But a growing family meant the property soon became unsuitable and left Nick, 38, and Jacqui, 33, with a decision to make.

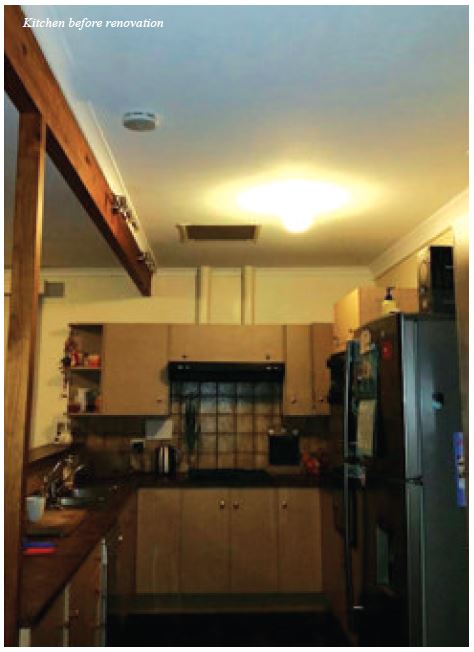

“It’s a five-bedroom house, and when we bought it we thought we’d be living in it for the next 10 to 15 years or so. But then we had another child and it didn’t really suit our needs any more. When we bought the house it needed some work, and we’d redecorated and redone the kitchen and bathroom,” Nick says.

“We were left with a choice to make: we could either sell it and move on or rent it out and find another property.

The Harts decided to go down the route recommended by their broker, which has now seen them renovate a further three properties, all while living in them with their four children.

The Harts’ portfolio is now made up of four properties worth just over $1.6m and has been put together by following a careful strategy.

“What we’ve done is target rundown houses that we can try and get for around $40,000 to $60,000 under market value. We’ve found that if a house has a bad kitchen or bathroom you can usually pick it up for much cheaper because these are the rooms people focus on,” Nick says.

“They’re also the rooms you get the most bang for your buck from in terms of increasing the equity in the house. We might do some more decorative work on the rest of the house, but we focus mainly on the kitchen and bathroom.”

Rather than renovate and then look to sell the properties, the Harts have elected to hold on to each completed project and draw down on the improved equity, which is why Nick places heavy emphasis on tracking their budget.

For a quality kitchen or bathroom renovation the Harts budget to spend $10,000 to $30,000, and after deciding on their outlay they do their utmost to stick to it.

“When we start a project we put together a strong estimate of what the equity improvement will be and how much we plan on spending. From there we really try to keep track on a day-to-day basis of where the money is going, and that’s really helped us make sure that we’re doing the right thing as we move through each project.”

While sticking to their budget is an important part of their process, Nick says there is an equally important step the Harts take before picking up their tools.

“You do need to buy the right house in the right location. Just because something is cheap doesn’t mean it’s going to benefit from a renovation.

“We target houses that are under market value, but we look in areas that are mainly owner-occupied. We find you get a better quality of tenant in those areas and the market is generally more stable. They’re also the areas that people want to buy in, which helps capital growth.”

Nick Hart's Reno Tips

1 Find the right help

If you’re using tradesmen, make sure you find ones you can trust. It makes life a lot easier to know the work they do will be of good quality and what you want.

2 Know your finances

On the financial side of things it's important to have a good broker, but try to get an understanding of things yourself. A broker is never going to be deep inside your life and really know everything, so if you can do your brokerage qualifications that will really help.

3 Set goals

Renovating a house while living in it with four kids can be pretty stressful, but having an end goal in mind, and our hearts really set on it, has been the thing that has kept us going.