Like many who forge a successful path through property investment, Melbourne’s Kavitha Vipulananda had a goal in mind when she started out.

Despite having had a successful career that allowed her to work across Australia and the globe, Kavitha didn’t want to spend her entire life working for somebody else, which is why she turned her attention to real estate and the opportunities offered by property development.

“I was working, but I wanted to do something while I was working that would set me up for my future,” Kavitha says.

“At my job I was being paid a good wage, but I wanted to do something that could set me up so that I didn’t have to have a job where I was working from 9 to 5 every day, and do something that would give me financial freedom a bit earlier in life, so that’s why I started.”

Now in her late ’30s, Kavitha’s decision has proved to be a successful one; however, her journey hasn’t been straightforward. Kavitha’s first purchase was an inner-city apartment in Melbourne, and while it proved to be a smart decision, it may not have been one she would have made if it had not been for some guidance from her father.

While Kavitha may have developed a desire to build financial security for herself, like many young people it wasn’t something she had always had.

“I was basically wasting a lot of money. Things like clothes and going out ... I was doing the same things that a lot of 20-year-olds do, and my dad happened to notice that,” she says.

“He said, if I started saving for [a deposit] then he would match whatever amount I could save, and that was something that helped me out. He had always tried to teach us those values about saving and investing from when we were quite young.”

“I moved around a bit. I’m from London, and I moved to Melbourne when I was young, then moved to Sydney and then to the UK and was there for about three or four years.

“So there was a bit of a gap there where I wanted to experience things and I wanted to travel. At that point I wasn’t too concerned with saving money or anything like that. I was basically spending what I earned.”

After a period spent working abroad, a family tragedy brought Kavitha back to Australia, and it was then that she underwent a change in mindset and decided to take the next step.

The experience saw her take a more committed approach to her professional career and start paying down her existing debt.

“I moved back and it was really then that I started pulling up my socks and thinking that it’s my life and I have to be responsible. That was the real turning point for me and was what really started my investing.

“One of the big things for me was that I really changed my mindset around some things like what sort of jobs I could apply for. I picked up a lot experience in the UK, so I started applying for roles that were pretty competitive and had good salaries.

“My thought was that if I could make as much money as I could in as short amount of time as possible, I could pay off the apartment I had. That was the main thing for me; I committed myself to getting a good job as well as really saving.”

That plan paid off for Kavitha, who managed to clear the mortgage on her inner-city Melbourne apartment, after which she pulled out the equity needed to buy her first development site in Melbourne’s Kew, where she had grown up.

Kavitha had some good fortune with that purchase, entering the market during a period when many others were reticent about buying.

“It was right in the middle of the GFC and I was the only one who bid at the auction, which I suppose was a bit of luck for me,” she says.

Breaking ground

Kavitha admits that she “sort of stumbled” into the purchase at Kew, and despite knowing she wanted to develop the site, she didn’t have a firm idea at the beginning about what the project would look like.

“I didn’t actually know what I could do to the site. I just thought I’d build a couple of townhouses and I might live in one and sell the other.

“My intention was to live in one and move back to the area and get married and have kids and they would grow up in the same area that I did.

“There was somebody at work that was a doing a subdivision, and he said you’re sitting on this block and you should do something with it. So I went and met an architect and that’s how it all started.”

While she may have been relatively inexperienced when it came to development, Kavitha did have some knowledge and experience to draw on to ensure the site she bought was one that was suitable to be developed.

“I was really interested in development because my dad was a property developer. I saw what my father was doing and I realised he became successful through property. When I was younger I didn’t really know much about property, so he suggested a few things [to me].

“I stumbled across Kew and I used a bit of my knowledge then, but I still didn’t really know a lot at that time.

“Even though I didn’t know a lot about development, I did some research on the property. There was a heritage overlay on it, so I went to council and spoke to a planner and found out what that involved and what I needed to do to be able to work with that.”

Kavitha’s research paid off and she was able to get approval to build a block of nine apartments on the site in Kew, but the fact that she was a first-time developer did slow down proceedings somewhat.

Dealing with the roadblocks

The plan for units on the site hit some roadblocks due to objections from neighbours in the area, resulting in the plans being changed for the site to accommodate five townhouses. Issues also arose when Kavitha realised the ‘experts’ she was working with perhaps weren’t the right fit.

“I didn’t really understand development, besides what my consultants told me, and I quickly learnt that’s a pretty dangerous thing,” she says.

“A lot of it does depend on the architect and the planner, but what [mine] told me wasn’t in my best interest at the time.”

The complications at Kew meant that work on the project is far from finished, while Kavitha has already seen work get underway and be completed on other projects.

“I really have learnt a lot from the one in Kew,” she says. “I learned by stumbling across things. Hitting roadblocks and then trying to work across them, which wasn’t the best strategy to do a development.

“It’s taken me the longest amount of time because I actually made the mistakes at the start. If I’d done it the right way to begin with, it would be a very different story.

“My site that’s just finishing in Brisbane, we finished in just two years end to end. Every project has little problems, but it was pretty seamless in comparison.”

Learning curve

While the Kew project may not have progressed as quickly as Kavitha would have liked, it has left her with a few key lessons.

“You need to either have a role model that really understands development and can teach you, or you need to go and get thoroughly educated from people who really understand it.

“Some of the lessons I learned were to have a really good architect and a really good town planner. It’s really important to have good consultants and a great team.

“From an architectural point of view, if you’re doing a development it doesn’t always have to look like the Opera House or anything like that; it just needs to work from a feasibility perspective.

“It should be tasteful, but it should be cost-effective as well. It’s important that you have an architect that knows how to work with developers.” While making sure you’re working with knowledgeable people is an important step, Kavitha says none of that will matter if a developer makes a bad decision before work even starts.

“I now have a checklist of what I do in terms of due diligence on a site. It can take weeks or months to do due diligence properly. Anybody that wants to purchase a development site needs to really keep that in mind.

“It has to be a very black and white and unemotional decision. For instance, if you go to auction, you have to set a figure in your head and not go a cent over. I try to not buy at auctions because it can just get too emotional and you can get sucked in.

“In particular, people need to realise that just because a site may be vacant, it doesn’t mean it’s a viable one for development. It’s about doing the numbers on them. You can have a block that’s just sitting there and you can say it’s a bargain and I’ll be able to make it work, but that often is not the case.

“You have to do the numbers on what you’re going to buy it for, what you’re going to sell it for, what you’re going to build it for, and what your holding costs will be, and you need to know that it will make the returns on what the bank will finance you on.

“There are some clear requirements on what the banks will want to see before they fund you, and a lot of people get stuck because they think they’re buying a bargain block and they get caught, because the resale might be a townhouse for $350,000 and it’s pretty hard to make any margin on that.”

Professional development

While Kavitha has taken those lessons on board personally, she is now also using her knowledge in another practical way through her development and advisory firm Alleura.

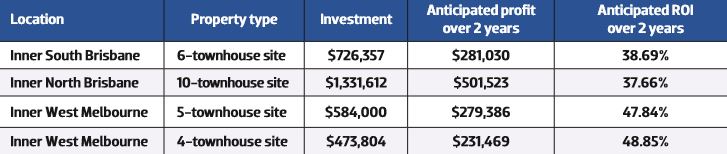

“What we do for clients is work with them to get them a return on their equity through development. Some people may try to do that through shares; we do it through property,” she says.

“They buy the site and own it and then we do the entire thing for them. The most work they probably do is on settlement day.

“We’ve managed over 15 projects using that strategy.” While Alleura is a full-time operation, Kavitha doesn’t look at her work like the 9 to 5 job she once wanted to use development to escape from.

“I love it. You do come across little stresses; I’ve got a settlement day coming up and there’s a public holiday, which will make transferring across bank accounts difficult. Little things like that pop up all the time, but even though it can get stressful I really love and enjoy what I do.

“I wouldn’t think of doing anything else. I don’t even look at it as a job – it is my passion.”

Top 5 negotiation tips

1 Be confident and unfaltering

2 Find out what the other party's concerns/issues are in closing the deal and address their concerns.

3 Create a sense of urgency by providing a timeline for your proposal.

4 Present not just your Plan A but your Plan B and C, giving the other party a choice as to which offer suits them best.

5. A no is not a no forever. It is a no right now. Go back and try again. or move on to your next investor/purchaser.

1 I was born in Central London and moved to Melbourne when I was eight.

2 My favourite toys as a child were LEGO and Monopoly.

3 I am the owner and founder of Alleura, an organisation that assists investors in making great returns on their investments through property.

4 I wanted to get over my fear of public speaking and joined Toastmasters. Within six months I have been asked to speak at four property groups about property development.

Recent client projects