Ash and Simon, who both work in emergency services, moved from Mount Isa in northwestern Queensland to the sunny Gold Coast in 2011. It was there that they began turning their property investment aspirations into something more concrete.

“We had both grown up watching our parents try their hand with the property market,” says Ash. “And though at times they were unsuccessful, we both always felt that, for long-term gain, property was where we wanted to invest.”

The couple have a plan in place for their ideal future – one in which they both retire at 55, live comfortably and travel the world, without worrying about bills and unexpected financial burdens.

With that end in mind, they know that in order to hit their future target they need a portfolio of properties with strong capital growth prospects.

They are therefore focusing on acquiring and holding properties for the long term, rather than on quick-turnover opportunities or high yield at the expense of growth.

“We’re open to properties that may come across our path that are in a five- to 10-year plan, but we’re aiming to acquire the blue-chip, keep-it-stored-on-a-shelf-somewhere properties,” Ash says.

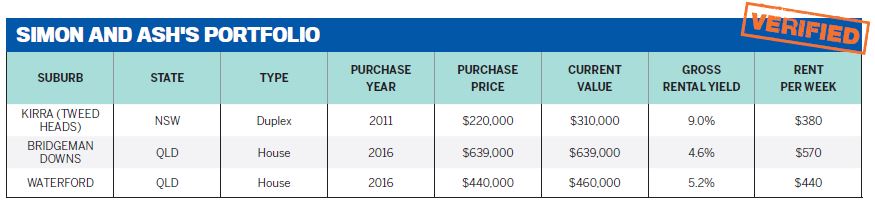

When they relocated to Southeast Queensland, Simon and Ash purchased a duplex at Kirra Beach but made the decision to move to give their much-loved dog more room to roam. They put the duplex up for rent and used the equity to buy a three-bedroom, two-bathroom house in Currumbin, 10 minutes north of Kirra Beach.

“We put a lot of time and effort into landscaping and renovations at this house, but after our dog passed away it was really too big for us,” Simon says. The couple decided to sell the property and use the funds to buy their first investment.

“We both always felt that, for long-term gain, property was where we wanted to invest” Rent to live, buy to invest

At this point, the novice investors turned to Caifu Property Group for guidance.

The couple’s interest was piqued by the ‘rent to live, buy to invest’ strategy proposed by the property group. They felt this strategy would enable them to use the proceeds of the sale of the Currumbin house to purchase an investment property in a location with good growth prospects that lined up with their long-term goals, and then rent in the location where they wanted to live.

They hoped this strategy would free them up from having to save for a second deposit for the investment property, and allow them to take advantage of tax benefits on their investment (eg through negative gearing). They liked the idea of sidestepping all the regular costs of owning their own home, and letting issues like a broken hot water system become the landlord’s problem.

“It was something that we were willing to try at the time as it would free up money for us to use towards the investment property, and we were also unsure what type of property we wanted to live in,” Simon explains.

This ultimately led them to a dream property just metres from the beach. The couple found and rented a brand-new two-bedroom, two-bathroom duplex 200m from the water, which they called home while their chosen investment property – a house-and-land package in Bridgeman Downs, Queensland, just 15km from the Brisbane CBD – was under construction.

“The development was an infill area in an already-established suburb where the median house price was in the high-$700k range,” Ash says.

“We were able to purchase our house-and-land package for a total of $639,000 for a 400sqm block of land, which we placed a four-bedroom, two-bathroom, two-car house on through NCL Builders.”

Adjusting expectations

After handover of the property in September last year, Simon and Ash hit their first speed bump as landlords when they had to knock the asking rent down from the estimated $610–$630 to $570 per week, due to the volume of new housing on the market.

Location: Kirra, NSW

Property type: Duplex Purchase price: $220,000 Purchase year: 2011

Current value: $310,000 Current rental return: $380/wk

Having to put it up for $570 per week and being unsure if we’ll get tenants, it’s a bit nerve-wracking,” Ash says.

But even though it’s a setback for their immediate cash flow expectations, the couple are confident that the numbers will still stack up. “In terms of long-term growth, we can’t see it being a bad investment,” Simon says.

While waiting for their Bridgeman Downs property to be completed, the determined couple wasted no time looking for the next property to add to their fast-tracked portfolio.

This time, they thought outside the box again and explored the idea of purchasing through a self-managed super fund.

“We enlisted Vogue Financial Services to help us create an SMSF and then purchase a property through that,” Ash explains.

Then they sourced a new four- bedroom, two-bathroom house in Waterford, midway between Brisbane and the Gold Coast, which they purchased for $440,000.

“We bought this property because we felt the value of owning land over a unit in a high-rise building would be more beneficial in the long term,” Simon says.

“Because we’re in this for the long-term gain, we think that finding a property that is going to be rented consistently and will grow over a 15-plus-year period is the most important thing for our strategy.”

Strategy to save $1k per month

With their two new assets still cooling in their portfolio, the couple have already set their sights on achieving their next goals.

Firstly, they plan to move back into their Kirra Beach duplex when their own lease runs out.

“With interest rates as low as they are, we will end up saving over $1,000 a month by moving back into the unit, compared to renting,” says Ash, who adds that living in a rental property didn’t allow her the freedom to make the house a home.

“I've learnt that the rental side of things isn’t my cup of tea, and Simon sees the economic side as more beneficial at Kirra.”

They don’t regret the decision to rent their home out, however, explaining that turning the duplex into an investment was a springboard strategy for them.

“For the last three years we have had our duplex at Kirra as an investment property, and it was certainly the cornerstone to giving us a foot in the door for our future investments,” Simon says.

Now, Simon and Ash plan to strengthen their financial standing in preparation for the next addition to their portfolio. “At this stage, it will be working towards building a strong ‘buffer’ for the Bridgeman Downs property, along with putting money aside for a deposit,” explains Simon.

They plan to bolster their borrowing power by letting time and capital growth work its magic on their current properties.

“We’re hoping that when things settle down with the estate in Bridgeman Downs, a re-evaluation of the property will open up some equity,” says Simon. “We might be able to use that, along with a saved deposit, to invest in another property.”

Taking their first steps on the property ladder has been a learning experience for the new investors, who aren’t afraid to face their mistakes head-on.

For example, they found themselves with a smaller buffer than they had anticipated when they purchased their Bridgeman Downs property, after they used some of their funds to pay off other debt.

“We had planned on having a buffer that allowed for the interest payments during the build time,” explains Simon. “We’ve been tipping in extra dollars to help boost that buffer.

“When we purchased Bridgeman Downs, there was just so much that we didn’t know,” adds Ash. “We’ve learnt a lot in this process!”

• Make the decision to start, and then turn it into action – even if that action is just meeting with a financial advisor or property expert.

• You don’t know what you don’t know! Rely on the knowledge of others. Ash and Simon engaged a professional property investment group to help them with their research, and then did their own due diligence and went with what they felt happy with.

• Before buying, do your own research. Refer to internet listing sites to do comparisons of similar properties.

• Read up on the local market to assess where it’s sitting and where it’s expected to go.

• Listen to those around you. Other people’s experiences and knowledge can help when making decisions.