By David Shaw. 24/02/2015

One of the most significant and positive development I have seen during my 4000 interviews over the past 10 years is the dual occupancy property. The dual occupancy is simply a property with two sources of income. Some Local Councils will allow a 3 bedroom and a 2 or 1 bedroom apartment to be constructed on the one property. Returns for both the short and long term are superior and this assists tax payers with the recurring question of “how can I make my property positively geared?”

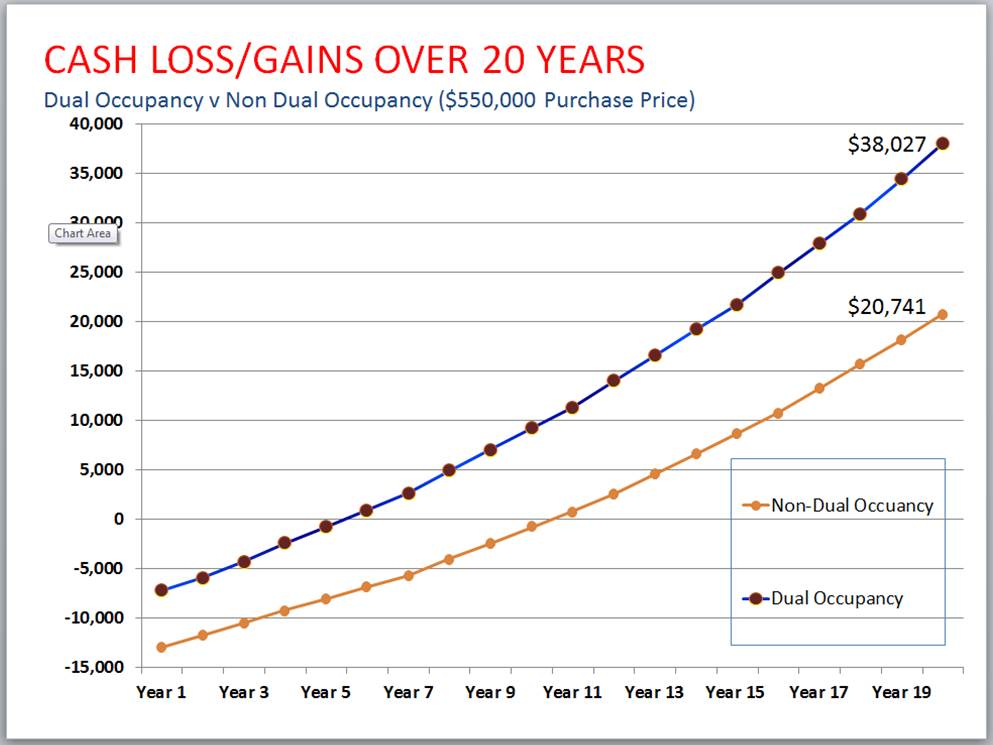

Dual occupancy gives superior cash flow because of the two sources of income. Upon analysis of this, I discovered the following:

- Cashflow:

See the below graphic example which proves this point.

- Levels of Debt:

Because the dual occupancy delivers a superior cash flow you actually need less of these properties in retirement to achieve the same result. In the example used above, if you were to purchase 3 of these properties today with a 5% rental growth over the next 20 years without paying off any debt, you would generate a positive cash flow of $114,081 per annum. If a $550,000 non-dual occupancy property was purchased with the same rental growth you would need 6 of these properties to develop the same cash flow.

Therefore, with a dual occupancy property you take on half the debt and achieve the same long term cash flow.

David Shaw is the CEO of WSC Group: Certified Practising Accountants and Business Advisors, and was voted Property Tax Specialist of the Year in the Your Investment Property 2013 Readers Choice Awards (runner up in 2012 & 2014 ).

The above information is supplied by WSC Group.

Disclaimer: while due care is taken, the viewpoints expressed by contributors/sponsors do not necessarily reflect the opinions of Your Investment Property.