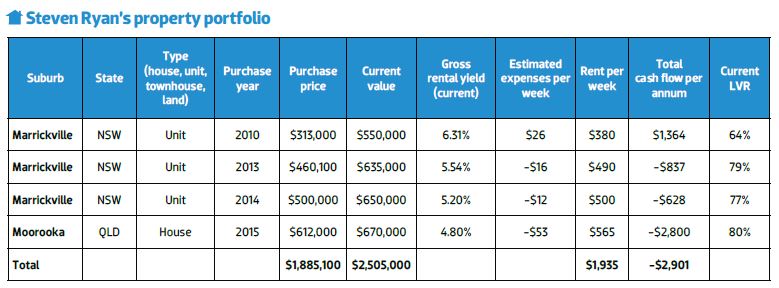

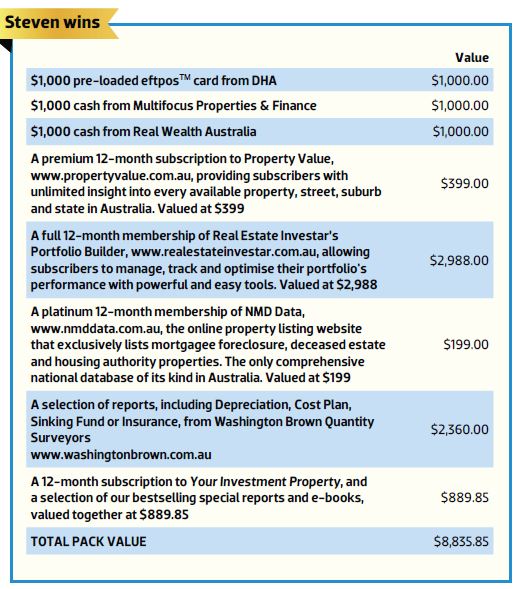

Despite making a costly mistake early in his investment journey, Steven Ryan pushed through and was able to turn his $40k capital into a solid $2.5m portfolio within four years. His uncompromising commitment to his goals and meticulous research have also earned him high marks from our judges, helping him win this year’s top award.

Despite making a costly mistake early in his investment journey, Steven Ryan pushed through and was able to turn his $40k capital into a solid $2.5m portfolio within four years. His uncompromising commitment to his goals and meticulous research have also earned him high marks from our judges, helping him win this year’s top award.Judge's comment

“I really like the way Steven has a strategic approach to investing yet keeping it flexible enough to adapt to current circumstances and learnings. And wow, what a goal, ‘to have a significant positive impact on one billion people’. Steven, I wish you all the best in achieving it – don’t let anyone interfere with that goal!”

– Helen Collier-Kogtevs, Real Wealth Australia

For three years, Steven Ryan was transfixed by the interest rate movement. He watched it like a hawk, day in, day out. He monitored any hint that it could be falling. The reason? $40,000. That’s the amount he had to pay to break off from the 15-year fixed rate loan that he’d taken to finance his first investment property.

“I watched the rate every day,” he recalls. “I told myself that when it dropped below $20,000, I’d break my loan off. When that day came, I immediately refinanced my mortgage. It took me three years of watching and waiting. Looking back, I should have just cut my losses and run. If I’d do it all again, I would have paid the $40,000 so that I could continue investing. But it was such a psychological battle for me. That $40,000 represented almost a year’s salary for me. I realise now that waiting for three years to save $20,000 on a break fee has cost me a huge deal in terms of lost opportunities.”

This initial setback would have been enough to put off many investors and might have made them give up altogether. Not Steven. It strengthened his resolve to succeed even more.

“I was determined to create a better future for me financially,” he says. “After seeing my parents divorce a couple of years before, and seeing three decades of their lives together with not much to show for it, I’ve decided I don’t want to follow their footsteps.”

What the judges say

“Steven has clearly defined requirements when assessing a purchase, with separate criteria for houses and apartments. He focuses on seeking out properties that can be acquired below market value by undertaking extensive research to identify the full potential of

the property.”

– Madeline Dermatossian, DHA

“Steven is very focused on his own fundamental principles of buying property. This has certainly proven to be very fruitful. Having a flexible investment strategy coupled with high levels of discipline, research, and ethics will help him reach his personal goal. Keep up the good work!”

– John Kovacs, NMD Data

“What appealed to me about Steven is the fact that his strategy is evolutionary, not fixed. This is very important, especially in an

ever-changing market and all the smaller markets that make up that market. Buying under market value is essential to create wealth, and by doing research you can understand the true value of a property. The way he has also addressed manufacturing growth, by aiming to renovate his portfolio to improve yield and equity, is also a must. As is looking at multiple ways to profit from a property. From a creative aspect, I love that he doorknocks neighbours to learn all he can about a property or area. Two other things resonated: learning that he needed to build a team, and the fact that he sees his tenants as partners.”

– Justin Davey, Real Estate Investar

“Steven is certainly very good at understanding town planning as well as finances, which gives him an edge in picking good deals. His approach to property, ie targeting developments, is more risky, but his background and results show that he is in his element.”

– Philippe Brach, Multifocus Property & Finance

Humble beginning

Right from the start, Steven knew he had to make sacrifices if he was to succeed as an investor.

“I saved hard, worked plenty, and lived frugally to get my first deposit,” he recalls. “I lived well below my means as a student and continued to save diligently when I began full-time work at age 24, on a $50,000 salary.

“It wasn’t easy saving as a student, but once I got into full-time work it was a bit easier. I took on a lot of extra work after work and during weekends to earn more and save faster. It took me about five years from student days till I got a full-time job to save up.

“When I fully grasped the power of compounding growth and leverage,

I felt as though I’d been struck by a bolt of lightning – the possibilities were electrifying. I realised the sooner I got started the better, and so I set about getting into the market as soon as possible.”

But then, before he was able to save enough for a deposit, Steven’s landlord unexpectedly gave him notice to vacate his rental property.

“I was about six months away from my savings target. I thought I’d just rent elsewhere until I was ready to buy, but when I told my father about my situation and how close I was to saving enough for a deposit, he kindly offered to loan me just $10k to make up for the shortfall. I immediately went hunting and I purchased my first apartment, an entry-level one-bedder unit in Marrickville, NSW, a few weeks later. I then set about saving for my next.”

To ensure he stayed the course, Steven created crystal-clear goals and mapped out three distinct stages of his investment journey.

Stage 1

Build a strong foundation. Buy under market value in areas poised for immediate and medium-term capital growth, looking for signs of gentrification in particular. Leverage equity into more of the same until

reaching a serviceability wall.

Stage 2

Increase income and renovate the entire portfolio to manufacture capital needed for Stage 3.

Stage 3

Begin developing. Repeat. “I have recently purchased my first development site and plan to turbocharge my portfolio (both capital growth and cash flow) through development from here on, while holding for the long term. So far things have worked out well and I’ll continue to adapt as necessary,” he says.

Overcoming challenges as a newbie investor

Just like many beginner investors, Steven admits that he was overwhelmed by the sheer amount of information he had to assimilate quickly.

“I found it challenging to get a feel of what properties are worth in the area and understanding the process of negotiation or how everything works,” he recalls.

“I also struggled with serviceability. Starting out on a $50k salary meant I would run out of puff quick. It was only with the help of an incredible mortgage broker who was able to strategically structure my finance that I was able to continue accumulating properties and to punch above my weight.”

But the biggest lesson he learned was in making the mistake of not educating himself enough before buying his first home, and, in particular, not seeking out a mortgage broker to help with his first loan and talk about his long-term plans.

“I followed advice of non-investors and fixed my first loan for a ridiculous 15 years at 8.09%! In all, that decision cost me almost $50,000 in both extra interest and a whopping break fee three years down the track. I’m glad for the experience, though. It was an expensive lesson, but a valuable one. I learned a lot trying to navigate my way out of that, including how important it is to be informed and get expert help.” Steven’s mistake was talking to people who had bought in the early ’90s when interest rates were at 17–18%.

“I didn’t realise that fixing my rate at such a high rate would inhibit my borrowing capacity severely for a number of years,” he explains. “I certainly learned my lessons not to ask people who haven’t done what I’m trying to do and have a different mindset. I was asking friends and family who don’t really have much assets created. They were ultra conservative with their approach, and their advice was appropriate for the questions I was asking. I wasn’t asking how to build a solid portfolio. I was asking about what they thought about fixed rates and variable. While it was the right decision for me at the time, it didn’t take long for me to realise I made a mistake.”

Strategy for choosing the best area and property

Steven’s property strategy is deceptively simple, yet it has proven to be effective in maximising his portfolio and reducing his risks.

“I follow a few basic principles, which include buying for immediate capital growth. I see no point of waiting for growth if you can achieve it immediately and use it to expand your portfolio further,” he explains.

Strategies for the current market

Steven believes Brisbane offers some of the best opportunities for investors at the moment. Therefore he’s keen to buy more houses, ideally with development potential, in a location 5km to 15km south of the CBD. In particular, he’s looking at Moorooka.

He believes Brisbane is ripe for the picking for the following reasons:

• With two consecutive blows(GFC, floods), prices are atypically depressed.

• The discrepancy between median house prices in Sydney, Melbourne and Brisbane sees Brisbane at the bottom of the heap by an unusually large margin.

• Money goes much further in Brisbane now, about twice as far as in Sydney (based on median house prices).

• Lots of investors and home buyers

are priced out of Sydney and Melbourne now.

• There are record low rates.

• Things are heating up in pockets of Brisbane but overall things aren't crazy. Yet.

• The Aussie dollar looks to be headed further south, and this will stimulate tourism, which makes up a small but significant sliver of the Queensland economy.

• The media is starting to catch on to Brisbane. It’s only a matter of time until the masses move in.

As more areas start to heat up, Steven believes it’s important to conduct your due diligence rigorously and act decisively.

“The areas I’ve been investigating are starting to rise. The first open home will have plenty of people and a handful of offers. The key is to know the market well, be intimately familiar with values, do your research and be prepared, and make a strong offer in week one. Although I always aim to buy under market value, it’s OK to pay fair price in a moving market if you anticipate good growth. Perhaps another suitable property won’t appear for two or three months; meanwhile, prices continue to rise.”

If I were to start investing all over again ...

Just like many investors, Steven has a few regrets, including not starting sooner and building the best team around him.

“If I could start again, I’d invest earlier and surround myself with the best mortgage broker, accountant, property managers and solicitors. I would have worked on significantly improving my active and recurring income from day one to prolong serviceability issues. I would also have networked with other investors at all stages in their journey, learning from them, asking questions, bouncing ideas, discussing strategies, sharing goals. I educated myself very thoroughly with books, videos, seminars, forums, magazines after buying my PPOR, but neglected to really connect with other investors for a while. It’s a great way to learn and grow. More importantly, it’s inspiring to see what others have achieved.”

Investing with a heart

In an industry infamously known for its shady characters, Steven stands out with his strong moral compass.

“I live by the principle of never telling a lie under any circumstances,” he says. “This may not produce the ideal financial result every time and limits my hand in negotiations, but it keeps my conscience clear.”

Steven also believes in always treating others, especially his tenants, fairly and respectfully.

“I view my tenants as partners and am happy to do what it takes to ensure they have a great home and stay for the long haul. If they make reasonable requests, I'm happy to oblige and do what I can to ensure they stick around. I've sought strata permission for cat ownership in each of my apartments on behalf of incoming tenants. I also give my tenants the freedom to treat the property as their own as long as it’s returned to its original state when they vacate. And while I maintain rent at market value, I never push it too high for the sake of a few dollars, or hold off on important repairs.”

Steven’s positive outlook is certainly manifesting itself in the results he’s getting. He attributes his calm demeanour to his meditation practice.

“Meditation gives me perspective that things, no matter how bad they are, will pass, and all the worries that may arise are just thoughts that happened in the past and not happening right now. All you have is the present moment and you have no control about what’s going to happen.”

Spoken like a winner indeed.

Top 5 negotiation tips

1. Build a rapport with agents. We’re all human, and emotions play an important role. Make an effort to connect with someone and you’ll find you have a very different negotiation experience.

2. Create a win-win outcome. Find out terms that are favourable to the vendor/agent and aim for an outcome in which everyone wins.

3. Think about your competition, and human psychology. If it looks like a place is worth about $400,000, there’s a good chance that’s the magic number the vendor has in their mind. Further, consider what your competition will offer. If you believe offers might come in $555,000 for somewhere, offer %550,001 or $552,000 to put you in the lead. I nabbed a place for $460,100 using this strategy, later to find out two offers of $460,000 had come in right after mine and the agent had told other parties, "Sorry, there's a higher offer". While they went to think, the vendors accepted my offer. Plus it looks like you've stretched to the limit, even shaking your spare change from the piggy bank, when your offer doesn't end in '000'.

4. Don’t let your emotions get involved. Do your numbers, determine your walk-away price and stick with it.

5. Where appropriate, put time pressure on the vendor and agent. The vendor usually has the upper hand in negotiations, so force them into making a decision by putting an expiry on your offer.

Best deals to date

“I bought well on my first investment property, and 90 days after settlement, with no work done, I had it revalued and I drew out $55,000, which I immediately used towards this purchase.

“In a piping hot market, it’s not easy to buy under value, but they say luck is when preparation meets opportunity, and I was very lucky. An email alert landed in my inbox with an unfamiliar agent. I noticed he was from out of area. When I read the listing, I noticed a few glaring omissions, like the newly built light rail 400m away which was about to begin service. Other critical information was left out, and the photos didn’t do the place justice. The icing on the cake was that the first open clashed with a few other comparable apartments which were better presented and also open for the first time. I thought a few less people might turn out on week one, and wanted to take it off the market before many others had a chance to look.

“I scrambled to do my due diligence, which even included doorknocking neighbours for some insights. I turned up at the first open home with an unconditional offer and a blank cheque for theatre. I told the agent I was going to make him an offer he could not refuse, and signed the cheque in front of him. I said I'd need an answer that afternoon as there were plenty of other places I had my eye on.

“He obliged. A few hours later, following some negotiation, we had a deal. Word got out among local agents that I was the buyer, and a few of them actually reached out to congratulate me on the deal and confirmed my thoughts: the consensus was that I'd picked it up $40,000 to $50,000 under value. I’d have happily paid $540,000 on the day.”

Strategy

“My broker knew big changes in the lending space were on the way, so we acted quickly to top up two of my other loans, and I parked money in offset accounts before it was trapped. Not long after, APRA waved their magic wand and my borrowing capacity fell off a cliff with those lenders. It was a close one!

“The next step was to obtain conditional approval with an unaffected lender before APRA put their foot to the throat of the last of them. We moved fast to open a 90-day window in which my application would be assessed on ‘at the time’ policy, even if changes came through – and they did – just days after obtaining the approval. Another close call.”

Research

“I focused on finding a great block with future development potential in an area showing signs of gentrification, with great transport and amenities and pricing discrepancies compared to surrounding suburbs. Moorooka stood out like a sore thumb on all fronts. It’s close to the CBD; has rail, bus and road access; and, most importantly, has a bit of a stigma which has kept prices down despite the suburb having all the fundamentals. As prices rise in the coming years, demographics will change and the suburb will transform.

“In addition to all the usual suspects (magazines, websites, forums, fellow investors), I decided to fly to the area every single weekend until I had secured a property. I’d get the 6am flight from Sydney and return on the last flight of the evening. This on-ground research allowed me to get very familiar with the area, connect with local agents, and see what was happening in the market.

“I was looking for a property with an LMR2 block so I could develop it in the future. I wanted the largest, most developable block I could find, as close to the city as possible. It also had to be off a main road, near transport, not flood-prone, and with high owner-occupier appeal.

“It’s not often that LMR2 corner blocks come up in Moorooka, let alone one of over 650sqm, so when this one hit the market and the listing didn’t mention the LMR2 zoning, I acted quickly to take it off the market before others with deeper pockets had a crack. I would have happily purchased something rundown and settled for a very ordinary rental return, but the icing on the cake was that it was an awesome family home in a super spot which helped me achieve a great rental return and find tenants immediately.

“Most of the other properties I was looking at had at least one big downside, eg way too close to the train, right on a main road, poor floor plan, big structural issues, pest problems, unapproved works, smaller block, not on a corner, or not LMR2 zoned. This one was a clean sweep.

“I decided very quickly. I’d done my research and knew this fell within my budget and was the most suitable property to hit the market in months. It was an easy decision.

“I’m very happy with how things have gone so far. I bought well, found tenants immediately, and achieved a rental yield nearly 1% higher than the suburb average, which isn’t bad for a development site.

“The biggest challenge I faced was six months of delays in topping up my other loans and getting finance in place. I had intended on buying in Moorooka in late 2014, but a bad valuation, failed challenge of said valuation, and other hold-ups delayed me while I watched prices move, unable to do a thing about it. The other challenge was a lot of buying competition. Every ‘typical’ house without major problems is under contract the Monday after it opens, so I had to know the market well, offer strong and act quickly.”

Top 5 property management tips

1. Seek out the best property manager you can. Ask around and don’t settle for anything but the best. Think ‘value’, not ‘cost’.

2. Be a great landlord. Respect your tenants and view them as your partners.

3. Maintain your properties well. My investments are better maintained than my own home.

4. Thinking about self-managing? Consider carefully. Aren’t you investing for passive income?

5. Be strategic and creative. Ask your property manager the best time of year to be seeking tenants, and offer leases accordingly. The first lease options I offered were eight months or 14 months. And be innovative in what you offer. There's no law saying you have to follow the herd, so don't! I've offered tenants choices such as doing a cosmetic reno to their place in exchange for a higher rent.

.JPG)