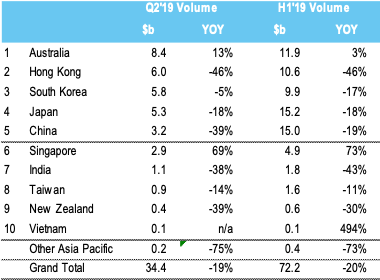

Australia beat the likes of Japan and China to top the Asia-Pacific commercial real estate rankings in the second quarter of 2019.

The country’s commercial property investment reached US$8.4bn for the quarter—up 13% compared to the same period last year, according to Real Capital Analytics (RCA).

Renewed investor appetite amid the national election and foreign capital flows strengthened the commercial market.

“Australia’s leading second-quarter performance clearly stands out among the top five biggest Asia-Pacific real estate investment markets, as there was a sharp uptick in the consolidation of property ownership over the period and a handful of large domestic deals,” said David Green-Morgan, managing director of Asia-Pacific at RCA.

Meanwhile, Japan’s commercial property investment fell 18% year-on-year during the second quarter. Chine real estate capital flows also slumped, declining 39% to US$3.2bn.

Source: RCA

Total Asia-Pacific property investment transactions fell 19% year-on-year to US$34.4bn in Q2 2019, affected by the US-China trade war and global economic slowdown.

Investments may bounce back later in the year, with RCA recording US$10bn in completed deals for Q3 2019 and a further US$20bn worth of deals still pending.