Whenever I am delivering a presentation or conducting a webinar, I always make sure to leave time for a 30-minute Q&A session at the end. In most Q&A sessions, the topic that by far receives the most queries has to do with the concept of scrapping in relation to property tax depreciation.

Scrapping allows you to claim the residual value on items that are about to be removed, which can significantly increase your tax depreciation deductions. The problem is that many investors who renovate miss out on this due to a lack of awareness.

It’s important to understand the basics of property depreciation before diving into the subject of scrapping, so let’s quickly recap what property depreciation is all about.

The basics of property depreciation

Just like you claim wear and tear on a car purchased for income-producing purposes, you can also claim the depreciation of your investment property against your taxable income.

There are two types of depreciation allowances available: depreciation on plant and equipment assets, and the capital works deductions. Depreciating plant and equipment assets (Division 40) refers to items within a building, like ovens, dishwashers, carpets and blinds. Capital works deductions (Division 43) refers to the construction costs of the building itself, such as concrete and brickwork.

While both of these costs can be offset against your assessable income, the property must be used for income-generating purposes in order for you to do this. It is also important to note that to be eligible to claim on the capital works component, a residential property needs to have been built after 17 July 1985.

What is scrapping?

Put simply, scrapping is the ability to claim deductions on items within your investment property that you are about to throw away. It is a topic that I cover in some detail in my book, CLAIM IT! A property investor’s and developer’s guide to depreciation, as I’ve discovered that many investors don’t know enough about the potential financial gain on offer.

Engaging a qualified quantity surveying firm will ensure that you do not miss out on claiming any eligible residual value of these items as a depreciation deduction. This value can be claimed immediately in whole once the items have been removed.

The reason scrapping is such a hot topic is the fact that these deductions can often add up to thousands of dollars.

There is one major caveat though. In order to claim the residual value of these items, your rental property must be producing an assessable income prior to the disposal. There is no clear guideline as to how long the property needs to be rented out for – just that it must have been producing an assessable income.

The following are two ways that we can assess the scrapping allowances of an investment property.

Option 1: Only depreciable assets can be scrapped

This means the building was built before 1985 and no residual capital works deductions are available. For Division 40 depreciable assets, if a taxpayer ceases to hold a depreciating asset (sold or destroyed) or ceases to use a depreciating asset (doesn’t need it any more), a ‘balancing adjustment’ will occur.

You work out the balancing adjustment amount by comparing the asset’s termination value (sales proceeds) and its adjustable value. If the termination value is greater, you include the excess in your assessable income, but if the termination value is less, you deduct the difference. These deductions can add up quickly, even if only in relation to depreciable assets.

Let’s crunch some numbers.

Joan Smith settled on a property for $650,000 on 15 October 2015. The property had a long-term tenant in place, who had agreed to stay for another six months. The property was 19.5 years old when she settled on it.

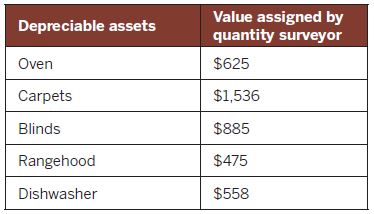

Washington Brown inspected the property on 15 October 2015 and assigned the following values to the depreciable assets:

"Claiming the residual value of items that are about to be removed can significantly increase your tax depreciation deductions"

Option 2: Depreciable assets and capital works deduction can be scrapped

If you start moving walls or replacing kitchens in buildings built after 1987, your claim has the potential to be huge! And let’s face it: it’s not that unusual to want to update a 20-year-old kitchen.

Now let’s look at the numbers for a situation in which Joan has renovated the kitchen and bathroom as well:

This amounts to the tidy sum of $15,816 as an immediate tax depreciation deduction!

One thing that needs to be considered when calculating the amount of deductions available is whether or not you or another person are allowed a deduction for capital works. It’s complicated, but see the following method statement from the Income Tax Assessment Act.

The amount of the balancing deduction

Method statement

Step 1

Calculate the amount (if any) by which the * undeducted construction expenditure for the part of * your area that was destroyed exceeds the amounts you have received or have a right to receive for the destruction of that part.

Step 2

Reduce the amount at Step 1 if one or more of these happened to that part of * your area:

(a) Step 2 or 4 in section 43-210, or Step 2 or 3 in section 43-215, applied to you or another person for it;

(b) you were, or another person was, not allowed a deduction for it under this Division;

(c) a deduction for it was not allowed or was reduced (for you or another person) under former Division 10c or 10d of Part III of the Income Tax Assessment Act 1936.

The reduction under this step must be reasonable.

So, in simple terms, you need to take into account any periods in which capital works deductions could not be claimed, and subtract that amount from any residual value left.

The last line, “The reduction under this step must be reasonable”, is interesting. I say interesting because there are so many variables and not a lot of rulings to go by.

However, here are some reasonable examples, based on my opinion.

"In order to claim the residual value of these items, your rental property must be producing an assessable income prior to the disposal"

1. It would be reasonable to assume that, if you purchased an industrial or commercial property, capital works deductions were available the whole time, so no allowance for non-use would be required.

2. It would be reasonable to assume that, if you purchased a serviced apartment, capital works deductions were available the whole time,

so no allowance for non-use would be required.

3. It would be reasonable to assume that, if you purchased a unit in a ski resort, it was utilised for perhaps two weeks of the year for private use by the previous owner, and you would need to factor that in.

4. It would be reasonable to assume that if you purchased a holiday house in an area where holiday lettings are common and you saw the property listed on Airbnb prior to your purchase with the holiday period blocked out, then you should factor two weeks of private use per year into the equation.

5. Now the tricky one: you buy an average unit with a tenant in place. Who knows, it may have changed ownership five times since it was new. I think it would be unreasonable for you to have to find out the full history of the unit. Privacy laws are very strict now, particularly in Victoria. So in that case, I would personally assume it was an investment property the whole time – but that’s me!

Tyron Hyde

is a director of quantity surveying firm Washington Brown.