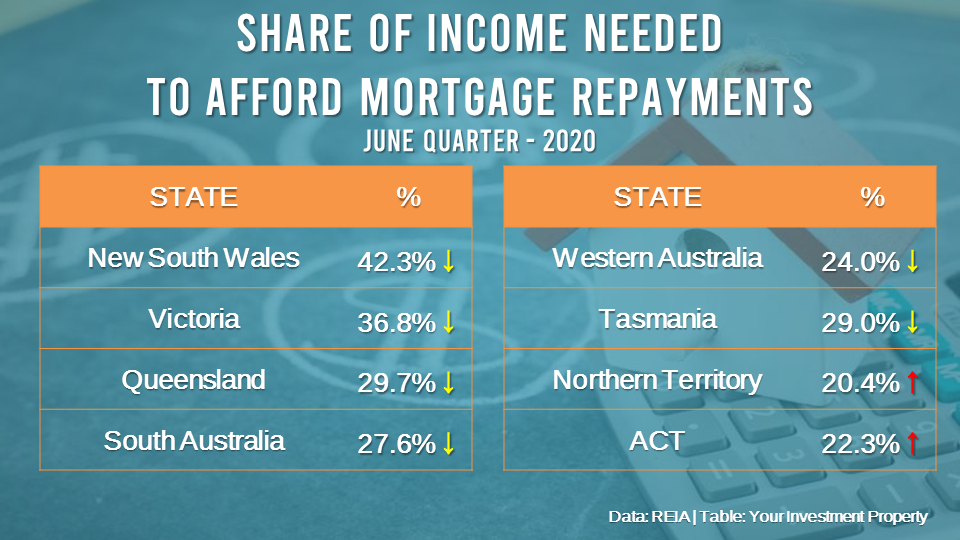

Renters are experiencing the best rental affordability since 2007, as the proportion of income needed to meet rent payments continued to decline over the June quarter, latest report from the Real Estate Institute of Australia (REIA) shows.

Renters allotted 23.3% of their income, on average, to meet rents during the quarter, down by 0.4 percentage points from the previous quarter and 0.5 percentage points from last year.

All states and territories, save for the Australian Capital Territory, reported either a reduction or a stabilisation in rents over the quarter, contributing to the improvement in affordability.

"Rental affordability has not been this high since December 2007, a positive for renters in these COVID times," said Adrian Kelly, president of REIA.

The table below shows the rental affordability measures in each state over the June quarter:

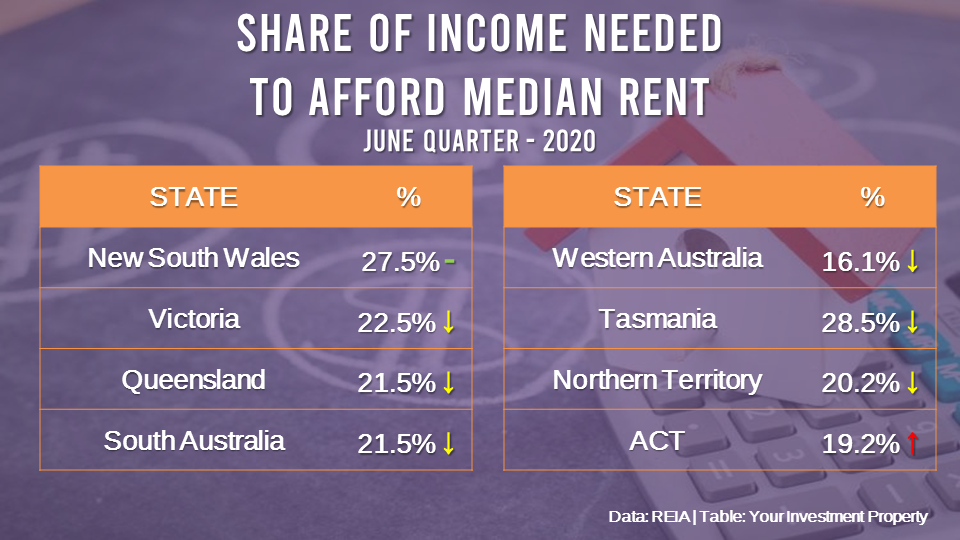

Affordability among homeowners also improved in the quarter, with the share of income required to meet loan repayments reducing to 34.5%.

"Even though family income only increased 0.1 percentage point during the period, the average loan repayment decreased 0.6 percentage points through a drop in the average variable standard interest rate," Kelly said.

However, the restrictions brought about by the COVID-19 pandemic have reduced the activity in the market, leading to a drop in the number of new loans over the quarter.

"This is the lowest number of new loans issued in the past five years for all areas except New South Wales and the Australian Capital Territory and reflects the reduced activity in the housing market as a result of restrictions associated with COVID-19,", Kelly said.

The table below shows the average share of income needed to pay mortgage repayments in each state: