Property investment is one of the most easily accessible methods of growing wealth for everyday Australians. Buy a property, rent it out, hold and eventually sell for profit – this seems to be the most popular strategy to follow.

However, there’s more to investing than simply buying a property and hoping it grows in value, as Jane Slack-Smith, the director of Your Property Success and Investor's Choice Mortgages, explains in our latest Podcast episode.

“In the last couple of months, I’ve sat with my colleague John and we’ve discussed, ‘How come we've got so many people that we're talking to and they still are getting it wrong?’ We started surveying people to find out what we were missing.”

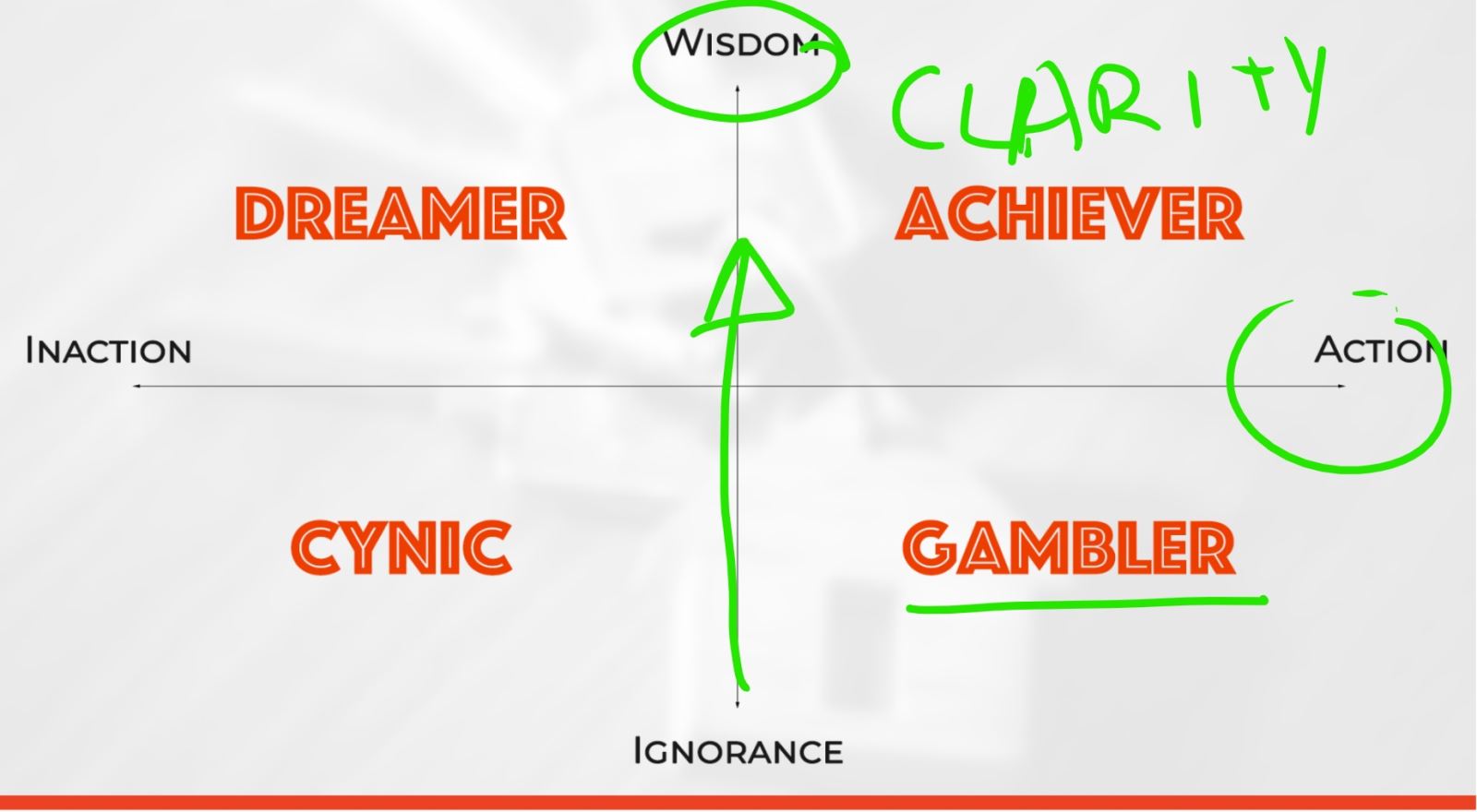

Based on the results of the survey, Slack-Smith formulated a framework that categorised investors according to the way they make investment decisions. In a grid presentation, the top of the Y axis denotes wisdom and the bottom denotes ignorance; meanwhile, the right of X axis corresponds to inaction while the left corresponds to inaction.

“In the bottom right corner, we have what I affectionately called the gamblers – these guys are all about action taking. They might get a little bit of information and then they are in, so they don't necessarily have all of the wisdom behind their decision making. Then across the grid we have the dreamers – they are almost like junkies who are not so much taking action. These are the two extremes on my framework.”

Gamblers ride high when they’re successful, but can also crash and burn when they reach their borrowing capacity and are unable to move, or when they invest in poor properties.

“For an action taker not to take action becomes really frustrating. And so, the process for them is sometimes coming back and doing a portfolio review. Is there a portfolio killer in the mix that they need to get rid of? And if they do get rid of that, can they use that borrowing capacity to propel them forward, now with some understanding and education?” Slack-Smith says.

There are also, inevitably, the cynics in the bunch, who lack both knowledge and action but are there to be pessimistic when a mistake is made. This is where having a strong vision for where you want to go in your investment journey is crucial.

“Often, the cynics in our lives are the people who love us the most – our parents, spouses, siblings or best friends. But being able to admit when you stuffed up is also a recognition of the learning experience and journey that you've been on that goes past that and acknowledges what you did wrong.”

Having the right companion and support is a big step in getting to the point of being a savvy investor.

“Most investors in our community are investors in solitude. So it's really nice to find the person who relates to them – they enable each other to move to the top right quadrant, which is the achiever. This is where I want people to be,” Slack-Smith explains.

“[Achievers] have clarity and confidence – they understand what they need to do with the wisdom and education they have, and they take effective action in the right direction. Sometimes it's about finding a like-minded group, someone who's going to keep you accountable or paying for mentoring.”

For more, listen to our chat with Jane Slack-Smith in episode 5 of the YIP Talk podcast