After some successful experiences with Australian real estate, investor Armand Aguillon turned to the American market, where he purchased properties for as little as US$1. A moderate risk profile has earned Armand several US investments, ready for his children to cash in on in years to come

Though Armand was always aware of the potential wealth creation opportunities that property investing offered, he didn’t take serious action until his son was born four years ago.

Many years earlier, back in 2005, he dipped his first toe gingerly into the landlord market, going as far as to purchase his first property

sight unseen.

“One of my friends worked for an investment property company and showed me what they had. They went through the whole property with me,” he says.

He was given all the information to help him come to a decision, including the area of the property, its amenities and infrastructure, and a timeframe for the house to be built in.

“I did a lot of further research online with resources such as the local city council website, which shows what they’re doing or what their plans are in the area,” he explains.

“I also checked Google Maps to become informed about what local infrastructure and schools were in the property’s vicinity, and its location in proximity to the city.”

Armand was able to purchase the property together with his sister and that’s how he became the proud owner of his first investment, a three-bedroom home in Cranbourne, Victoria.

They purchased the townhouse for $230,400 in 2005, and sold it just last year for $315,000.

In 10 years of owning the property Armand didn’t set foot in it once – which doesn’t bother him, as his main concern was driving a profit. His initial success gave him confidence, and prompted him to expand his horizons and consider other international investment opportunities.

The inexpensive risk: properties for $1 each

Already comfortable with buying sight unseen, Armand had no qualms about investing overseas.

“With the technology available nowadays, it is much easier to buy properties without having to travel.

It really depends on your risk profile. Some people want to be able to touch an object, and it gives them the peace of mind that what they’re buying is in fact tangible if they can see it,” he explains.

“Others, like myself, are comfortable to make a decision, given enough data and documentation that everything is what it is – and that is where I am currently at.”

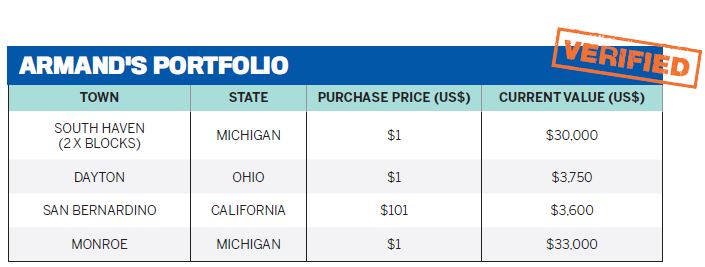

Armand now owns several pieces of land in Michigan, Ohio and California, all purchased between August 2013 and now.

“You wouldn’t believe how much I paid for some of these. Less than the cost of a bottle of water! It costs me almost $500 to transfer it to my name, so it actually costs me more to process it than to buy the land,” Armand says.

Finding such incredible deals came down to research, he adds – a lot of it.

“I looked at different online platforms where I could buy them, as well as at online auction places. I also researched the local counties – in Australia we call them city councils – and read a lot of information on what they plan to do in the area, what types of investments are coming in and which companies are investing in the area,” he says.

Armand also educated himself on the demographics of where the properties were located, the process necessary for purchase, “as well as the logistics needed to make sure the transition from sale to receiving title to the deed would be a seamless one”.

It all led to him becoming a landowner several times over in the US, for less than the cost of a mortgage for 12 months on a small property

in Australia.

Securing a future for the family

Having paid less than $500 for each of his land acquisitions in the US, despite one of the properties being a double block, Armand is thrilled with the deals he has secured to date.

He has no immediate plans to sell – or, in fact, any plans to sell at all.

“At the moment I’m just holding them and I’ll one day pass them on to my kids. I’ve got a four-year-old son and 16-year-old daughter, so I’ll give it to them,” he says of his plans for his American investments.

He has finished his run of acquiring US assets for now, and he plans to turn his attention back to the Australian market. He has recently begun work as a licensed real estate agent so that he can learn more about the local real estate market and research an investment opportunity closer to home.

Armand may not be able to secure a deal quite as cheaply as he did in the US, but at least he’ll have the inside scoop on some quality deals down under.