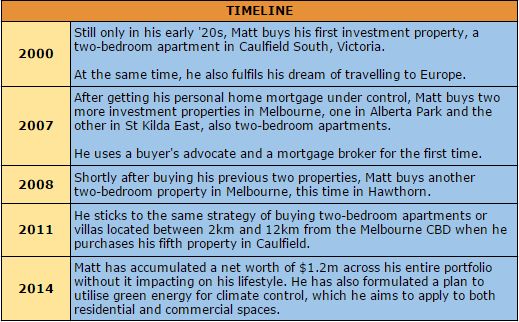

When Matt Armstrong was in his early ’20s, he was confronted with one of the hardest and most important decisions of his life.

At the time, Matt was working as an IT consultant and felt that he had two choices about what to do with the money he had saved: invest it in property, or travel to Europe.

He had already established a growing portfolio of shares and managed funds but wanted to diversify beyond those financial markets. It was his mother who came up with the answer. “Well, can you do both?” she said to Matt at the time. “And that was actually when I crunched the numbers and realised I could do both,” says Matt. “It was a great feeling and somewhat fitting, given my decision-making, that the settlement of my first property took place while I was on my first European holiday.”

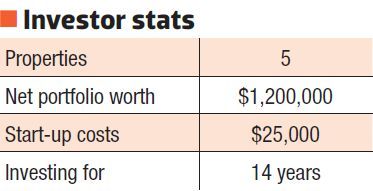

As Matt looked deeper into property investing, he realised he understood it better than shares and found the information much more accessible. “Like all investment options there external influences I can’t control, such as the RBA decision or the demand for rental properties, but the more tangible nature of bricks and mortar, and its stability over the long term, made it more attractive to me,” he says. After taking the plunge, Matt has followed a simple but highly effective strategy to eventually accumulate a property portfolio with a net worth of $1.2m.

Property highlight 1: Most successful purchase

Research

Instead, he decided to use his weekends to look at properties that might be suitable to invest in. Each Monday morning he discussed the results with a work colleague who was also passionate about real estate. And after a few weeks had gone by with no luck, she offered to join Matt on his weekend property hunts.

“It was perfect – exactly the sort of thing I had been after. I bid at the auction and was successful,” he says.

Matt says his initial selection criteria were that it should be in a highly sought-after location and have a comfortable and practical layout. Furthermore, he was after a property that was larger than the average two-bedroom villa in the same area.

Finance

At this stage Matt was not using a mortgage broker; he conducted his finance through the lender he was associated with.

“My banking was with the Commonwealth Bank, and I approached them to find out what funds I had available,” says Matt. “The approach I was looking at was within the available funds, so I knew I didn’t have a problem purchasing it – it was a 10% deposit.”

Performance

This has been Matt’s most successful property transaction. Not only has it trebled in value in 14 years, but it has also, even more importantly, given him the confidence to continue to invest in property.

“I was recently at this property performing some maintenance, and I could appreciate that this was a great investment,” Matt says. “It exceeded the general market trend to double its value every seven to 10 years, and this was despite it needing a makeover – which is scheduled for over the coming 18 to 24 months.”

However, despite the property performing above Matt’s expectations, he says he will probably sell it sometime in the next five years or more. “I will use the money from it to partially fund the development of my residence,” Matt says.

.jpg)

The capital that Matt raises from selling his first property will partially fund the redevelopment of his primary residence.

“I want to redevelop to keep up with my changing lifestyle, but also because my wife and I are very conscious of self-sufficient living,” says Matt. “Victoria’s reliance on burning coal to produce electricity has devastating effects on the environment and climate change. We believe there are far better renewable energy solutions, but these will take time, money and effort to realise.”

Matt is exploring different ways of making his own home more self-reliant, and making it smarter from a heating and cooling point of view. This involves trying to use the natural design of the property to improve its ability to maintain a constant temperature, and capturing the energy from the sun for powering.

The concept was first brought to Matt’s attention by an inventor at a private function. The inventor is a successful environmental and sustainability engineer, so Matt is confident that the expertise and passion are right.

Matt and his wife are currently preparing a proposal to become partners with the inventor. He believes his technical expertise in IT – a problem solver with analytical skills – could help take the invention to the next stage of commercialisation. “Like with my property portfolio, I will look to identify experts in their fields. I am already in close contact with a company that has successfully taken new products to the market,” says Matt. “There are a number of indicators that suggest demand will be strong: public opinion, views expressed in the media, environmental studies and consumer research all validate the drive for smarter, more efficient ways of living and conserving the environment.”

Once the proof of the concept has been established and he has a clear idea of the costs, Matt’s first step will be to determine the break-even point of the investment that he is prepared to make. “From that point I expect it will be a matter of negotiating investment values, equity shares, roles, company structure and much more!”

Property highlight 2: Matt consults the experts

- Research

“I love Albert Park. It has wonderful shops, restaurants and all sorts of things,” says Matt. “For me, it would be a desirable place to live, even though I would never live in the investment that I purchased.”

It was also at this time that Matt started using a buyer’s advocate, because he wanted a lot of the guesswork to be taken out of his property purchasing. “I picked this particular advocate because their philosophy was basically the same as my philosophy,” says Matt. “I don’t look to buy cheap property, and I’m always very much purchasing on location and quality. I believe that in the long term this will be rewarding from a financial point of view. So far it certainly has been.”

The other two properties Matt purchased in the period between November 2007 and March 2008 were also within 2km to 12km from the CBD and had excellent amenities. He believes in not purchasing too close to the city (within 2km) because of the risk of the oversupply of apartments in that area. Moreover, he argues that, in purchasing outside a 12km zone around the CBD, he wouldn’t get his desired tenant – the young professional.

Even though Matt uses a buyer’s advocate, he still goes out and looks at the individual properties they have collected until he finds the one that most suits his criteria.

- Finance

- Performance

Looking back, Matt says he should have purchased his second, third and fourth properties sooner. “I had the capacity to fund my purchases earlier, but it was more a personal comfort factor that dictated the timing,” he says. “I felt I needed to get my personal home mortgage under control first.”

Smooth Sailing

Thanks to the smart decisions Matt has made, his property investing journey has been largely without drama. But this does not mean he hasn’t been challenged.

“It’s not so much the loans but maintaining the cash flow to ensure that if repairs need to be done there are always funds available. So making sure everything adds up, I think that’s the biggest challenge,” says Matt.

Matt’s strategy of targeting young professionals – which all his tenants are – has also meant he has had a stress-free run with his tenants. “I have a great property manager who collects all the tenants for me based on set criteria, so that’s never been an issue,” says Matt. “I have never had a problem with getting tenants in any of the properties, and I believe that’s because of the type of property, the location of the property, and the amenities around them – the properties pretty much sell themselves.”

Overall, Matt says he is comfortable with his investment strategy and feels that he has struck the right balance between growing his portfolio, being cautious in guarding the finances of his family, and leading a great lifestyle.

More Investing

The success Matt has achieved so far has only fuelled his desire to keep on investing. His goal is not so much early retirement but to be in a financial position where, if he chooses, he can retire at 55 without it impacting on his lifestyle.

“Whether I actually do or not will be very much dependent on how I feel and whether I’m enjoying working or not,” says Matt. “Looking ahead 20 years or more, if I have been able to realise my goals across the different stages of my investment strategy, the combined rental income from my portfolio will contribute to my retirement.” Not only that but it will also allow Matt to provide opportunities for his children at around the time they will be entering adulthood, he says.

Matt also plans to increase the diversity of his portfolio by investing in commercial property. And he has not ruled out investing outside Victoria as well. “Every time I go on holiday to a different destination, one of the things I always do is go and have a look at the properties available in that area. So far I have not stepped outside my comfort zone, but there is definitely no reason why I wouldn’t at some point,” says Matt.

Now that Matt has already achieved tremendous financial success through property, a new question has arisen: where to travel to next? “I have always wanted to go to Egypt. I almost booked to go there twice, but both times there has been some sort of unrest – as there tends to be over there – which has caused me to hesitate and not to book,” says Matt.

In addition to seeing the pyramids of Egypt, other parts of Africa and South America are also on his list. “I have two young children now, so that has been limiting my travel capabilities a little bit,” says Matt. “I am looking forward to when they are a bit older and they can appreciate all the wonders that are out there. There are definitely many different places which I have not yet been to, and I want to go there with my wife and kids so we can experience it together.”

How Matt did it – in his own words

Property selection

- I always select properties that meet the following key criteria to attract young professionals as tenants and help ensure long-term strong growth:

- Two-bedroom unit/villa on a strata title

- Make sure the floor plan works (logical layout that is usable and will appeal to lots of people)

- Between 2km and 12km from the CBD (close to the city but not in the CBD)

- Access to public transport

- Access to public amenities (parks, beach, shops, sporting facilities, etc.)

- Maximum of eight to 12 properties in the block

- Strong body corporate involvement to ensure the common property will be well maintained

- No lifts, gyms or pools

- Find an excellent property manager. (It’s important to shop around and find one that really works for you, and with you.)

- Shop around and don’t rush into purchasing. Do your homework. If you don’t have the time, use a buyer’s advocate. (I have used both approaches.)

- Find a really good mortgage broker to ensure your finances are set up correctly and you get the best interest rate possible.

- I have my mortgages independently re-evaluated every one to two years to ensure I am getting the best interest rate and package available.

- Generally, I don't fix the interest rate on my mortgages. Historically, and certainly at the moment, interest rates are lower on standard interest-only loans.

- If there was a sense in the market that interest rates were going to increase, I would assess the option of fixing some interest rates with my expert advisor.

- Like anyone’s portfolio, mine is sensitive to interest rate changes, but I have always been cognisant of this and include a level of security in my investment decisions to factor in interest rate volatility.

- The collateral for each mortgage is independent; there is no financial dependency between my properties. Each property stands on its own merits. This mitigates problems unique to one property so that they don’t disrupt the rest of my portfolio.

- I am vigilant in maintaining appropriate insurance coverage over all of my assets. My salary is another important temporary source of reserve funds, and I have income insurance to protect it.

For winning Your Investment Property’s 2014 Investor of the Year Award, Matt receives a prize pack worth $8,557, including:

- A preloaded $1,000 eftpos® card from DHA Australia

- $1,000 cash from Trilogy

- A 12-month Real Estate Investar 'Portfolio Builder' membership, valued at $2,988

- A selection of reports from Washington Brown, valued at $2,360

- A 12-month NMD Data 'Platinum' membership, valued at $199

- A 12-month subscription to Your Investment Property magazine, including an exclusive report pack compiled by Your Investment Property and RP Data, valued at $1,010

“I like Matt’s property investment story as it demonstrates that, with some hard work,

building a strong investment portfolio doesn’t have to mean sacrificing lifestyle.

Whilst Matt’s strategy has seen less geographic diversification than some, his diligent research and

adherence to a number of identified key performance indicators has seen his portfolio perform and grow impressively.

He also has a clear plan and set of goals, which is crucial.”

– Tyron Hyde, director, Washington Brown

“Matt recognised the importance of investing at an early age and having a diversified investment portfolio comprising property and equities,

having started investing in property in his early ’20s, and has built a portfolio of five properties in Melbourne with a net equity of $1.2m.

Matt has also developed a comprehensive investment strategy that contains clearly defined short-term, medium-term and long-term objectives.

Matt is highly commended for recognising the benefits of property at an early age and the importance of having a diversified investment portfolio.

– Madeline Dermatossian, COO, Defence Housing Australia