’s share of the DIY work, they employed qualified tradesmen to help.

“We don’t believe in cosmetic improvements at the cost of safety,” says Leanne. “Electrical and plumbing works should always be done to a high standard rather than just ‘tarting up’ a property.”

With land selling quickly, Leanne decided to subdivide the lot and sold the rear land ‘as is’.

“The sale of the land was interesting, because the subdivision took a long time and the market rose while we were waiting,” says Leanne.

“We had put in a ‘sunset clause’ that allowed us to exit the contract, so then we were able to go on to sell the land for $130,000 more.”

This gave them a final sale price for the land of $307,500. The original home is now valued at $550,000, giving them plenty of equity to develop two more properties in Bairnsdale and Chirnside Park.

The couple have rejuvenated several other properties, including one in regional Victoria, which Leanne says was “pretty much unliveable, with a concrete floor in the family room, a 1970s kitchen, and a horrendous bathroom. These places are not pretty to start, but they are always pretty to finish!”

She says their success is all due to finding the right properties.

“We buy entry-level houses at the bottom of the market,” Leanne explains.

“Often the purchase price will be not much more than the land value, which lends us room to value-add. We find properties that are ripe for subdivision, and then we renovate and sell as quickly as possible.”

When it comes to moving a property on, Leanne believes time is definitely money. “I would rather take $5,000 less if the offer was early in the marketing campaign, and it was a short settlement,” she says. “While your money is tied up in a property that’s ready to sell, you’re missing out on the opportunity to start another project.”

“Yields, costings and growth figures are key, and when you use them all the time, it’s easy to remove the heart from the equation”

As a person who loves number crunching, Leanne says finding the right place to buy is all about feasibility and asking real estate agents plenty of questions.

“I ask what price a subdivision would fetch, what would the vacant land get, is there a market for the vacant land, what’s the best type of house to build, and so on. Then I contact council to see what timeframes are involved with planning.”

Leanne says that if the numbers don’t stack up, don’t buy.

“Yields, costings and growth figures are key, and when you use them all the time, it’s easy to remove the heart from the equation,” she advises.

Easy profit in regional towns

While some investors shy away from regional properties, Leanne sees the benefits: there’s less market competition and good yields.

“We like to spread the risk, and we do that by buying regionally and at the lower ends of the market; we get good returns and split the risk a bit,” she says.

substantially cheaper, Leanne is able to buy two regional properties for the price of one in the city. This generates more cash flow through rental returns and means she doesn’t have to worry if one is untenanted for a period.

Subdivision is a simpler and faster process in regional areas too.

“I can get a permit to subdivide within two months, whereas in the city it can take six to nine months,” Leanne explains. Regional councils are keen to develop – Leanne has even had a town planner call at 7pm to answer her questions.

“No way would that happen in the city!” she laughs.

What Leanne has discovered is that regional buyers expect to buy a home, not just a vacant lot.

“In metro areas, you can make quick money on a subdivided lot without a house, but regional buyers just want the house ready to go,” she says.

No matter the location, Leanne looks for bottom-of-the-market properties that have potential for renovation capital and are always in high demand with entry-level buyers.

“There’s always someone wanting to get into that market, like first home buyers,” she explains. “It’s easy when it’s a buoyant market, but when the market tightens there’s still those entry-level buyers wanting in.”

A flexible future

Leanne’s plans for the future are fluid. She intends to add more subdivisions and renovations to her portfolio, ultimately holding around 10 investments that she and Manfred can use throughout their retirement.

“Realistically, we want to have a new asset every two years, so we’re looking at around 10 years to hit our target,” Leanne says. “We may sell some; we might hold on to them and live off the income. Nothing is set in stone with us – we’re quite fluid in our thinking.”

For Leanne, the joy of seeing a home restored to its full glory is more than enough, and she plans to keep doing it for as long as she can.

As a reward for their hard work, they indulge in little treats like a special holiday every year.

“I just went out a couple of months ago and bought myself a new car,” says Leanne says with a smile.

“Manfred said, ‘It’s not your reward, it’s your reminder’. We’re passionate about being responsible for ourselves, having that independence, and being able to enjoy life.”

"Leanne has a clear strategy of buying at the bottom of the market – and I like that. She doesn’t get sucked into the next hotspot, and that strategy seems to have worked to date, helping her build a solid portfolio.”

– Tyron Hyde, Washington Brown

"Leanne has a great well-defined strategy and she sticks to it. She has a very targeted, narrow strategy to invest – subdivide and renovate in regional areas – and she seems to excel at it. It requires guts to do this, but the upside is that there are not many people who would compete with her. She also has a good risk management strategy in place. I love the dedication and stubbornness – it is what is making Leanne successful.

– Philippe Brach, Multifocus Properties & Finance

"Leanne Jarchow has a diversified investment strategy that includes subdivisions and investing in regional markets across Australia. Research, due diligence and number crunching are her main focus and she lives by the premise ‘If it doesn’t stack up, then you don't buy it’. A very sound and logical approach!"

– John Kovacs, NMD Data

HOW TO SUCCEED IN REGIONAL MARKETS

1. Look for infrastructure. Take advantage of rental demand by buying near hospitals and education facilities, Leanne says. “Defence Force bases are another good option,” she adds. “That way you’re close by for staff wanting to live in the area.”

2. Look for multiple industries. Leanne suggests looking at towns with government departments that will provide economic security. “Otherwise, if the industry in the town goes belly-up, you’re in trouble!” she says.

3. Cater to folks moving in off the land. “Look in the older parts of town when you’re subdividing, because people coming in off the land want to be near the services,” she advises.

4. Build a home. While land alone sells easily in the metro market, Leanne says a home is necessary to attract regional buyers.

5. Spread the risk. “Have a foot in the regional and metropolitan markets,” Leanne says. Properties in towns provide high yields and low price points, while cities offer excellent capital growth – together, they make a risk-averse, balanced portfolio.

LEANNE’S 3 ESSENTIAL ‘DON’TS’ FOR INVESTORS

1. Don’t be restricted by where you live. If you can’t afford to buy in your own area, then buy somewhere else. “Predominantly people always think about what they know and the area they know, but my advice is to look outside those areas,” she says.

2. Don’t be afraid to invest in regional markets. Cities can be cost-prohibitive, but in regional areas “you can get fantastic returns for rental”, Leanne says. “This means you can get a foot in the door and be moving up with property, having someone else paying off your property, and down the track you can get exactly where you want to be, but taking a roundabout route to get there.”

3. Don’t be afraid to buy something out of the ordinary. “Looking outside the ordinary has paid dividends for us – whether it was a property that was incomplete, or needed a bit of work so we were able to value-add. You pay a premium for something that has got everything done, so put the work in and do it yourself.”

Property type: House – which was

subdivided and half the land sold off

for $307,500

Purchase price: $392,000

Purchase year: 2012

Current value: $550,000

Current rental return: $400

LEANNE’S 5 TIPS TO MAKE A ‘RENO AND FLIP’ STRATEGY WORK

• Buy entry-level properties to ensure there’s always a buyer for the home, regardless of the suburb’s property cycle.

• Watch what’s happening in the local market so you know when to buy and sell.

• Have your finances organised so that you’re ready to pounce on a bargain when you find one.

• Subdivide and sell the second lot for a quick cash boost.

• DIY as much of the renovation works as you can, but always use the experts for the important stuff.

Leanne shares her secrets for spotting motivated sellers and distressed listings.

• Look for places that are vacant (especially for some time).

• Look also for poorly maintained interiors or gardens.

• Quiz the agent about the vendor’s reason for selling. They shouldn’t tell you, but some will spill the beans if you ask.

• Relationship break-ups are a common motivator, so look for clues to this, such as one set of clothes in the wardrobe when there are two names on the title.

• Stay on top of your research to find deceased estates and foreclosures.

LEANNE'S SECOND RUNNER-UP PRIZE HAUL

As the 2nd Runner-up in the 2016 Investor of the Year Awards, Leanne won an amazing prize pack worth $4,683, including:

- $250 eftpos® card from DHA Australia

- $500 cash from Multifocus Properties & Finance

- A full 6-month membership of Real Estate Investar’s Portfolio Builder, allowing subscribers to manage, track and optimise their portfolios’ performance with powerful and easy-to-use tools, valued at $1,494

- A platinum 12-month membership of NMD Data, the online property listing website that exclusively lists mortgagee foreclosure, deceased estate and housing authority properties. The only comprehensive national database of its kind in Australia, valued at $199

- 2 x Residential Depreciation Reports from Washington Brown Quantity Surveyors, valued at $1,320

- A 12-month subscription to Your Investment Property, and a selection of our bestselling special reports and e-books, valued together at $889.85

- A copy of the bestselling book, The Armchair Guide to Property Investing, by Ben Kingsley and Bryce Holdaway