Rigorous research followed by decisive action enabled Yola Bakker to build a solid portfolio within a short time. These qualities also helped her win our judges’ votes and the First Runner-up award.

Rigorous research followed by decisive action enabled Yola Bakker to build a solid portfolio within a short time. These qualities also helped her win our judges’ votes and the First Runner-up award.Judge's comment

“Yola Bakker is very passionate and cautious in her approach to property investing. Research, asking the right questions, getting the best financial advice and diversifying her portfolio is in the forefront of her strategy. She has a clear plan that's structured and has been carefully implemented to achieve long-term success. Well done!”

– John Kovacs, NMD Data

Young, free and living overseas with all expenses paid by the government. Things couldn’t get any better for Yola and she knew it. She was having the time of her life, enjoying herself so much so that the thought of finishing her stint abroad filled her with terror. She wondered if there was a way for her to be able to continue living this way…

The answer came during a chance encounter with an old friend from Australia. “I bumped into an old friend who was also travelling, and I asked if he’d been back to Australia,” Yola recalls. “He told me that he went back every now and then to check his investment property in Brisbane.

“Straight away I knew I wanted to do just that: invest in property so I could continue travelling overseas. I decided right there and then that’s what I had to do if I wanted the kind of freedom he had. That was the defining moment for me.”

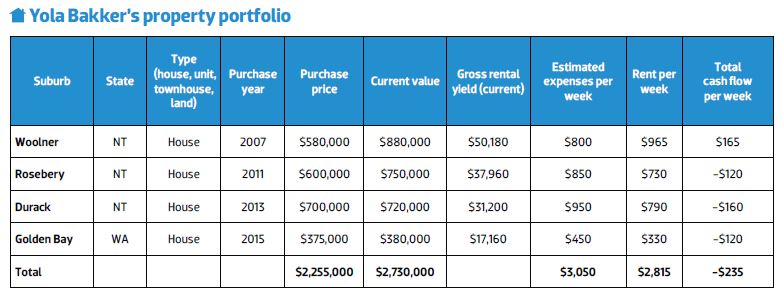

As soon as she got back to Australia, she started what would become a $3.1m property portfolio within eight short years.

Starting out young

Luckily for Yola, she was still living with her parents when she was starting out, so breaking into the market was a lot easier than it might have been.

“I wasn’t paying any rent and board so I used that opportunity and my significant savings to get started,”

she says.

At just 25, and despite her father’s reservations about her plan to invest, Yola has proven to be a naturally astute investor.

“I got started in 2007 with a house and land package in Woolner, NT. Using my $60k savings, I bought the land for $280k and spent $300k to build a house on it. I even got the builder to install a flashier finish at no extra cost. After the house was built, the developer rented it out from me as a display home. I like the control I have with houses. Once I got my first property, I discovered that it was pretty easy to hold. I realised that if I had five of these earning that much income and growing in value, I’d do very well.”

Researching and picking the right property

Researching and picking the right property Yola also looks at the property sales in the area over the last 10 years. She takes into account current vacancy rates and future developments.

“All these help me decide if it is the right time for that particular spot,” she says.

“With regard to property, the numbers such as rental yield and capital growth potential must be high. The property has to be either positively geared or neutral, depending on how the portfolio is performing as a whole. I also need to feel comfortable that if I add this property to my portfolio it will allow me the maximum leverage for the next one.”

To gather this information, she scours magazines and reports as well as talks to other investors and people in the real estate industry. She then collates this information to work out where she should be investing next.

“Once I’m equipped with the knowledge, I make the decision and I act,” she says. “The investment potential of a property for me comes down to the following, and I literally tick them off in order of priority:

• Good socio-economic area

• Lots of long-term, secure jobs

• Convenience and access to amenities (schools, shops, public transport)

• Numbers: how much does it cost, what is the rental rate, what are the vacancy rates in the area, what kind of growth can be expected?

“I picked one of my houses in Darwin because it was in an upcoming estate that was located within walking distance of a new development that had been approved, which will host a new shopping precinct and hospital. The new developments represent significant considerations for the residents in Darwin as a whole, and what’s more the immediate vicinity. Over the long term, I could see the property performing well and had low risk of being vacant. The entry point wasn’t ideal but I decided [there were] other benefits.”

Top 5 property management tips

1. Remember you are paying your leasing agents and property managers – they work for you, so make sure they are doing their job well.

2. Establish a professional rapport and practice efficient communication on your part – return emails and phone calls in a timely manner, ask questions, confirm actions, and every six months just pick up the phone to talk your managers about how they feel the market is going, how is business for them, who they are seeing through their door, what changes they have noticed, etc. It’s just another part of that ever-so-important ‘research’.

3. Quality tenants. Period.

4. Maintain your properties. Period.

5. If you’re not comfortable with something, speak up and get involved, understand your contracts and all party obligations.

Top 5 finance tips

1. Know the difference between good and bad debt and live by it!

2. Make the most of your circumstances, and after failure continue to persist.

3. Shop around; work closely with your bank/mortgage broker.

4. Maintain ‘clean’ accounts.

5. Reassess your financial standing every year. How is your portfolio performing? What can you tweak to optimise? What are you now in a position to do?

Maximising profit and reducing risk

Yola’s overall strategy is to buy and hold long-term. This is for the purpose of both asset preservation and capital appreciation. Specifically, she follows a set of strategies to maximise her portfolio and reduce her risks.

“I don’t just stick to what I already know. If I don’t know much about another state or area, then I educate myself about it to enhance my ability to diversify my portfolio. Once I feel comfortable with my level of knowledge, then I proceed to ‘shop’ and make a purchase in other areas,” Yola explains.

“I establish straight off the mark whether a property I am interested in is in a lower or higher socio-economic demographic. If it’s the former, then I'm

just not interested,” she says. “I’m a busy mother with three young kids and a job. I simply don’t have the time to deal with issues that are associated

with these areas.”

3. Look after your tenants

I'm quick to respond to correspondences, I maintain the properties well, I’m flexible without compromising what’s important to my family, and I communicate closely with managing agents and treat my properties as my business (because that’s what they are!)

4. Reinvest profits from property sales

“No ifs, no buts. Though my strategy is to buy and hold, sometimes there are reasons to sell, ie an offer just too good to be true or a property is poorly performing and carries more risk than it is worth. If this is the case, I crunch my numbers thoroughly and proceed to sale with the clear intention to reinvest all of the profits back into property,” Yola says.

5. Become finance-savvy

“It can be all well and good to find the best property deals, but securing the finance in a timely manner more often than not can be where you come undone. I have a really good rapport with my mortgage broker but I also shop around. I keep my accounts transacting smoothly and maintain good records to facilitate the process. When I find a deal that I really want, I’ll put a contract and put a $1,000 just to secure it, and put subject to finance clauses so that I know that if I can’t get my finance in place, I know that I can pull out," Yola explains.

6. Avoid selling prematurely

“Avoid having a knee-jerk reaction and selling prematurely, especially when the market you’re in starts to turn downwards. For example, vacancy rates have risen in the Darwin market; however, with low interest rates my properties are still looking after themselves. As an optimist I think this is great news for renters. As an investor, it will entice people back to these markets which were previously unaffordable and literally driving residents away,” she says.

My most successful deals so far

Yola’s most successful deal was her second property: a brand-new unit on the market for $415,000 within walking distance of Darwin CBD.

“My husband and I made an offer of 380,000 developer made a counter of $385,000, which we accepted. We secured a tenant privately for $430 per week and subsequently sold the property in 2013 for $530,000. At the time it was tenanted for $630 per week so it was an appealing low-risk acquisition for the buyer. Unless you talk to people, you never know. People break up, get divorced, etc. You just never know.

“Of course, my first property, which was my home, was also very satisfying. It was a home and land package of $580,000, constructed in 2007. Upon renting it out in 2013, my managing agent suggested marketing it at $850 per week, but I suggested marketing it at $950 per week as I wanted to gauge the market for myself. A quality tenant was secured within three days and it is currently tenanted at $965 per week by the same family.”

Biggest mistakes and challenges

“I wished I’d diversified at the onset,” she says. “I stuck with my comfort zone so I bought my first few properties in areas I know best. But I acted within my circumstances at the time. I'd much rather have bought where I did than not made the decisions at all. I'm conscious that the next step is only possible because of the ones in place before. Apart from diversifying sooner, I think I wish I had better understood, and sooner, the legislation around capital gains and principal place of residence in order to optimise sales made. But again I've found this much easier to grasp with experience as opposed to reading it textbook style.”

As a mother of three young kids, Yola’s biggest challenge is the lack of time to do her research. “I'm time-poor. I’m a parent of three children under five and have a busy job. I’d love to spend more time perhaps pursuing established residences and undertaking small renovations, but it’s just not within my capacity at the moment,” she says.

“I find property investment challenging, rewarding and returns a great deal of personal satisfaction. I love the concept of building wealth and leveraging with minimal effort. I’m aware that life is short, and although I love my work I am aware that this may not always be the case,” she says.

What the judges say

“Clearly Yola is a number cruncher that falls in love with the numbers first and then the deal. Learning the lesson of keeping her emotions out of the equation will put her in good stead for continuing to build her property portfolio.”

– Helen Collier-Kogtevs, Real Wealth Australia

“Research is key to Yola’s success. She manages her risks through geographical diversification by buying in other states. Importantly, she only buys after extensively researching the market. She avoids low socio-economic areas and takes into account rental yield, capital growth potential, established infrastructure, and asks the question ‘Would I be happy to live here?’”

– Madeline Dermatossian, DHA

“Yola thinks outside the box; she thinks numbers and performs great detailed analysis of her every move. She also has a good team around her, which is definitely smart.”

– Philippe Brach, Multifocus

"I like the description of the strategy ‘to learn and act’. Yola approaches property investment pragmatically, always reading articles and reports, always talking to other investors and engaging people in the industry. Often this is at little cost of money and time, and can really help you better understand a location or property investment prior to purchase.

By using data like property sales history, trends can be identified

and taken advantage of. I like the focus on positively geared or neutral properties, with an eye to the future where growth may not be as strong as historically. Looking after her tenants is also very important to her. I love the quick response focus, also to ensure properties are maintained. Numbers are important when investing too, and Yola has pointed out this is essential. Finally, being close to your mortgage broker and looking after your tenants are great tips. They will look after your property in return.”

– Justin Davey, Real Estate Investar

Top 5 negotiation tips

1. Do your research, then cross-check it. This includes the internet, written articles, property reports, recent sales, and conversations with others in the industry.

2. Leave your emotions at the threshold. Talk facts, and while comparing value for money don’t get too caught up on every single dollar. All too often people miss out on a great investment/buy because the sellers wouldn’t budge a thousand or two on the price. You’ll make that back overnight if it’s a smart buy.

3. Everyone has an agenda – remember that when talking to ‘people in the know’. Your agenda should always be research or securing your next solid investment.

4. There are so many deals to be made once you know what you’re looking for. If you’re keeping yourself up to date and in the loop, you won’t miss them as they present.

5. Be direct, use your instincts and always look after your own interests.