New home sales increased in February, but the level remained low compared to last year.

According to the Housing Industry Association (HIA), sales in February rose 14.3% from previous month. Despite this growth, sales activity remained low.

Sales in the three months to February were 46.8% lower than during the same time last year.

This was consistent across the biggest states, with declines of 76.6% in New South Wales, 51.2% in Queensland, 42.3% in Victoria, and 14.8% in Western Australia, and 6% in South Australia.

HIA chief economist Tim Reardon said the annual decline was due to the adverse impact of the RBA’s rate increases, which continue to erode market confidence.

“Tighter access to finance and a higher cash rate are seeing many new homebuyers withdraw from the market — customers that received approval to build a new home early in 2022 are cancelling these projects as the cost-of-living bites and banks withdraw financing,” he said.

“Without an improvement in access to finance, or a lowering of rates, the number of new homes commencing construction will slow later this year."

Rental vacancy rates easing in some markets

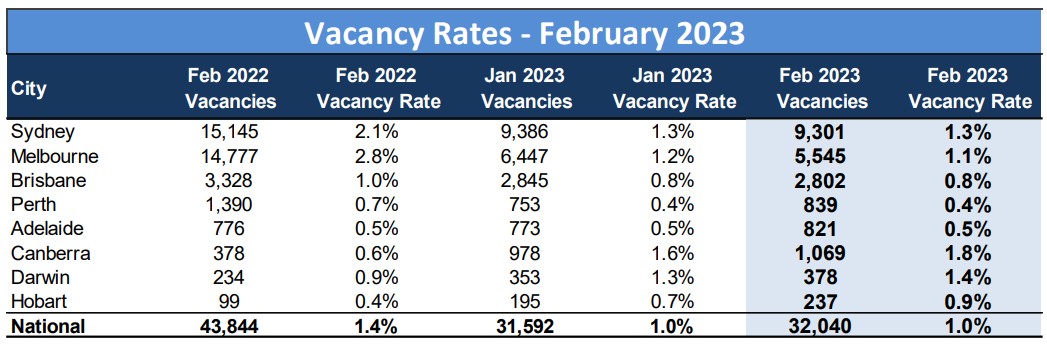

A separate report from SQM Research showed easing in vacancy rates in some markets in February.

Canberra, Hobart, and Darwin witnessed increases in vacancy levels in the month, while the national figure remained steady at 1%.

SQM Research managing director Louis Christopher said the increase in vacancy rates in some markets can serve as hard evidence that the rental crisis is now easing.

“Could we be seeing some light at the end of the tunnel for our national rental crisis? Perhaps for some cities and regions, yes,” he said.

“However, we still remain very concerned for the situation in Melbourne, Sydney and Brisbane where most international arrivals first land.”

-

Photo by Jens Neumann on Pixabay.