The downturn in dwelling prices seemed to have regained pace in December, driven by the worsening price situation in some capital cities, particularly in Melbourne.

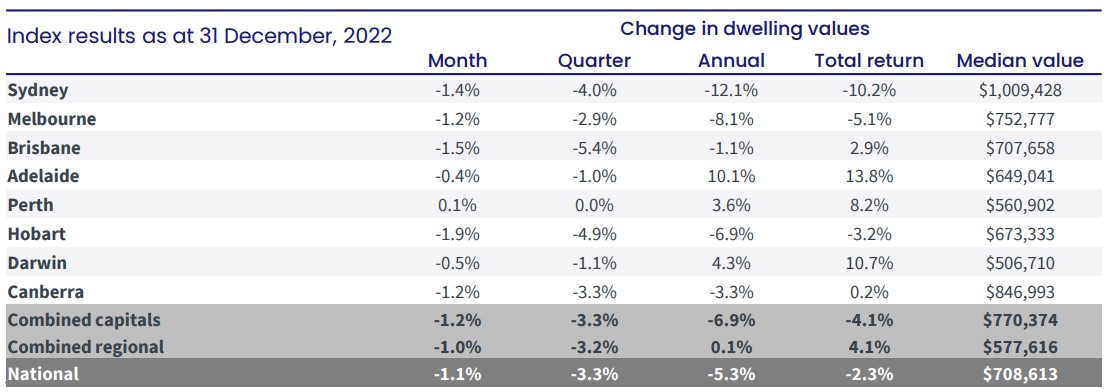

CoreLogic’s Home Value Index for December 2022 showed a 1.1% decline, bringing the overall dwelling values down 5.3% from the same month in 2021.

Melbourne’s monthly decline is considered a major driving force behind the December data — during the month, the city recorded a 1.2% fall in dwelling values, extending the previous month’s 0.8% decline.

Sydney, Adelaide, and Darwin also witnessed their price declines re-accelerate over the month.

On the other hand, the pace of declines eased across Brisbane and Hobart.

In annual terms, Sydney recorded the steepest fall at 12.1%, followed by Melbourne at 8.1%.

CoreLogic research director Tim Lawless said 2022 has been a year of contrasts — dwelling values mostly rose through the first four months but fell sharply as the cash rates rose over the latter months.

“Our daily index series saw national home values peak on May 7, shortly after the cash rate moved off emergency lows. Since then, CoreLogic’s national index has fallen 8.2%, following a dramatic 28.9% rise in values through the upswing,” he said.

Meanwhile, the more expensive segment of the housing market led both the upswing and the downturn.

“Recent months have seen some cities recording less of a performance gap between the broad value-based cohorts — Sydney is a good example, where upper quartile house values actually fell at a slower pace than values across the lower quartile and broad middle of the market through the final quarter of the year,” Mr Lawless said.

Over the regional markets, while dwelling values were roughly unchanged over the year, results were mixed across the states.

For instance, the annual declines across regional New South Wales and Regional Victoria offset the yearly growth witnessed in other regional markets.

“Regional SA has been the standout for growth conditions over the past year, with values up 17.1% through 2022. The well-known Barossa wine region led the capital gains with a 23.0% rise in values over the calendar year,” Mr Lawless said.

Despite the overall downturn across the housing markets in Australia, overall dwelling values remained well above pre-COVID levels.

Across capital cities, dwelling values remained 11.7% above their level in March 2020. Meanwhile, regional areas recorded a 32.2% growth in values compared to the same period.

Melbourne is the only capital city where the current downwards trends is getting close to wiping out the entirety of COVID gains — dwelling values in the Victorian capital were 1.5% above the March 2020 levels.

“The relatively small difference between March 2020 and December 2022 levels can be attributed to a number of factors, including a larger drop in values during the early phase of COVID, a milder upswing through the growth cycle and the -8.3% drop since values peaked in February,” Mr Lawless said.

At the other end of the spectrum is Adelaide, where housing values remain 42.8% above pre-COVID levels.

This capital city recorded a 44.7% gain through the upswing, and have held relatively firm since interest rates started to rise, down only -1.3% from the recent peak.

—

Photo by doctor-a from Pixabay.