A rental property is negatively geared when it is purchased with the assistance of borrowed funds and the expenses of owning the asset exceed the rental income. As a result, a loss is incurred and this loss can be offset against your income tax.

Deductions include mortgage interest costs and depreciation as well as all rental expenses, such as council rates and property management fees.

These property losses incurred can be offset against other assessable income such as salary, wages or business income. This enables either a reduction in tax payable or a larger tax refund. The largest part of the deduction is usually the interest portion of the mortgage, but you may also claim property management fees, rates, loan costs, and maintenance and repairs – all of which adds up.

Negative gearing deductions are most beneficial to people in high-income tax brackets where they are at the top marginal tax rate. This allows larger deductions when you borrow bigger amounts, as you will pay more interest.

Generally, you will find that a newly purchased, negatively geared property will have better capital growth than a positively geared property. This will allow you to set the investment up and wait for growth, so you can then use the equity from this property to purchase your next investment.

Example: If your property’s rental income is $450 per week and the expenses of owning the property total $600, then your property is considered to be negatively geared. You can claim your loss of $150 per week against your income tax.

Does negative gearing suit all investors?

The key benefit associated with negative gearing is that the loss associated with the property ownership can be offset against other income earned, reducing your assessable tax income and thereby reducing your tax payable.

The result is that the cost of owning the property is being funded by your tenant (in the form of rent), the tax office (in the form of tax savings), and your surplus cash flow.

Generally, high taxpayers are advised by their accountants to choose the negatively geared investment option to maximise their tax returns and benefit from the long-term capital growth potential.

Ultimately, most investors will aim to be positively geared in the long run, but they start out negative and then hold property for a few cycles.

The difference between positive gearing and positive cash flow

The main difference between positively geared and positively cash flowed property is that positively geared assets generate more income than expenses before tax, whereas positive cash flow property only generates more income than expenses after tax.

Positive gearing is where the rental income received is greater than the total amount of the expenses, and therefore creates a situation where tax must be paid on the net income.

Example: If your property’s rental income is $600 per week and the expenses of owning the property total $450, then your property is considered to be positively geared. You need to pay income tax on your profit of $150 per week.

On the other hand, a positive cash flow property is an asset that generates a loss (ie more expenses than income) before tax. However, after tax deductions and refunds are taken into account, your income becomes greater than your expenses.

Example: Your property’s rental income is $500 per week and the expenses of owning the property total $550. However, your depreciation claim adds another $100 per week to your tax deductions.

You can claim your on-paper loss of $150 per week against your income tax, giving you a tax refund of $74. Because the property only costs you $50 per week to own, the property is positively cash flowed at $24 per week.

Positive cash flow properties are self-funding and you don’t need your tax rebates or your wage, as the rent pays for everything. This requires high yields; however, many high-yielding properties can be located in volatile small areas, so it is important to be wary of investing in these areas and do deeper research before you buy.

Is one better than the other?

The short answer is no.

Different investment plans require different strategies based on a person’s income and tax position.

Let us start with some cash flow basics. There are three parts to the cash flow puzzle: your wage, the taxman and your tenant.

If your tenant can pay the rent and

it covers your mortgage, you are doing well, as you are freeing up your own cash flow so you are not constantly forking out your money. The longer you own real estate, the more likely this is to occur.

Once upon a time, many investors ran off to small mining towns to chase high rents to avoid negative gearing. Returns of 9% or 10% were commonplace in these areas. With interest rates at 7%, they were the only property vehicles in Australia that paid for themselves.

For a while it was a successful notion, but in the end it failed. The fundamentals were not there to support the high rents, and when the mining economy slowed, so did the rental returns. It wasn’t a long-term and sustainable strategy.

So, what is going to be investors’ best hope of cash flowing property into the future?

Given the current deflation in the economy and Australia’s record low cash rate, we can still shop in good areas and get good medium yields. We don’t have to take huge risks to get a sensible return in 2016.

Having a combination strategy that includes both cash flow and capital growth will provide you with both serviceability and equity as a borrower and allow you to continue to move forward. For these reasons, a strategy focusing only on yield is flawed. Equity and servicing allow you to buy more properties, borrow more money, and keep building your wealth.

What will happen if gearing rules change?

During the federal election this year, we came close to seeing negative gearing rules changed to reflect that only

new properties would be eligible for negative gearing.

This was a scary prospect for many investors, particularly those who rely on negative gearing for their properties to be affordable.

You will not be able to stop the government from messing with gearing one day, but it shouldn’t be a big concern – if you buy well.

If you buy the right property it will be in demand; if you buy in the right suburb it will always be growing; and if you buy in the right market you will even be getting the best rents from day one.

In 2016, the best way to minimise your exposure to negative gearing is to find properties with a high rental return. This is easier said than done, as there are more properties that are negatively geared in the marketplace than there are positive ones.

The fact is, we are shopping in a saturated property market. Beyond this problem, and compounding the challenges we all face, regional markets – which have typically shown investors good returns – have now become speculative markets.

Three investment planning ideas

1. Flight to quality

2. Dual income properties

3. Running the numbers

1. Flight to quality

The first rule for beating the gearing trap is ‘flight to quality’.

People will pay more for what they cannot readily have. In a flight-to-quality market, there are fewer of the best-designed properties situated close to amenities, so these are getting the best returns due to lack of supply and high demand.

Conversely, as properties grow older and are more homogenous, new properties are also being supplied. That means the existing properties are not effectively growing from a rental point of view. If anything, they are actually losing more rent than ever before. They are being pushed to the bottom of the market and tenants are paying less for them.

A recent RealEstate.com.au survey concluded that 75% of tenants would pay more if the standard of property available were better, which demonstrates that they’re not willing to pay as much for older properties.

This is exactly what they are doing for the better properties within the marketplace. Landlords with better-quality stock are now getting higher yields, up to 1% above other properties.

Today, you can have two new buildings or homes on the same street; one will collect a 4% rental return and be very negative, and the other a 6% return, because of its quality inclusions and designs. A rental premium is available in the market and is our new way to get better cash flow.

Why would someone rent an old property with no amenities when a new property is offered at the same rate?

2. Dual income properties

Dual income properties are a great way to extract extra rent. They follow the premise of the highest and best use of real estate!

Having two tenants in a property instead of one usually boosts rent and ensures you are maximising the property’s yield. Dual income can be in the form of two properties on one title; or under granny fl at legislation it could allow for two occupancies on certain properties.

Let’s look at an example of a real-life negatively geared property in Sydney, to see how this works in action.

A recent rentals report from CoreLogic revealed that average yields in Sydney are around 3–3.5%. This means an $800,000 home may only rent for $450–$500 per week, giving a grand total of around $25,000 in annual income.

At current interest rates, a home loan rate is around the 4.5% mark. Based on an interest-only loan at a 90% lend (ie a loan of $720,000), your mortgage repayments are going to be around $620 per week.

Once you factor in council rates and property management, it’s clear that you’re making a substantial weekly loss. If interest rates go up, these ongoing property costs could become crippling for an investor.

The better investment could be a dual income property, such as one I saw in Western Sydney. It was marketed and sold for $800,000 but actually produces $890 per week in rent. This represents a 5.7% return – almost double the average for Sydney – and the property produces $46,280 in rent.

Remember, the average annual rental return in Sydney is closer to $25,000 for an $800,000 property. The extra $20,000-plus that this property produces is an investor’s safeguard against many things, one being changes to gearing.

3. Running the numbers

This is of huge importance! A property could look great on the surface, but until you measure the rental return and the outgoings and any associated costs, you won’t know how much the true cost is per week.

You never want to be too income negative with property. In my view, the property expenses should not be more than 30% of your income production. If you exceed this level, your wage or income will become the major contributor to the property’s upkeep.

With a growth buy-and-hold plan, it is common to contribute a little bit along the way as the long-term goal is to get bulk wealth. We don’t, however, want to contribute too much: in the early years of ownership perhaps $50 a week maximum until rents grow.

Your tenant and the tax deductions should pay for the majority of your real estate running costs, including the mortgage, so you should avoid properties with a gross yield of 1–3% and start with a 4%-plus return in this current market.

The idea is that the yield should mirror the interest rate as closely as possible. In a high interest rate market, often you see much higher rents, and in a low interest rate market there will be much lower yields – as seen today, when the average capital city has dropped over 1% in yield variation.

In a higher interest rate market, rental rates could sit at around 7% plus. In this environment it becomes less affordable for people to own real estate so fewer people buy property. This means more people continue to rent, and in turn rents rise accordingly. A property with today’s 4% return may actually reach a 6% yield in such conditions.

Australia has a historically low cash rate today, which is linked back to what banks sell: interest rates, which presently start from around 4.5%. Lots of people have now leapt out of the rental pool and bought property for themselves, and now form part of the homeowners’ club.

These interest rates are so affordable the reality is that this current rate climate is going to be many people’s best chance to acquire real estate in their lifetime. Why? When rates are much higher, it is a lot harder to afford property and for people to get into the marketplace. It is a much higher barrier to entry. In a low interest rate market, you have higher sales volumes, which are great for growth, but you also get lots of supply.

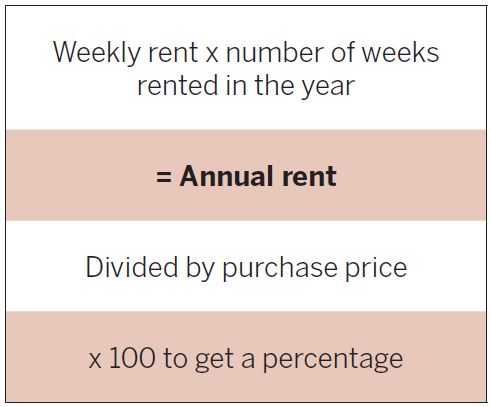

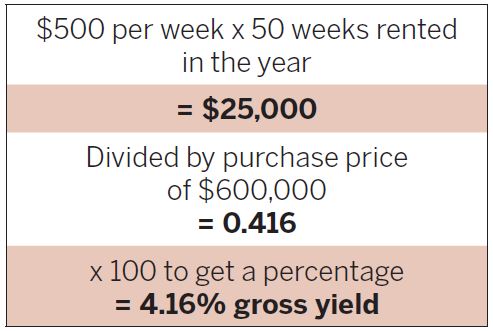

A good lesson to help you understand how to calculate rents is the following formula, which determines your percentage gross yield:

For example:

Falling into a financial hole Property investors actually fall deeper into a financial hole if they rely only on gearing, making it harder to get ahead. As a property investor, you should do better than just buying a good property. It should have a good yield too.

Property is the best investment in the world. Think of what you can achieve with Australian property:

• Great rental yields; better than the bank offers and healthier than the inflation rate

• Capital growth rates that work off leverage

• An inflation rate that naturally sees rents rise over the longer term Growth from the inflation of the cost of goods and services, which can be linked to new housing being supplied into the market

• Loan products that allow you to manage your cash flow and debt ratios

• As you age with your property, the real estate rents can become a great source of cash fl ow and fund your life (as rents will go up over the long term).

• A rapid population and skills growth plan that is the envy of the world.

• Vested interest from banks and government to make it work over the long term.

Regardless of whether negative gearing is removed, you can still get the benefits of property. Remember that with Australian property there are many benefits. One of them is capital gains tax-free investment if you live in the property. So, at a bare minimum, make sure you buy your own home so you can benefit from property and growth.