“I recall as a child, barely tall enough to peer over the top of my father’s desk, being fascinated with all the building plans and models displayed in his architecture office next door to our house. For half of my primary schooling I attended an alternative school, Guriganya, which operated on the key learning principals of self-expression, self-discipline and working as a team.”

Christine went on to study visual and performing arts and worked as a performer, acting and singing throughout her 20s. Given the sporadic nature of working in this field, she wanted to create some financial security, and turned to property to establish the foundations for this. But for Christine, investing in property is about far more than making money.

“Owning property, and the resulting access I had to equity, gave me the freedom to choose to work less during the end stage of my mum’s life, so I could spend more quality time with her, which meant the world to me,” she says. Christine has certainly been able to reap the rewards of investing, so where did her property journey begin?

Getting a foot in the door

Getting a foot in the door

The seeds of her first investment were planted in 1996, when her income was around $27,000 from casual earnings and she had “no real savings behind me”.

“I wanted to set myself up well financially, and had a strong desire to build wealth safely, and was exploring what would be the best avenue for me. I knew that the pension wasn’t going to meet my needs,” Christine explains. “I was spending what I was bringing in each month and only had a few thousand in savings. I realised that my small wage alone wasn’t going to give me the financial security and lifestyle comforts that I wanted to enjoy or peace of mind in retirement, and I was hugely motivated by a desire to set myself up financially – but I wanted to proceed in a low-risk way.”

At around this time, she saw a tiny ad in the newspaper, for ‘How To Build Wealth Safely with No Savings at All’. “I promptly booked my partner and I into the seminar. From that point on I began educating myself in the area, attending regular seminars covering topics on the economic cycle, shares and property investment. Property jumped out as the best vehicle for me,” she says.

“I was excited by the leverage and passive income that I could clearly see, along with the fact that property could help me to build substantially more wealth than I could make from working. I also knew that picking the right properties was important, but starting as soon as I could mattered more, as time in the market was key.” Eighteen months later, after some leaner living and squirrelling away her savings, she pooled resources with a friend and her former partner in order to get a foot in the door.

“We put down the required 10% deposit on a Darlinghurst terrace that cost $310,000 in 1998. Neither of us was in a financial position to buy anything alone, other than a studio in Sydney, and we knew that we would get better growth from a house or two-bedroom unit, and that banks often didn’t loan on studios.”

Selling was ‘my biggest mistake’

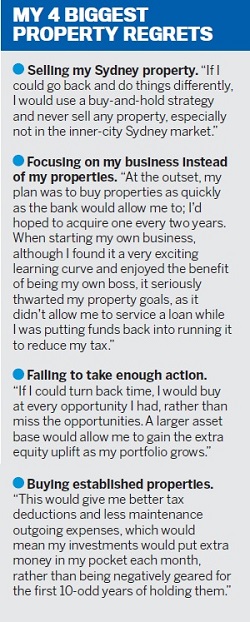

Christine has since sold her share of the Darlinghurst property and, looking back, says this is a decision she regrets. “My biggest mistake was that I sold my share of the Darlinghurst terrace in 2007. I did this as a favour to my

friend,” she explains.

“Now I realise that, being Sydney, I may not be able to buy into that market again. I was working two jobs at the time and didn’t give it the proper consideration I should have. In hindsight, I regret that I didn’t consult a property expert to review my property portfolio before selling such a valuable, appreciating asset that was also positively geared.

As a result of selling, she significantly reduced her asset base, and made only additional $400,000 in equity.”

It was a huge and costly learning curve, and one that has prompted Christine to involve experts more closely in her investment decisions.

“I cannot stress enough how important it is to seek the support of someone who has more experience investing and has achieved more than you have; and to reach out to experts when making key decisions, as it could save you not just thousands of dollars, but hundreds of thousands of dollars,” she adds.

“If I kept my share of the Darlinghurst property ... Today, I would have an additional $400,000 in equity”

Investing with a lifestyle goal in mind

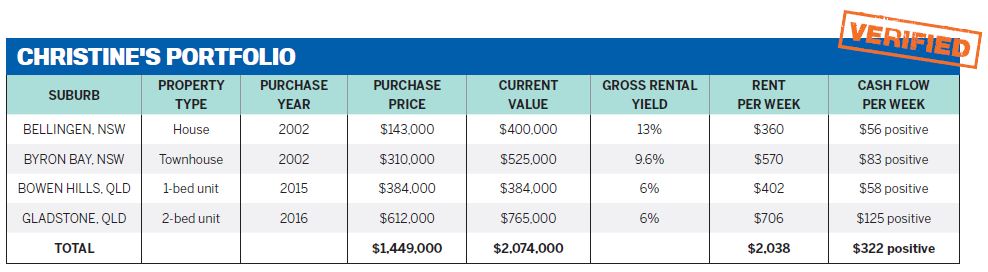

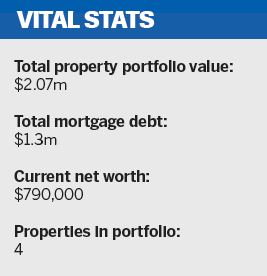

Mistakes aside, Christine has also made plenty of positive decisions regarding her property portfolio. She has gone on to amass her own portfolio of four homes throughout NSW and Queensland, with more purchases on the horizon.

It was more than a decade ago that Christine began investing in northern NSW, with plans to move there eventually and enjoy a coastal sea change. At present she’s still based in Sydney, and says that although a move northward hasn’t eventuated yet, she enjoys having “a good excuse to visit the beautiful region in which two of my properties are situated – as well as receiving all the tax benefits when I make my usual annual inspections.”

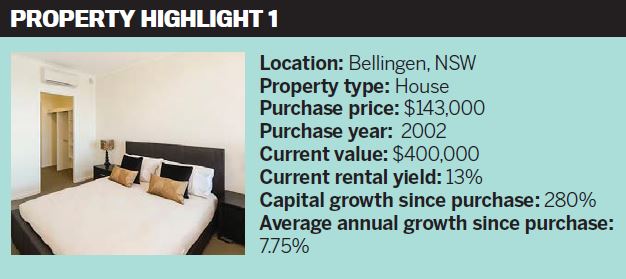

In fact, she counts her house purchase in the region as her most successful property transaction yet. “I purchased a three-bedroom house in Bellingen, New South Wales, in July 2002 for $143,000, and it doubled in value in less than two years,” Christine says.

“It was initially rented for $210 per week. The current value is approximately $400,000 and it now rents for $360 per week, giving me a yield of 13% on my investment.”

She now enjoys a positive cash flow return from her investments of $310 per week, or almost $17,000 per year. From here, Christine has plans to increase her property holdings to 10, with a goal of acquiring six more investment properties over the next three years. “Ideally, I’d like to buy two per year for the next three years, including different property types in diverse areas, with a national perspective to lower my risk and reduce land tax. I plan to buy in markets with good evidence of growth potential in the upcoming few years, where there has been little price movement for the previous five to six years,” Christine says.

“I’m going to focus on buying in areas where there are definite drivers in place for growth, such as confirmed public and private infrastructure spend, as well as low vacancy rates and minimum 5% yields. My strategy now is also focused on new properties, to give the best tax deductions and also to offer the most hands-off approach, allowing me more time to spend with my partner, family and friends.”