Lending restrictions may be creating hurdles for investors financially, but that’s no reason to forfeit the idea of refinancing. You may be able to access significantly better rates, better terms, or an interest-only loan – but you need to put your best foot forward.

With its ability to provide passive income and set investors up for a comfortable financial future, property investing is a strategy that hundreds of thousands of Australians are using to build wealth.

Many of these investors are living with loans that were arranged years ago, and which could be costly them far more than they need to be spending.

Arranging a mortgage is not a ‘set and forget’ exercise; rather, it should be something that investors revisit every 12 months, to ensure they’re not over-paying and the loan still suits their needs.

This is where refinancing comes in. This is a process of taking an existing loan and transferring it to another lender, usually for one of the following reasons: to capitalise on a lower interest rate; access better loan conditions, such as offset or redraw; to stretch out a loan for a longer period of time; or to access a new interest only (I/O) period.

Whatever your motivation, when you refinance, there’s usually more money in your pocket to use in either paying off a mortgage or buying a new investment.

“Cash flow is a key benefit of refinancing, apart from simply getting one over the banks by ensuring you are paying as little interest as possible,” explains Graeme Salt, managing partner at Chan & Naylor Finance.

“Imagine that someone who has 20 years to run on a mortgage refinances it to a new 30-year loan – they then get to spread out their loan repayments over a longer period and at a lower rate. This then frees up cash to do other things.”

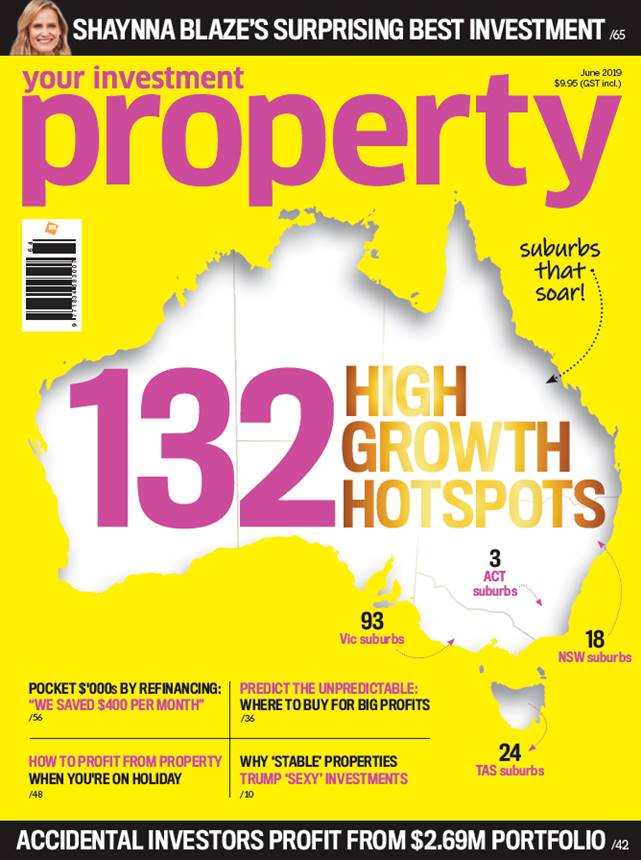

Learn how to refinance smartly, including tips to get your home loan approved, in the June 2019 edition of Your Investment Property magazine.

On sale at news agencies and Coles supermarkets 9th May to 5th June or download the magazine now.